China's EV Price War Goes Global, Squeezing Tesla and Legacy Automakers

An intense EV price war, fueled by massive overcapacity in China, is now hitting global automakers like Tesla and Ford, squeezing profits and forcing strategic retreats. Here's what it means for your portfolio.

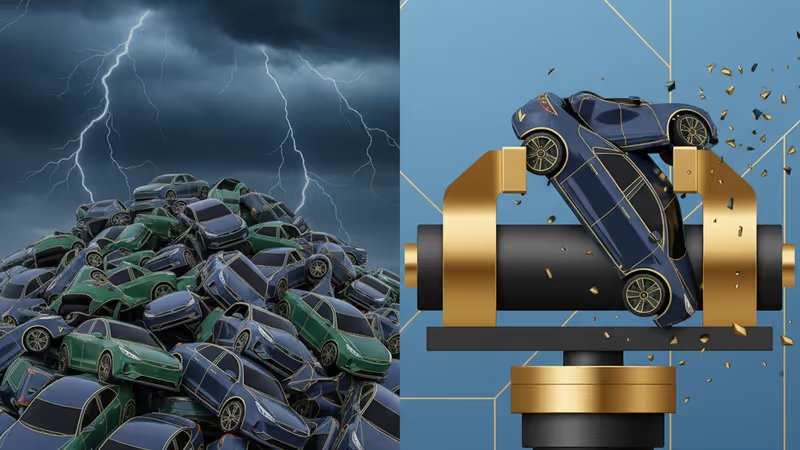

An Oversupply Problem Becomes a Global Threat

A brutal price war in China's electric vehicle market is no longer a domestic affair. It's now spilling onto the global stage, creating a severe margin crisis for industry leaders like Tesla, Ford, and Hyundai. With Chinese automakers like BYD launching models for under $10,000, a massive oversupply problem is forcing a painful reckoning across the entire automotive sector, reshaping the competitive landscape from Europe to Southeast Asia.

The Math Behind the Mayhem

The conflict's origin is simple: China can produce nearly twice as many EVs as it can sell domestically. Years of government subsidies fueled a boom that created over 100 different brands, all now fighting for survival as domestic growth slows. This has led to aggressive discounting, with the average vehicle in China selling for 15% below its sticker price in `2023`, according to Reuters. This excess inventory has to go somewhere, and the target is international markets.

Global Contagion: From Margin Pressure to Pulled Investments

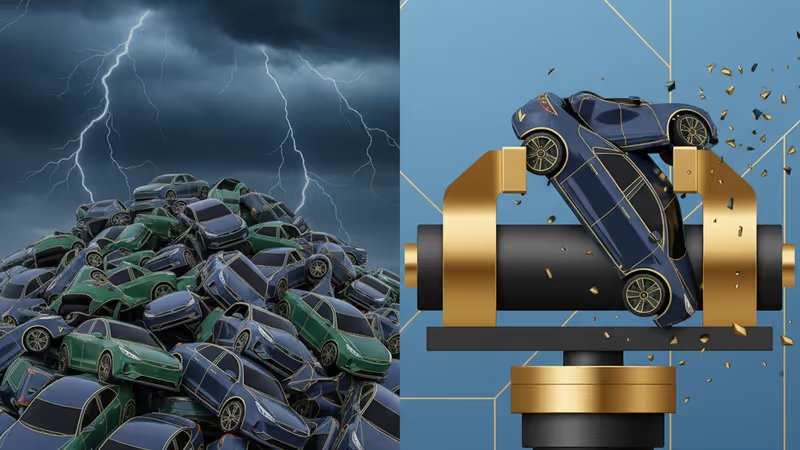

The fallout for global automakers is stark. Tesla has been forced into repeated price cuts to defend its market share in China, eating into its once-enviable profit margins. Legacy automakers are feeling the chill, too. Ford and General Motors are scaling back or delaying their ambitious EV investment plans, a direct response to the deteriorating profitability of the sector. Meanwhile, Hyundai and Kia face intense pressure in key Asian growth markets from lower-priced, feature-packed Chinese rivals.

Western governments are starting to build a political moat. The European Union is investigating Chinese state subsidies, which could result in significant import tariffs. In the U.S., the Inflation Reduction Act (IRA) already serves as a major barrier, effectively locking out most Chinese-made EVs and batteries from its lucrative tax credits.

This war of attrition isn't creating clear winners, even in China. Tech-heavy but loss-making players like 'Nio' and 'Xpeng' are burning through cash at an alarming rate. The endgame isn't dominance; it's survival. The most likely outcome is a painful industry consolidation. For investors, this means balance sheets and cash flow statements have become far more important indicators of long-term viability than quarterly sales figures.

본 콘텐츠는 AI가 원문 기사를 기반으로 요약 및 분석한 것입니다. 정확성을 위해 노력하지만 오류가 있을 수 있으며, 원문 확인을 권장합니다.

관련 기사

중국 전기차 시장의 과잉 공급이 촉발한 가격 전쟁이 테슬라, 현대차 등 글로벌 기업들을 위협하고 있습니다. '치킨 게임'의 원인과 각국의 대응, 투자자를 위한 분석을 제공합니다.

일본 3분기 GDP가 연율 -2.3%로 하향 조정되자, 정부는 122조 엔 규모의 역대급 예산안으로 대응에 나섰다. 하지만 메가솔라 지원 축소 등 엇갈린 정책 신호에 시장 불확실성은 커지고 있다.

일본 SMFG가 미국 베인캐피털, 뮤지니치와 손잡고 35억 달러 규모의 펀드를 조성, 유럽 M&A 시장 공략에 나선다. 일본 금리 인상에 따른 자금력을 바탕으로 한 글로벌 투자 전략을 분석한다.

한국은행이 3년 만에 기준금리를 3.50%에서 3.25%로 0.25%포인트 인하했다. 경기 둔화 우려에 대응하기 위한 정책 전환으로, 자산시장에 미칠 영향을 분석한다.