China's EV Price War Goes Global, Squeezing Tesla and Legacy Automakers

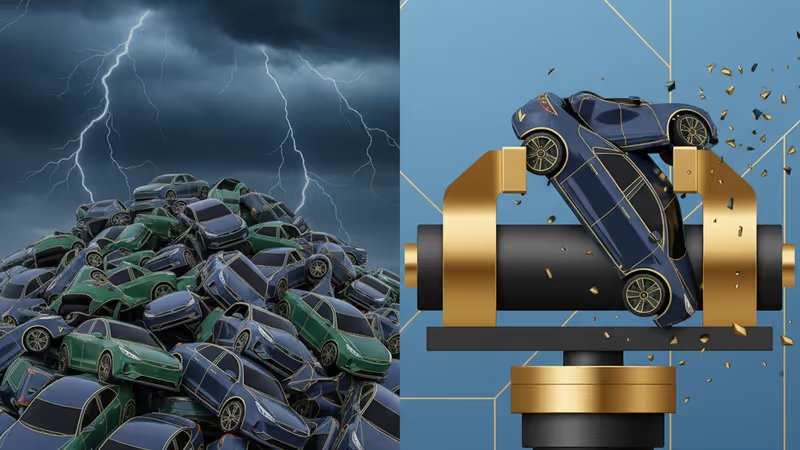

An intense EV price war, fueled by massive overcapacity in China, is now hitting global automakers like Tesla and Ford, squeezing profits and forcing strategic retreats. Here's what it means for your portfolio.

An Oversupply Problem Becomes a Global Threat

A brutal price war in China's electric vehicle market is no longer a domestic affair. It's now spilling onto the global stage, creating a severe margin crisis for industry leaders like Tesla, Ford, and Hyundai. With Chinese automakers like BYD launching models for under $10,000, a massive oversupply problem is forcing a painful reckoning across the entire automotive sector, reshaping the competitive landscape from Europe to Southeast Asia.

The Math Behind the Mayhem

The conflict's origin is simple: China can produce nearly twice as many EVs as it can sell domestically. Years of government subsidies fueled a boom that created over 100 different brands, all now fighting for survival as domestic growth slows. This has led to aggressive discounting, with the average vehicle in China selling for 15% below its sticker price in `2023`, according to Reuters. This excess inventory has to go somewhere, and the target is international markets.

Global Contagion: From Margin Pressure to Pulled Investments

The fallout for global automakers is stark. Tesla has been forced into repeated price cuts to defend its market share in China, eating into its once-enviable profit margins. Legacy automakers are feeling the chill, too. Ford and General Motors are scaling back or delaying their ambitious EV investment plans, a direct response to the deteriorating profitability of the sector. Meanwhile, Hyundai and Kia face intense pressure in key Asian growth markets from lower-priced, feature-packed Chinese rivals.

Western governments are starting to build a political moat. The European Union is investigating Chinese state subsidies, which could result in significant import tariffs. In the U.S., the Inflation Reduction Act (IRA) already serves as a major barrier, effectively locking out most Chinese-made EVs and batteries from its lucrative tax credits.

This war of attrition isn't creating clear winners, even in China. Tech-heavy but loss-making players like 'Nio' and 'Xpeng' are burning through cash at an alarming rate. The endgame isn't dominance; it's survival. The most likely outcome is a painful industry consolidation. For investors, this means balance sheets and cash flow statements have become far more important indicators of long-term viability than quarterly sales figures.

This content is AI-generated based on source articles. While we strive for accuracy, errors may occur. We recommend verifying with the original source.

Related Articles

Japan and Bangladesh have confirmed a broad economic partnership agreement to eliminate tariffs on key exports like steel and auto parts. Analyze the impact on supply chains and investment in South Asia.

The U.S. and Indonesia have reached a new tariff agreement. Indonesia gets exemptions for palm oil and coffee, while the U.S. secures access to critical minerals.

U.S. regulators have escalated their investigation into Tesla's Autopilot system, now covering 830,000 vehicles. This move to an engineering analysis raises the risk of a major recall.

Donald Trump's tariffs on China have turned Vietnam's Mong Cai into a major hub for rerouting goods to the U.S. An analysis of the supply chain shifts reshaping global trade.