Intel's $100B Gamble: The World's Most Advanced Foundry Is Open—And Empty

Intel's advanced 18A chip fab is running, but with no major customers, its $100B foundry dream faces a crisis of trust. Can US industrial policy succeed?

The Trillion-Dollar Question

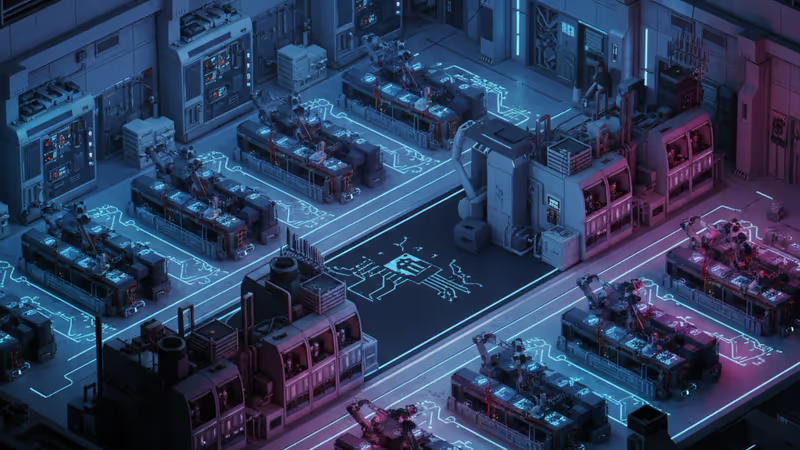

Intel has built its field of dreams in the Arizona desert. Fueled by billions in CHIPS Act funding, its most advanced process node, 18A, is now in high-volume production. This is the technology meant to restore Intel to a leadership position it lost a decade ago. There’s just one problem: besides Intel itself, no one is lining up to use it. For any executive, investor, or strategist in the tech ecosystem, this isn't just a story about one company's turnaround. It's the ultimate stress test for America's entire strategy to reclaim semiconductor dominance. The factory is built. The technology is ready. But in the high-stakes world of chip manufacturing, that's the easy part.

Why It Matters: More Than a Chip, A Geopolitical Chess Piece

The success or failure of Intel Foundry Service (IFS) has consequences that ripple far beyond Santa Clara. A viable, leading-edge foundry on U.S. soil is the central pillar of the West's strategy to de-risk the global technology supply chain from its over-reliance on Taiwan.

- Supply Chain Resilience: If major fabless players like Nvidia, Qualcomm, and AMD remain wholly dependent on TSMC in Taiwan, the geopolitical and economic leverage remains concentrated in one of the world's most volatile regions. Intel's success is a direct hedge against this risk.

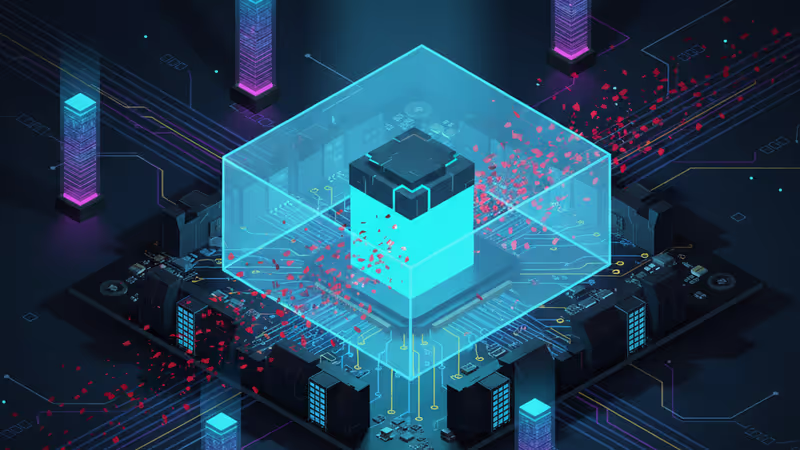

- The AI Arms Race: The insatiable demand for AI accelerators means there is theoretically room for a strong second supplier. However, the cost of a manufacturing stumble is catastrophic for AI leaders. A single faulty batch of wafers could derail a multi-billion dollar product launch. This makes the perceived reliability of TSMC an almost insurmountable moat.

- Industrial Policy's Proving Ground: The CHIPS Act provided the capital. But it cannot manufacture trust. If Intel, with all this government backing, cannot attract top-tier customers, it will raise hard questions about the efficacy of state-led interventions in hyper-competitive, capital-intensive markets.

The Analysis: Intel's Trust Deficit

For a decade, Intel's story was one of missed deadlines and manufacturing missteps (its 10nm and 7nm nodes being prime examples). In that same period, TSMC built its empire not just on technical excellence, but on something more valuable: flawless, metronomic execution. They became a trusted utility for the world's most innovative companies. Intel's current CEO, Pat Gelsinger, has architected an aggressive five-nodes-in-four-years roadmap to erase that painful history, and by all technical accounts, 18A appears to be competitive with TSMC's upcoming 2nm process.

But the core challenge is not technical; it's cultural and commercial. Can a company that has always prioritized its own products serve its fiercest competitors with the same fanatical devotion as a pure-play foundry like TSMC? For a company like Nvidia, placing an order with Intel isn't just a business transaction; it's betting a generation of its architecture on a direct competitor's factory. Yield issues on a new node are normal—TSMC has them too. The difference is that TSMC has a long-established track record of rapidly fixing them for its clients, whose success is its only business. Intel has yet to earn that trust from anyone but itself.

PRISM Insight: Watch the Customer, Not the Transistor

Investors and industry observers should stop focusing on the angstroms and nanometers. The key performance indicator for Intel Foundry is not transistor density or power efficiency—it's the customer list. The $8.9 billion in government funding is a subsidy, not a business model. Vague praise from potential partners like Nvidia is encouraging, but it's not a wafer order.

The first signal of a genuine breakthrough will be a public commitment from a major, high-volume fabless customer for a flagship product. This could be a future Snapdragon chip from Qualcomm, a next-generation GPU from AMD, or even a smaller, non-critical chip from Apple to test the waters. Until that name-brand design win materializes, the market will rightly view IFS as a speculative, high-cost internal manufacturing arm rather than a credible challenger to TSMC.

PRISM's Take: The Clock is Ticking

Intel has successfully completed the technological marathon. Now it faces a commercial Everest. Building the fab and creating the process technology, while monumentally difficult, plays to Intel's historic strengths in engineering. What comes next—sales, service, and obsessive customer-centricity—is a muscle the company has allowed to atrophy for decades. Gelsinger's strategy is bold and, from a national security perspective, necessary. But Intel is asking the world's most successful tech companies to ignore a decade of data and bet their future on a promise. It's a staggering request, and so far, the silence from potential customers is deafening.

관련 기사

인텔이 TSMC 추격을 위해 18A 공정 양산을 시작했지만, 핵심 고객사 부재로 위기에 직면했다. 반도체 왕좌 탈환을 위한 인텔의 거대한 베팅은 성공할 수 있을까? 심층 분석.

라이엇 게임즈가 특정 PC의 BIOS 업데이트를 요구합니다. 이는 치트와의 전쟁이 하드웨어 펌웨어 수준으로 격상되었음을 의미하며, 게임 산업의 보안 패러다임을 바꿀 것입니다.

LG TV의 코파일럿 강제 업데이트 논란 심층 분석. 이 사건이 스마트홈 AI 주도권 전쟁과 사용자 경험에 미치는 영향을 파헤칩니다.

닌텐도가 스위치 2에 저용량 카트리지를 도입합니다. 이는 게임 소유권, 디지털 전환, 그리고 물리적 미디어의 미래에 대한 중요한 질문을 던집니다.