Beyond the FDA: The New Regulatory Playbook for Disruptive Startups

Startups in regulated industries face more than just the FDA. A new analysis of the 'Legislative Quilt' vs. the 'Regulatory Moat' for founders and VCs.

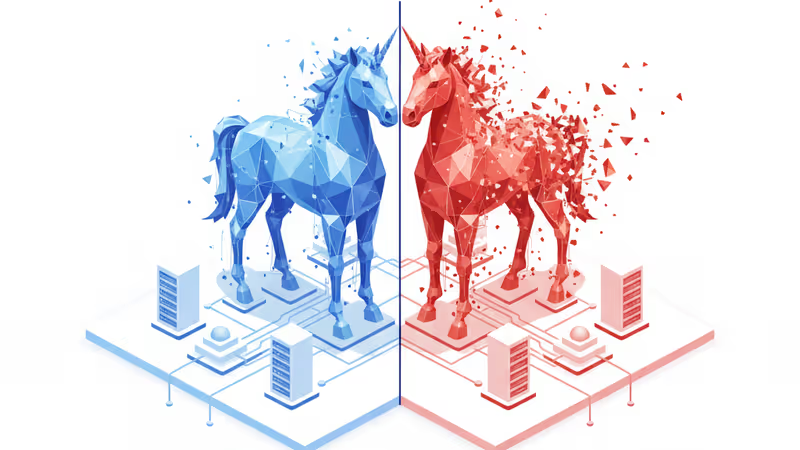

The Two-Front War on Regulation

For decades, founders in regulated spaces viewed the challenge as a singular, monolithic beast: conquer the FDA, the SEC, or the FCC, and you’ve built an unassailable moat. This view is now dangerously obsolete. The new reality is a two-front war. While giants like Enspectra Health spend a decade navigating the federal labyrinth, a new breed of disruptor like Earth Funeral is fighting a guerilla war, state by state, in the court of public opinion and legislative session. Understanding which battle you’re fighting is now the most critical strategic decision a founder can make.

Why It Matters: Strategy Follows Structure

The type of regulatory hurdle a startup faces dictates its entire operational and financial strategy. The distinction isn't academic; it's the difference between life and death for the company.

- The FDA Moat: Enspectra Health’s decade-long quest for FDA clearance for its non-invasive biopsy device is a classic example. This is a capital-intensive, R&D-heavy marathon. The prize is a massive, protected market. The second-order effect is a company built for deep science and clinical rigor, attracting patient capital from specialized life-science VCs. The moat is deep but requires immense upfront investment to dig.

- The Legislative Quilt: Earth Funeral, which turns human remains into soil, faces a different challenge. With no single federal body governing funeral practices, its market access is a patchwork of state laws. This requires a strategy of political agility, public affairs, and grassroots lobbying. The company's core competency isn't just its technology, but its ability to change laws and societal norms, one state at a time. This model favors operators with policy savvy and VCs who understand how to price political risk.

The Analysis: The Evolution of the Moat

The traditional venture capital thesis lionized the “regulatory moat.” It was a barrier to entry that, once crossed, defended a startup from fast-following competitors. This model holds true in deep tech and biotech, where scientific validation is paramount. We see this in the years-long journeys of companies in gene editing, medical devices, and novel therapeutics.

However, as software and novel business models continue to eat the world, they are increasingly colliding with industries governed not by federal agencies, but by a complex web of state and local rules. Think Uber and the taxi commissions, Airbnb and city zoning laws, or fintechs and the 50 different state money transmitter licenses. Earth Funeral is the latest archetype in this trend. Its success hinges less on a single green light from Washington D.C. and more on a sustained campaign to win over hearts, minds, and legislative votes from Sacramento to Albany.

This creates a bifurcation in startup strategy. The “FDA Moat” requires a fortress-building approach: concentrate resources, build an unbreachable scientific case, and wait for the single gatekeeper to grant access. The “Legislative Quilt” demands a dynamic campaign approach: deploy resources flexibly, build local coalitions, and secure market access incrementally.

PRISM Insight: The New Due Diligence for VCs

For investors, this new landscape demands a fundamental shift in due diligence. Asking a healthtech founder about their “FDA pathway” is table stakes. The more sophisticated question is now, “What is your policy and public affairs strategy?”

VCs must now underwrite a new type of risk: legislative execution risk. A brilliant technology or business model is worthless if it remains illegal in 45 states. We anticipate the rise of funds with in-house policy experts and former lobbyists, capable of not only evaluating a startup's GTM strategy but actively helping them execute it. The ability to navigate and shape legislation is becoming as valuable a skill set in a founding team as engineering or product management.

PRISM's Take: Regulation is the Product

The most consequential founders of the next decade will not treat regulation as a bureaucratic hurdle to be cleared, but as a core feature of their product. They will understand that in industries from climate tech to end-of-life care, the code they write is inseparable from the legal code they must navigate or rewrite. The old playbook of “move fast and break things” is being replaced by a more calculated “move deliberately and build consensus.” The startups that master this two-front war—marrying deep technological innovation with sophisticated political strategy—will not just enter markets; they will create them.

관련 기사

미국 H-1B 비자 추첨이 '수혜자 중심'으로 개편됩니다. 빅테크, 스타트업, 그리고 글로벌 인재에게 미칠 영향을 심층 분석하고 미래를 전망합니다.

구글이 법원 명령에 따라 대체 결제를 허용했지만, 새로운 '대체 수수료'를 도입했습니다. 이것이 개발자에게 미치는 영향과 업계의 미래를 심층 분석합니다.

전 스플렁크 경영진이 설립한 Resolve AI가 1조원 가치로 시리즈 A를 유치했습니다. '변동형 가치평가'의 비밀과 AI SRE 시장의 미래를 심층 분석합니다.

구글이 검색 결과 스크래핑 업체 SerpApi를 고소했습니다. AI 시대 데이터 패권을 둘러싼 이 소송이 기술 업계에 미칠 파장을 심층 분석합니다.