U.S. Secures Critical Minerals Access in New Tariff Deal with Indonesia

The U.S. and Indonesia have reached a new tariff agreement. Indonesia gets exemptions for palm oil and coffee, while the U.S. secures access to critical minerals.

The U.S. and Indonesia have struck a deal that swaps American tariff exemptions on key agricultural goods for access to Indonesia's vast reserves of critical minerals. The agreement, announced in Washington on Monday by Indonesian economic minister , is expected to be formally signed by the end of .

The Anatomy of the Deal

Under the terms of the agreement, major Indonesian commodity exports like palm oil, coffee, and cocoa will be exempt from U.S. levies. In exchange, the U.S. gains preferential access to Indonesia's critical minerals, a strategic win for the administration's efforts to diversify supply chains away from China. Minister described the pact as “mutually beneficial for both economies.”

A Strategic Win for Washington's Supply Chain

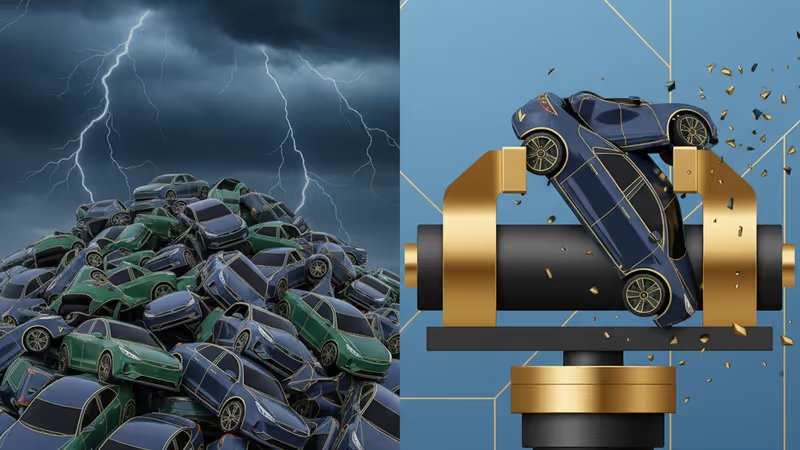

This isn't just about cheaper coffee. It's a calculated geopolitical move. Indonesia is the world's largest producer of nickel, a vital component for electric vehicle batteries and other advanced technologies. By securing this access, Washington takes a significant step in shoring up its industrial base and reducing its vulnerability to supply shocks orchestrated by strategic rivals. For investors, this signals a more stable long-term supply for U.S.-based EV and tech manufacturing sectors.

This agreement marks a tactical evolution in U.S. trade policy. It's moving beyond broad-based tariffs toward transactional, bilateral deals that use market access as leverage to secure strategic resources. Expect to see more of these 'resource-for-market' swaps as the global competition for the building blocks of the green and digital economies intensifies.

This content is AI-generated based on source articles. While we strive for accuracy, errors may occur. We recommend verifying with the original source.

Related Articles

South Korea's KOSPI rose for a third day, driven by foreign buying as AI valuation fears eased. Shipbuilding stocks surged on reports of a new naval deal with the U.S.

Japan and Bangladesh have confirmed a broad economic partnership agreement to eliminate tariffs on key exports like steel and auto parts. Analyze the impact on supply chains and investment in South Asia.

In 2025, gold and copper are the top-performing assets, surging 70% and 35% respectively. The rallies reflect a flight to tangible assets amid systemic fear and an AI boom, leaving Bitcoin behind with a 6% loss.

An intense EV price war, fueled by massive overcapacity in China, is now hitting global automakers like Tesla and Ford, squeezing profits and forcing strategic retreats. Here's what it means for your portfolio.