The AI Tax Is Coming for Your Smartphone: Why Your Next Upgrade Will Cost More

The AI boom is creating an unexpected 'AI Tax' on smartphones. Discover why memory chip shortages will drive up prices by 2026, hurting consumers and shaking up the entire industry.

The Bottom Line Up Front

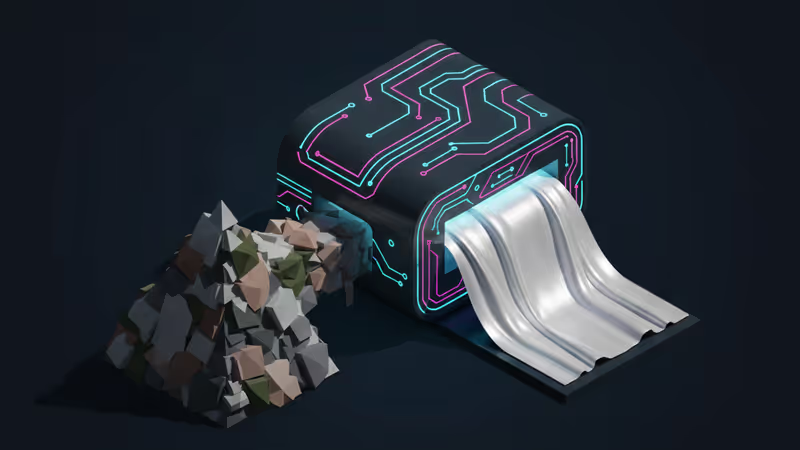

The generative AI boom, fueled by an insatiable demand for data center chips, is about to hit your wallet. A new analysis projects that the average price of a smartphone will jump by nearly 7% in 2026, not because of new features, but due to a critical shortage of memory chips being rerouted to the AI industry. This isn't just inflation; it's a fundamental supply chain collision we're calling the "AI Tax," and it's set to reshape the entire mobile landscape.

Why This Matters: Beyond a Simple Price Hike

This development signals a tectonic shift in the tech ecosystem's priorities. For the past decade, the smartphone has been the center of the universe, driving innovation and commanding the supply chain. That era is ending. AI infrastructure is now the priority customer, and consumer electronics are feeling the squeeze. The second-order effects are what most reports will miss:

- The End of Predictable Upgrades: Manufacturers, especially in the mid-range, may be forced to downgrade other components—like cameras or displays—to offset rising memory costs. You could pay more for a 2026 phone that is objectively worse in some areas than its 2024 predecessor.

- Market Consolidation: The crisis will create a clear divide between the haves (Apple, Samsung) and the have-nots. Companies without massive scale or vertical integration will struggle to absorb costs, potentially leading to market exits or acquisitions.

- Slowing a Decade of Progress: The trend of powerful technology becoming more accessible to everyone, particularly in emerging markets, is at risk. A sharp price increase could stall smartphone adoption and innovation at the lower end of the market.

The Analysis: The Great Component Collision

When Data Centers Cannibalize Consumer Tech

The heart of the issue lies in a component called DRAM (Dynamic Random-Access Memory). While essential for your phone's multitasking capabilities, it's also a foundational element for the high-bandwidth memory (HBM) that AI accelerators from companies like Nvidia devour. Chipmakers like SK Hynix and Samsung face a simple economic choice: allocate their limited production capacity to the high-margin, booming AI market or the mature, lower-margin smartphone market. AI is winning.

Counterpoint Research's data is stark: Bill-of-materials (BoM) costs for low-end phones have already surged 20-30% this year. With memory prices projected to climb another 40% through mid-2026, the pressure is becoming existential for some brands.

A Two-Tiered World: Why Apple and Samsung Are Insulated

Not all players will suffer equally. Apple, with its colossal cash reserves, unrivaled purchasing power, and long-term supply contracts, can navigate this storm. It can absorb the cost increase to protect market share or pass it on to a premium customer base that is far less price-sensitive. Samsung possesses an even more powerful advantage: vertical integration. As one of the world's largest memory manufacturers, it can prioritize its own mobile division, creating a powerful competitive moat that other Android makers can't cross.

This leaves Chinese and other mid-range manufacturers in a precarious position. Brands like Xiaomi, OPPO, and Vivo built their empires on offering high-spec devices at competitive prices. That model breaks when component costs skyrocket and you lack the leverage of an Apple or the supply security of a Samsung.

PRISM Insight: Navigating the New Reality

Investment & Market Impact

For investors, the signal is clear. The primary beneficiaries are the memory makers themselves (SK Hynix, Samsung's semiconductor division, Micron). The AI boom provides them with immense pricing power that will last for the foreseeable future. Conversely, investors should apply a new layer of scrutiny to smartphone OEMs that are not Apple or Samsung. Their margins are under direct threat, and their ability to compete will be severely tested. The key metric to watch is no longer just unit sales, but gross margin per device.

Business & Consumer Strategy

For businesses, this translates to higher future costs for corporate mobile fleets. For consumers, the calculus of when to upgrade is changing. Holding onto your current device for an extra year might become a financially sound decision, as the value proposition of new mid-range models diminishes. The era of the "good enough" phone, which we saw a few years ago, may be poised for a major comeback as consumers balk at paying more for less.

PRISM's Take

This is not a temporary supply chain glitch; it is the first tangible 'tax' the AI revolution has levied on the mass consumer. For years, the benefits of AI have been abstract for most people. Now, the cost is becoming concrete. The tech industry's center of gravity has officially shifted from the pocket to the cloud. The relentless annual cycle of cheaper, better, faster smartphones is over. It has been sacrificed at the altar of AI's insatiable appetite for processing power, a shift that will permanently alter the competitive landscape and redefine value for consumers for years to come.

관련 기사

AI 데이터센터가 당신의 전기요금을 폭등시키고 있습니다. 미 의회가 빅테크의 '전력 블랙홀'에 칼을 빼든 이유와 이것이 투자자와 산업에 미칠 영향을 심층 분석합니다.

팟캐스트 녹음툴 리버사이드의 AI 기능은 단순한 재미일까, 아니면 크리에이티브 산업의 미래를 위협하는 신호일까? AI 도구의 명과 암을 심층 분석합니다.

5만원짜리 캐시미어의 숨겨진 비용. AI 스타트업 에버블룸이 섬유 폐기물을 고품질 소재로 바꾸며 패션 산업의 지속가능성 공식을 다시 쓰고 있습니다.

OpenAI GPT-5.2가 단순한 성능 개선을 넘어 AI를 '지적 파트너'로 격상시켰습니다. 이것이 기술 투자와 산업 R&D의 미래를 어떻게 바꿀 것인지 심층 분석합니다.