Bitcoin's $582M ETF Exodus: Is the $83k 'Wall of Money' About to Crumble?

A $582M outflow hits Bitcoin and Ether ETFs, the largest since November. As BTC tests the critical $83k support level, is this a dip-buying opportunity or a warning sign?

The Lede: A Test of Conviction

U.S. spot Bitcoin and Ether ETFs have suffered their largest combined daily outflow since November, with a staggering $582 million exiting the funds on Monday. The withdrawal sent Bitcoin spiraling to lows of $85,100, putting a critical support level squarely in the crosshairs: the average entry price for all U.S. ETF holders.

Key Data Points

- Total Net Outflow: $582 million (BTC & ETH ETFs combined)

- Bitcoin ETF Outflow: $357.6 million

- Ether ETF Outflow: $224.8 million

- Key Support Level: ~$83,000 (Aggregate U.S. ETF cost basis)

- Largest BTC Outflow: Fidelity's FBTC with $230.1 million in redemptions

The Analysis

$83,000: The Market's New Line in the Sand

The most critical metric for investors to watch right now is the aggregate ETF cost basis, which Glassnode data places near $83,000. This isn't just another technical support level; it represents the psychological break-even point for the average investor who has bought into these ETFs since their inception. The market has successfully defended this level twice before, on Nov. 21 and Dec. 1. A third successful defense would strongly reaffirm it as a major support floor. However, a sustained break below this price would mean the average ETF holder is now underwater, a scenario that could trigger a fresh wave of panic selling.

Not All ETFs Are Created Equal: A Tale of Two Titans

Beneath the headline outflow number lies a crucial divergence. While Fidelity's FBTC bled $230.1 million, BlackRock's industry-leading IBIT recorded zero net flows. This is not a trivial detail. This discrepancy suggests a potential difference in investor behavior. BlackRock's IBIT is widely believed to have a larger concentration of long-term, institutional capital, which appears to be holding steady amidst the volatility. In contrast, the significant outflow from FBTC, along with other funds like BITB and ARKB, may indicate that more retail or faster-moving capital is heading for the exits. This is a clear sign that conviction varies significantly across different investor cohorts.

The 'Monday Effect' and Macro Headwinds

The source correctly identifies a recurring pattern of weakness on Mondays. This phenomenon is often attributed to institutional portfolio managers re-evaluating and de-risking positions at the start of the week after weekend price action and news flow. More importantly, this crypto-specific sell-off is not happening in a vacuum. It's moving in lockstep with weakness in traditional equity markets, particularly the Nasdaq, amid fears of a deflating AI stock bubble and anxiety ahead of U.S. jobs data. For now, crypto remains firmly tethered to its identity as a high-beta, risk-on asset.

PRISM Insight: Investment Strategy at a Crossroads

The current market action presents a clear decision point for investors, defined by the $83,000 cost basis level.

For Bullish Investors: The resilience of BlackRock's IBIT holders is a significant positive signal. If the market successfully defends the $83k level and macro fears subside (e.g., a positive jobs report), this period could be viewed as a prime accumulation zone. A strong bounce from this level would signal that the 'wall of money' from ETF buyers is holding firm.

For Cautious/Bearish Investors: A daily close below $83,000 on significant volume would be a major red flag. It would invalidate the market's most important support level and confirm that bears are in control in the short term. Such a break could open the door for a deeper correction, as underwater ETF holders may be forced to liquidate. The persistent outflows from Ether ETFs also signal a broader lack of appetite for risk within the crypto ecosystem beyond Bitcoin.

The Bottom Line

Monday's $582 million outflow is a significant bearish signal, but the battle is not yet lost for the bulls. The market's entire focus is now on the $83,000 support level. Investors should watch this price, the flow data from BlackRock's IBIT (as a proxy for institutional conviction), and the upcoming U.S. macroeconomic data to determine their next move. The outcome of this test will likely set the market's direction for the coming weeks.

관련 기사

미국 인플레이션과 일본은행의 금리 인상이란 두 개의 거시경제 파도가 비트코인을 덮치고 있습니다. 단순한 가격 조정을 넘어선 '엔 캐리 트레이드' 청산 리스크를 심층 분석합니다.

AI라는 이름만으로 오르던 시대는 끝났다. 브로드컴, 오라클의 급락이 보여주듯 시장은 이제 실적을 넘어 구체적인 실행 능력을 요구한다. 새로운 AI 투자 전략을 확인하라.

TSMC의 2025년 반도체 가격 인상이 NVIDIA, 애플 등 빅테크에 미칠 영향과 AI 시대의 새로운 비용 구조를 심층 분석합니다.

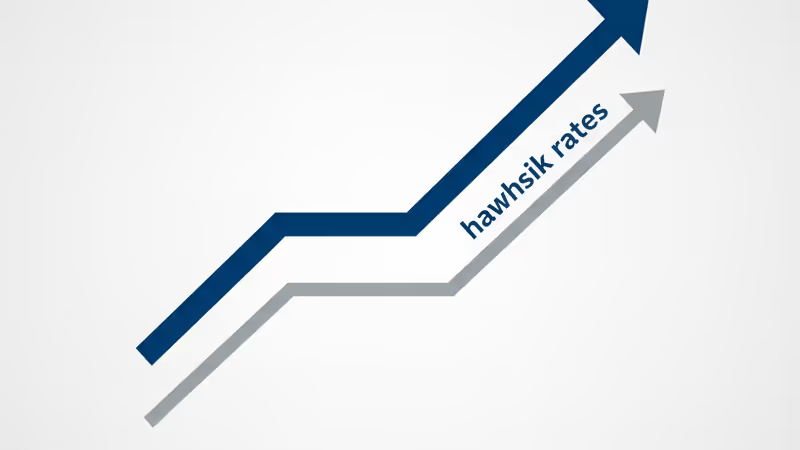

미 연준이 연내 금리인하 전망을 1회로 축소하며 시장에 충격을 줬습니다. '고금리 장기화' 시대, 글로벌 투자 전략을 심층 분석합니다.