The Robotaxi Cold War: Why Waymo, Tesla, and Amazon Are Fighting Three Different Battles

Waymo is leading the robotaxi race, but its victory is far from certain. A deep-dive analysis of the competing strategies of Waymo, Tesla, and Amazon's Zoox.

The Lede: Beyond the Hype

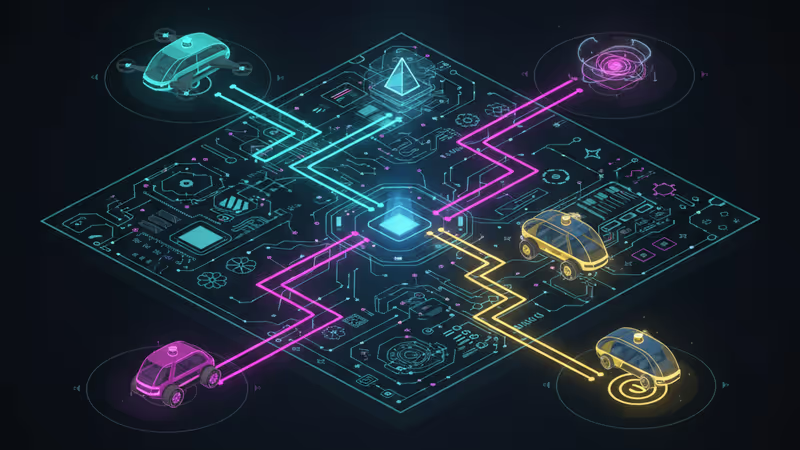

While 2025 was hailed as the year robotaxis went mainstream, the real story isn't about market share—it's about a high-stakes schism in strategy. We're witnessing a technological cold war between three tech titans, each betting billions on a fundamentally different philosophy for the future of mobility. Alphabet's Waymo is waging a ground war of attrition, conquering city by city. Amazon's Zoox is building a vertically integrated fortress. And Tesla is pursuing a high-risk, high-reward software gambit. For investors and strategists, understanding these divergent paths is more critical than tracking ride counts.

Why It Matters: The Battle for the 'OS' of Urban Mobility

The company that wins the robotaxi race won't just replace Uber; it will own the operating system for urban transportation, a multi-trillion-dollar prize. The second-order effects are staggering, poised to redefine personal car ownership, urban real estate values, and last-mile logistics. The core of this conflict isn't just about who has the best AI, but which business model can scale profitably and navigate the treacherous landscape of public trust and regulation.

- The Geo-Fenced Empire (Waymo): A capital-intensive model focused on achieving near-perfect safety within meticulously mapped domains. It's predictable and defensible but brutally expensive and slow to scale globally.

- The Bespoke Fleet (Zoox): A bet that custom-built hardware, controlled end-to-end, will ultimately yield superior economics and user experience. It's the classic Amazon playbook: control the entire value chain.

- The Scalable Network (Tesla): A vision where millions of existing consumer cars become autonomous earners via an over-the-air update. If it works, it's an instant global network. If it fails, it's one of the biggest tech promises ever broken.

The Analysis: Three Companies, Three Futures

Waymo's Empire: The Path of Costly Conquest

Waymo is the undisputed frontrunner in deployment and revenue-generating rides, now operating or testing in 26 markets. With over 14 million trips served in 2025 and expansion onto freeways, their operational lead is undeniable. This is the Alphabet/Google DNA: leverage a massive balance sheet to solve a hard engineering problem through methodical, data-driven execution. However, this progress comes at a staggering cost. The 'Other Bets' segment, which includes Waymo, lost $1.43 billion in Q3 alone. This strategy is a war of attrition. Waymo is proving the technology works, but it has yet to prove the business model can work at a global scale without incinerating capital for another decade. Their biggest challenge isn't technology—it's making the unit economics of a city-by-city conquest profitable before competitors find a more scalable shortcut.

Amazon's Dark Horse: The Vertically Integrated Zoox Play

While Waymo retrofits existing vehicles, Amazon's Zoox is building its vision from the ground up with a bespoke, carriage-style vehicle. This is a long-term play on a simple thesis: purpose-built hardware is the key to unlocking profitability and a superior passenger experience. By eliminating legacy car components like steering wheels, they can optimize for space, comfort, and manufacturing efficiency. Currently offering free rides as it navigates the final regulatory hurdles for commercial deployment, Zoox is playing a patient game. Its success hinges on federal approvals and its ability to ramp up manufacturing—aiming for 10,000 vehicles a year. This is a classic Amazon strategy: absorb early losses to build a moat based on integrated hardware and logistics, a tactic that could make Zoox a formidable competitor by the end of the decade.

Tesla's Phantom Fleet: The Software-First Gambit

Tesla's 2025 launch of a 'Robotaxi' branded service is, for now, more marketing than reality. The continued presence of human safety drivers reveals the vast gap between Elon Musk's promises and the current state of its Full Self-Driving (FSD) technology. Yet, to dismiss Tesla is to misunderstand their strategy. They aren't trying to win Phoenix or San Francisco; they're trying to win the planet. Their bet is that a vision-only system, trained on data from millions of consumer vehicles, can achieve a generalized autonomy that doesn't require pre-mapping cities. If they crack this code, they can activate a global robotaxi network almost overnight at a fraction of Waymo's capital cost. It remains a monumental 'if'. Public skepticism, regulatory scrutiny, and the technical hurdles are immense. But the potential payoff makes it the most disruptive—and volatile—strategy in the race.

PRISM Insight: The Investor's Dilemma

Investment Angle: The market is currently valuing Waymo's tangible progress while remaining skeptical of Tesla's grand vision. For an investor, this presents a choice between three risk profiles. Investing in Alphabet is a bet on methodical, capital-heavy innovation. Investing in Amazon is a wager on patient, vertical integration. Investing in Tesla is a high-volatility bet on a software breakthrough that could either redefine the industry or fail spectacularly.

Technology Angle: The fundamental schism is Lidar vs. Vision. Waymo's reliance on Lidar and high-definition maps creates a robust, safe system within a known environment but makes scaling to new locations costly. Tesla's vision-only approach mimics a human driver and is theoretically more scalable, but it struggles with edge cases and is proving far harder to perfect than anticipated. The winning technology will be the one that achieves Level 4/5 autonomy with a viable cost-per-mile, and it's still unclear which path will get there first.

PRISM's Take

The 2025 robotaxi narrative has been mistakenly framed as a simple race for market share. It is not. It is a clash of ideologies. Waymo has masterfully won the first battle: proving a fully driverless service is viable in complex urban centers. But this is just one battle in a much longer war. The ultimate victor will not be determined by who has the most cars on the road in 2026, but by which company develops the most scalable and economically sustainable model by 2030. PRISM's analysis is that Waymo's lead is formidable but fragile. Its capital-intensive model gives both Tesla and Zoox a window of opportunity to pursue more scalable, and potentially more profitable, long-term strategies. The next 24 months will be critical in determining whether Waymo can convert its operational lead into an insurmountable economic moat, or if Tesla's software gambit or Zoox's hardware play can rewrite the rules of the game entirely.

관련 기사

인스타카트가 AI를 이용해 일부 고객에게 식료품을 23% 더 비싸게 판매한 사실이 드러났습니다. 이것이 '디지털 가격 차별'의 시작이며, 소비자가 알아야 할 대응법을 심층 분석합니다.

우버의 '다크패턴' 구독 서비스가 24개 주로부터 집단 소송을 당했습니다. 이것이 구독 경제의 종말을 의미하는지, 당신의 지갑에 미칠 영향을 심층 분석합니다.

AI 붐의 이면, 데이터센터가 당신의 전기요금을 폭등시키고 있습니다. 미 상원의 칼끝이 빅테크를 향한 이유와 이것이 투자자와 시장에 미칠 영향을 심층 분석합니다.

그라인더가 단순 데이팅 앱을 넘어 AI와 헬스케어를 결합한 '게이 수퍼앱'으로 변신을 선언했다. 이 야심 찬 계획의 성공 가능성과 숨겨진 위험을 심층 분석한다.