Bitcoin's $90K Wall: Why U.S. Trading Hours Are the New Crypto Battlefield

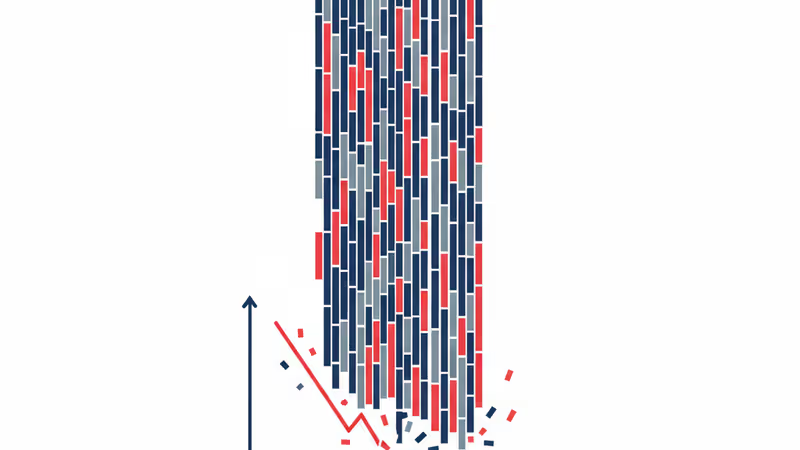

Bitcoin faces recurring sell-offs at $90k during U.S. hours. Our analysis reveals this isn't random noise, but a structural shift driven by institutional ETFs.

The Lede: More Than Just a Price Chart

Bitcoin's struggle to break the $90,000 ceiling is more than just another volatile week in crypto. It’s a clear signal of a fundamental market shift. The recurring pattern of strong overnight bids being systematically sold off during U.S. market hours reveals a new power dynamic: the methodical, profit-taking discipline of Wall Street institutions versus the global, 24/7 optimism of crypto natives. This isn't just a technical battle; it's the new face of a market reshaped by the 2024 spot ETFs.

Why It Matters: The 'Wall Street-ification' of Bitcoin

The fact that we can identify a consistent "U.S. sell pattern" is the entire story. For years, crypto markets were notoriously unpredictable, driven by offshore exchanges and retail sentiment. Now, price discovery is increasingly anchored to the 9:30 AM to 4:00 PM Eastern Time window. This matters for several reasons:

- Predictability Breeds New Strategies: This pattern introduces a degree of predictability. Sophisticated funds can now trade crypto on time-zone arbitrage, anticipating U.S. session liquidity and potential profit-taking.

- Correlation is King: The source notes crypto-related stocks like Galaxy (GLXY) and BitMine (BMNR) are rallying alongside the Nasdaq. This tightens Bitcoin's correlation with U.S. tech equities, cementing its role as a high-beta risk asset in institutional portfolios, not a decoupled safe haven.

- The Main Event: U.S. institutional flows, particularly through spot ETFs, are now the primary driver of market-moving volume. Global investors must now watch the U.S. open with the same intensity as they watch their local markets.

The Analysis: Deconstructing the Sell Wall

What is causing this persistent selling pressure during U.S. hours? It's not a single actor but a confluence of institutional behaviors, a direct consequence of the ETF-driven market structure.

First, consider year-end portfolio rebalancing. Funds that rode Bitcoin's stellar 2025 run are now taking profits to lock in gains before closing their books. This is standard institutional practice, a world away from the "HODL" ethos of retail. The $90,000 level serves as a natural psychological target for these sell orders.

Second, the influence of U.S. derivatives markets cannot be overstated. The CME's Bitcoin futures and options market sees peak activity during this window. The price action around $90k is likely influenced by large options positions expiring, forcing market makers to sell BTC to hedge their exposure and creating a gravitational pull on the price.

Finally, we're seeing the emergence of a two-tiered market. Overnight sessions, dominated by Asian and European markets, may have a different risk appetite or be responding to different catalysts. However, when U.S. institutions come online, they bring immense liquidity and a more conservative, data-driven approach, systematically selling into strength generated by other regions.

PRISM Insight: The Underlying Strength Signal

The most crucial insight here is not the selling itself, but the fact that Bitcoin is absorbing it without a catastrophic breakdown. For the price to be repeatedly hammered from $90k down to the mid-$80k range and consistently find enough buyers to climb back up signifies immense underlying bid support. While the sellers are disciplined, the buyers are resilient.

This suggests that for every ETF holder taking profits, new capital is rotating in, willing to accumulate in this range. The battle is not about a pending collapse, but about a consolidation and change of hands from early, tactical ETF investors to longer-term strategic allocators. The ability to hold the $85,000 level despite this institutional pressure is, paradoxically, a bullish sign of market maturity.

PRISM's Take: Welcome to the New Normal

Forget the narrative of a simple bull vs. bear showdown. We are witnessing the maturation of Bitcoin as an institutional asset class in real-time. The intraday volatility is the friction created as the decentralized, 24/7 crypto world grinds against the rigid, session-based machinery of traditional finance. This pattern of U.S.-hour selling is not a temporary anomaly; it is the new normal.

Investors must adapt. The key for long-term success is no longer just about analyzing the blockchain, but about understanding Wall Street's calendar: quarterly rebalancing, options expiry dates, and U.S. macroeconomic data releases. The path to $100,000 now runs directly through the trading desks of New York and Chicago.

関連記事

ウォール街大手シティグループがBTC価格14万3000ドルと予測。単なる強気論ではない、ETF、規制、マクロ経済が絡む3つのシナリオを専門家が徹底分析。

ビットコインの用途を巡る論争が激化。ベテラン開発者ルーク・ダッシュジュニアはOrdinalsを『スパム』と批判。BTCの思想と未来を深掘り分析します。

2026年、SECの規制緩和で暗号資産ETPが急増する見通し。市場の成熟化を意味する一方、淘汰の波も。投資家が知るべき勝者の条件を専門家が分析。

米ビットコインETFに1ヶ月超で最大の資金流入。ドミナンス60%への急騰は何を意味するのか?マクロ経済の嵐を前に、投資家が取るべき戦略を専門家が分析。