MicroStrategy's Red Flag: Is Bitcoin's Two-Year Support About to Collapse?

Bitcoin holds a critical two-year support level, but its top corporate proxy, MicroStrategy, has already collapsed. Is this a red flag for a major BTC sell-off?

The Lede

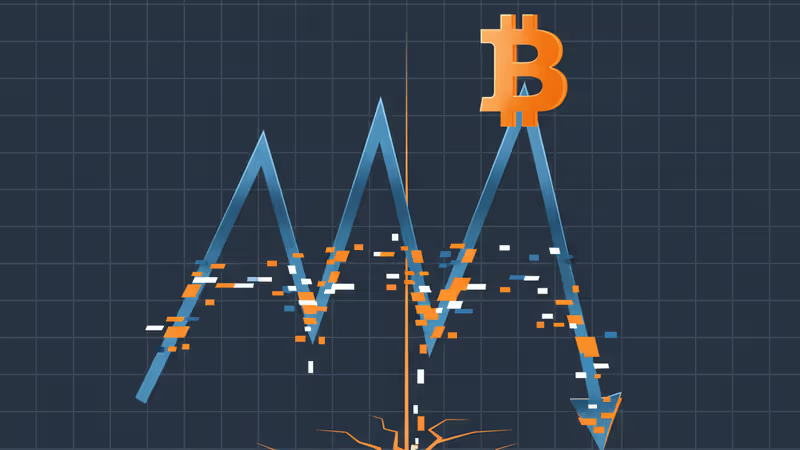

Bitcoin is trading at a critical juncture, clinging to its 100-week simple moving average (SMA) — a technical support level that has historically separated bull and bear markets. While BTC bulls have defended this line for three consecutive weeks, a crucial leading indicator is flashing a severe warning. MicroStrategy (MSTR), the largest publicly traded holder of Bitcoin, has already breached this same support level and suffered a catastrophic decline, suggesting a potential bearish roadmap for the world's largest cryptocurrency.

Key Numbers

- $87,018.43: Bitcoin's current trading price, hovering near its 100-week SMA.

- 60%+: The decline in MicroStrategy's (MSTR) stock price from its year-to-date high of $457 to its current price of $160.

- $3 Trillion: The key psychological level the total crypto market capitalization has fallen below for the third time in a month, signaling broad market weakness.

The Analysis

The Canary in the Crypto Mine: Why MSTR's Plunge Matters

The price correlation between Bitcoin and MicroStrategy is well-established, but investors must look deeper. MSTR isn't just another tech stock; it's a leveraged bet on the future of Bitcoin, making it a high-beta proxy for institutional sentiment. When MSTR’s stock broke its 100-week SMA in November and proceeded to lose over half its value, it wasn't just a technical breakdown. It signaled a crack in the conviction of investors backing the 'Bitcoin-on-the-balance-sheet' strategy. The fact that MSTR's breakdown preceded a period of intense pressure on BTC suggests its price action is serving as a leading indicator of waning institutional confidence and potential forced selling.

History's Verdict: The 100-Week SMA as a Bull/Bear Dividing Line

Technical analysts across asset classes revere the 100-week SMA as a long-term trend indicator. For Bitcoin, it has been a historically reliable battlefield. In previous market cycles, a definitive break below this average has often confirmed the start of a prolonged bear market, shaking out all but the most committed holders. Conversely, holding this line as support, as seen in previous cycle bottoms, has typically served as the foundation for the next major bull run. The current multi-week test is therefore not just noise; it is a battle for control over the long-term market narrative. A failure to hold would invalidate the bullish structure that has been in place for nearly two years.

PRISM Insight: Investment Strategy at the Precipice

Portfolio Implications and Actionable Triggers

For sophisticated investors, this is a moment for strategy, not reaction. The market is providing a clear line in the sand. A sustained, high-volume bounce off the 100-week SMA would be a strong bullish confirmation, potentially offering a favorable entry point for those who have been waiting on the sidelines. However, the bearish precedent set by MSTR demands a defensive posture.

- For Long Positions: A weekly candle closing decisively below the 100-week SMA should be treated as a critical signal to de-risk. Consider this level a natural point for setting stop-losses to protect capital from a potential cascade of selling, mirroring MSTR's trajectory.

- For Hedging: This is an ideal environment to employ hedging strategies. Investors with significant spot holdings could consider buying put options or opening short futures positions to protect against the downside risk presented by a technical breakdown.

- The Contrarian View: Is the market overly focused on this correlation? A potential decoupling, where Bitcoin holds its support while MSTR languishes, would be an exceptionally strong bullish signal. This would indicate that the underlying asset's strength is independent of its corporate proxies and that broad market support is absorbing institutional weakness. Watch for this potential divergence.

The Bottom Line

Bitcoin is at a technical and psychological inflection point. While the asset itself has so far respected its long-term support, the collapse of its most significant corporate advocate, MicroStrategy, offers a chilling preview of what could happen if that support fails. The key takeaway for investors is to watch the weekly close. A bounce reaffirms the long-term bull thesis. A break, however, signals that the market may be poised to follow MSTR's path into a deeper, more protracted downturn.

관련 기사

미국 인플레이션과 일본은행의 금리 인상이란 두 개의 거시경제 파도가 비트코인을 덮치고 있습니다. 단순한 가격 조정을 넘어선 '엔 캐리 트레이드' 청산 리스크를 심층 분석합니다.

2026년 SEC 규제 완화로 암호화폐 ETF가 쏟아질 전망입니다. 그러나 이는 곧바로 생존을 건 치열한 경쟁과 옥석 가리기의 시작을 의미합니다.

미국 CPI 데이터의 통계적 오류가 드러나자 비트코인이 급락했습니다. 데이터 신뢰도가 시장 향방을 가르는 핵심 변수로 떠오른 이유를 심층 분석합니다.

비트코인 가격이 급락했지만 실현 시가총액은 사상 최고치를 기록했습니다. 4년 주기 이론이 흔들리고 거시경제가 새로운 변수로 떠오르는 시장의 패러다임 전환을 분석합니다.