MicroStrategy's 60% Crash Is a Red Alert for Bitcoin's Last Line of Defense

Bitcoin clings to critical support, but MicroStrategy's 60% crash signals a major warning. Is institutional capital exiting? Actionable analysis for investors.

The Lede

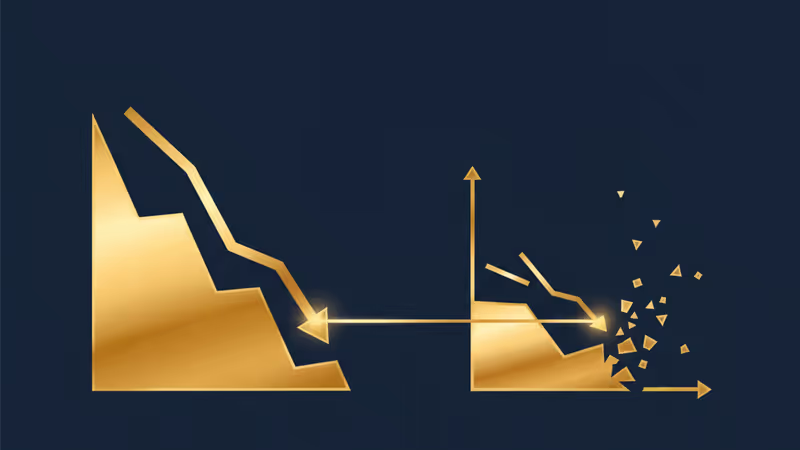

Bitcoin is currently trading at a critical juncture, clinging to a long-term technical support level that has historically separated bull market corrections from full-blown bear markets. While BTC bulls have defended this line for three weeks, a crucial leading indicator is flashing a severe warning: MicroStrategy (MSTR), the largest public holder of Bitcoin, has already broken this support and plummeted over 60% from its peak. This divergence is a high-stakes signal that sophisticated investors cannot afford to ignore.

Key Numbers to Watch:

- The Critical Support: The 100-week Simple Moving Average (SMA), currently the floor for Bitcoin's price around $87,000.

- The Warning Signal: MicroStrategy (MSTR) shares have already broken their 100-week SMA and extended losses, falling from a year-to-date high of $457 to $160.

- Market Pressure: The total crypto market capitalization has dipped below the $3 trillion mark, indicating broad-based selling pressure.

The Analysis

The Canary in the Crypto Mine: Why MSTR Leads Bitcoin

The price action in MicroStrategy stock is more than just a footnote; for many institutional traders, it’s a high-liquidity, regulated proxy for Bitcoin itself. The stock's dramatic breakdown below its own 100-week SMA in November, followed by a continued sell-off, provides a potential roadmap for where Bitcoin could be headed. Why does MSTR often lead the market? Institutional portfolio managers can sell a NASDAQ-listed stock like MSTR far more easily and quickly than they can unwind large positions in spot Bitcoin across multiple exchanges. MSTR's plunge suggests that institutional capital, the very force that drove this bull cycle, is now actively de-risking its Bitcoin exposure. This isn't just a technical pattern; it's a window into the sentiment of the market's largest players.

A Historical Line in the Sand

The 100-week SMA isn't an arbitrary line. In previous market cycles, a sustained breach of this average has often confirmed the end of a macro bull trend and the beginning of a prolonged consolidation or bear phase. For three weeks, Bitcoin has treated this level as a 'safety net,' halting the decline from all-time highs above $126,000. The market is now deciding if this net will act as a trampoline for a rebound or tear, leading to a much deeper fall. The precedent set by MSTR suggests the latter is a dangerously high probability.

PRISM Insight: Investment Strategy & Portfolio Implications

This is a moment for tactical decision-making, not passive observation. The divergence between MSTR and BTC creates a clear 'if-then' scenario for investors.

For active traders and investors, the key metric to watch is the weekly candle close. A decisive weekly close for Bitcoin below the 100-week SMA would confirm the breakdown and validate the bearish signal from MSTR. This could be a trigger to reduce exposure, tighten stop-losses, or for sophisticated investors, consider hedging or short positions. Conversely, if Bitcoin musters a strong bounce from this level, creating a clear rejection of the breakdown, it could signal a powerful bear trap and a potential short-term buying opportunity. The risk-reward is becoming sharply defined at this price level.

This scenario also forces a re-evaluation of using MSTR as a simple Bitcoin proxy. While it offers leverage to the upside, its recent performance demonstrates that it can also lead and amplify downside volatility. Investors seeking pure-play Bitcoin exposure may find that spot BTC or a Bitcoin ETF provides a more direct and less volatile instrument, without the added layer of corporate operational risk inherent in MSTR stock.

The Bottom Line

Bitcoin is at a technical precipice. While the coin itself has yet to fall through its final support level, its most important corporate proxy has already taken the plunge. The 60% collapse in MSTR stock should not be viewed in isolation; it's a potential leading indicator of institutional capitulation. Investors must remain vigilant and respect the 100-week SMA as the market's last line of defense. A failure to hold this level could swiftly realign market expectations towards a deeper, more prolonged correction.

관련 기사

미국 인플레이션과 일본은행의 금리 인상이란 두 개의 거시경제 파도가 비트코인을 덮치고 있습니다. 단순한 가격 조정을 넘어선 '엔 캐리 트레이드' 청산 리스크를 심층 분석합니다.

세계 최대 자산운용사 뱅가드가 비트코인 ETF 접근을 허용했습니다. 이는 시장에 어떤 의미를 가지며, 투자자는 어떻게 대응해야 할까요? 전문가의 심층 분석.

XRP가 5% 급락하며 $1.92 지지선이 붕괴되었습니다. 이는 AI 기술주 투매에서 시작된 연쇄 반응으로, 기관 자금의 위험 회피 신호일 수 있습니다. 시장 분석 및 투자 전략을 확인하세요.

미 법무부(DOJ)의 19조원대 암호화폐 압수가 시장에 미치는 영향을 심층 분석합니다. 투자자가 자산을 보호하고 기회를 포착하기 위해 알아야 할 모든 것.