The Micro-Pivot: Why Viral 'Leaps of Faith' Reveal a New Economic Imperative

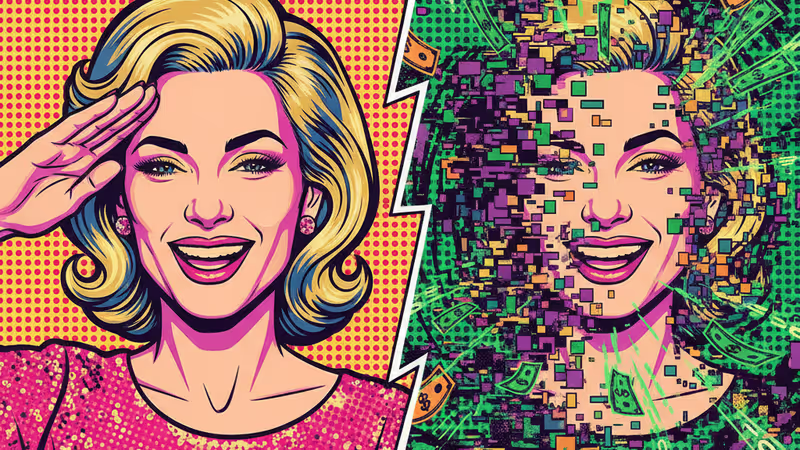

Viral 'leap of faith' stories aren't just feel-good fluff. They're data points on a major economic shift in work, talent, and risk. Here's why leaders must pay attention.

The Lede: Beyond Inspiration Porn

Your social media feed is filled with seemingly trivial, feel-good stories: a woman buys a balloon she was denied as a child; an artist sues a thousand online stores and buys an apartment; a homeless man becomes a surgical assistant. It's easy to dismiss this as inspiration porn for the masses. That is a strategic error. These viral anecdotes are not outliers; they are data points signaling a fundamental shift in how human capital assesses risk, values autonomy, and pursues growth. For leaders, ignoring this micro-behavioral trend is to misunderstand the future of work, talent, and value creation itself.

Why It Matters: The End of the Linear Career

These stories highlight the decay of the traditional, linear career path. The implicit contract of the 20th century—loyalty in exchange for security—is void. We are now in an era of radical agency, where the individual acts as a corporation of one, constantly evaluating opportunities for asymmetric bets—low-risk, high-reward moves.

- Talent Exodus: Your most ambitious employees are no longer thinking about the next rung on your corporate ladder. They are calculating the ROI on a personal 'leap of faith'—launching a side-hustle, reskilling for a new industry, or even litigating to protect their personal brand.

- Economic Resilience: The homeless man who stumbled into a college open house didn't follow a pre-ordained plan. He capitalized on a moment of serendipity. In a volatile economy, the ability to make a sharp, opportunistic pivot is a greater asset than decades of experience in a single, declining field.

- The New Moat: The artist who sued for IP theft demonstrates a new form of value capture. In the digital economy, one's brand and intellectual property are core assets. The willingness to aggressively defend them is the new competitive moat, and the tools to do so are becoming increasingly accessible.

The Analysis: From 'Company Man' to 'Portfolio Manager'

Historically, career management was about risk mitigation. The goal was stable, predictable, incremental growth within a single corporate structure. Today, the greatest risk is stasis. Technology has created both unprecedented volatility and unprecedented opportunity, shifting the dominant strategy from risk mitigation to optionality management.

Each individual is now the portfolio manager of their own career. The stories from the source content illustrate different asset classes within this portfolio:

- The Surgical Assistant: A high-risk, high-reward bet on reskilling. He traded present misery for a chance at future stability, investing sweat equity and time when he had no financial capital.

- The Artist: A value-capture play. She leveraged the legal system as a tool to convert the liability of theft into a capital asset—an apartment.

- The Makeup Wearer & Balloon Buyer: These seem minor, but represent the rejection of externally imposed constraints (family, parents) to invest in personal well-being and autonomy—a foundational asset for making larger bets.

Psychologist Dr. George Everly’s “creeping dread” of uncertainty once paralyzed workers into inaction. Now, that same dread of an uncertain future is the primary catalyst for action. The moment of “absolute certainty” never comes, so the rational actor bets on themselves now.

PRISM Insight: The Enablers of the Micro-Pivot

This trend is not happening in a vacuum. It is being accelerated by a new stack of technologies and platforms that de-risk the 'leap of faith' and empower the individual.

- EdTech & Micro-learning: Platforms like Coursera or Skillshare allow for rapid, low-cost reskilling, making career changes like the surgical assistant's more accessible than ever.

- Creator Economy Tooling: Services from Shopify to legal-tech platforms empower individuals like the artist to not only create but also distribute, monetize, and defend their work on a global scale.

- Fractional & Remote Work: The infrastructure for the gig economy and remote work allows individuals to build a financial safety net or test new ventures without immediately quitting their primary source of income.

The investment thesis is clear: The next unicorns will be companies that build infrastructure for personal sovereignty. These are the platforms that lower the activation energy required for an individual to make their own asymmetric bet.

PRISM's Take: Harness Volatility or Be Consumed By It

As a leader, you have two choices. You can lament the loss of employee loyalty and fight a losing battle to enforce outdated, linear career models. Or, you can adapt your organization to this new reality. Foster a culture of internal entrepreneurship. Create pathways for radical 'micro-pivots' within the company. Reward calculated risk-taking and treat your employees not as cogs in a machine, but as portfolio managers you want to co-invest with. The energy that drives a homeless man to become a surgeon or an artist to sue a thousand thieves is the most valuable resource in the modern economy. The challenge is to build an organization that can attract and channel that energy, rather than becoming the institution they need to leap away from.

Related Articles

An artist's viral dog embroidery reveals key trends in the creator economy, pet humanization, and the future of authentic D2C commerce. Analysis for leaders.

A viral story about a keyboard reveals a deep societal shift from gratitude to transactionalism. Here's why it impacts your company's future.

A woman spent $1M to look like a star, then lost everything. Her story is a stark warning about the risks of the influencer and digital identity economy.

Viral comic artist Berkeley Mews isn't just funny—his work is a masterclass in the creator economy. We break down his formula for digital success.