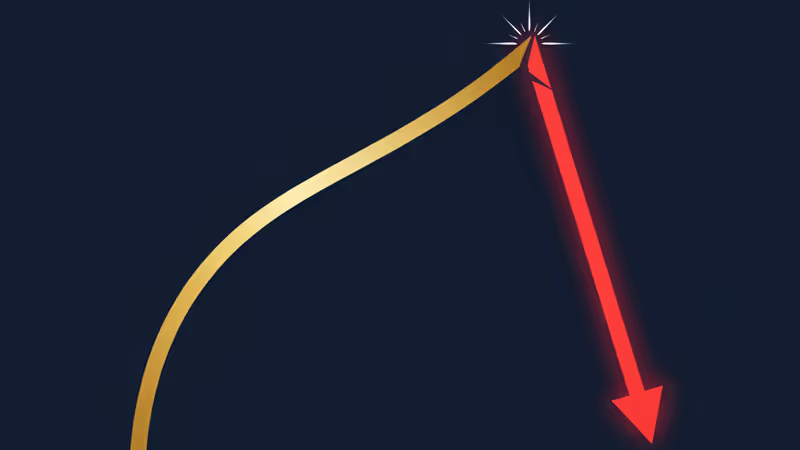

Crypto's Red Alert: Why Today's Jobs Data Could Spark a Violent Market Reversal

Bitcoin holds its breath ahead of pivotal US NFP data. With institutional outflows surging, here's the analysis investors need for the next big market move.

The Lede

The digital asset market is bracing for impact as traders await the pivotal U.S. nonfarm payroll (NFP) report, a release poised to either validate the current bearish trend or ignite a vicious short squeeze. Bitcoin is languishing near $86,400, pressured by the largest single-day outflow from U.S. spot ETFs since November and a technical chart breakdown that puts $80,000 in play. With institutional sentiment faltering, today’s employment data is the critical catalyst that will dictate crypto's next major directional move.

Key Numbers

- -$357 Million: Net outflow from U.S. spot Bitcoin ETFs on Monday, the highest in nearly a month.

- 4%: The level the U.S. 10-Year Treasury yield remains stubbornly above, signaling market skepticism about the Federal Reserve's easing path.

- $59 Million: The amount ARK Invest deployed to purchase crypto-related stocks during Monday's sell-off, a stark counter-signal to the prevailing fear.

- Significant Downtrend: The reading from the CoinDesk Bitcoin Trend Indicator (BTI) for the fourth consecutive day.

The Analysis

Good News is Bad News: The Fed's Crypto Conundrum

For risk assets like Bitcoin, the market is trapped in a classic "good news is bad news" paradox. A stronger-than-expected jobs report (consensus estimate: 40K) would signal economic resilience, giving the Federal Reserve less incentive to pursue the aggressive rate-cutting cycle the market has priced in. With the 10-year yield holding firm above 4% even after a recent rate cut, it’s clear the bond market needs more convincing. A strong NFP number would reinforce this "higher for longer" rates narrative, likely strengthening the U.S. dollar and adding further pressure on Bitcoin.

Conversely, a weak report would fuel expectations for more rapid monetary easing. As noted by XS.com analyst Linh Tran, this could "revive risk-taking." Given the dour market mood and growing short interest, a miss on employment figures represents the primary path for a "pain trade" to the upside, potentially triggering a sharp relief rally.

Institutional Nerves vs. Contrarian Conviction

The $357 million exodus from spot Bitcoin ETFs is a crucial indicator. It suggests that the newer, more traditional capital that entered via these products is proving less resilient to macro-driven volatility than crypto natives. This "fast money" is reacting to near-term headwinds like a decelerating pace of stablecoin growth—a key liquidity gauge—and delays in U.S. crypto regulation.

However, this institutional flight contrasts sharply with the actions of high-conviction players. ARK Invest's $59 million shopping spree across beaten-down crypto equities like Coinbase (COIN) and Circle (CRCL) demonstrates a clear long-term, contrarian strategy. While tourist investors are selling the macro FUD, dedicated funds are accumulating assets at a discount, betting that today's volatility is mere noise within a larger structural bull market.

PRISM Insight: Investment Strategy

The current environment presents two distinct playbooks based on an investor's time horizon and risk appetite.

1. The Tactical Volatility Play

For short-term traders, the NFP release is a defined event risk. The Volmex implied volatility index remains in a contained range, suggesting the options market may be under-pricing the potential for a large price swing. A tactical approach involves preparing for a binary outcome. A strong NFP print could confirm the technical breakdown, targeting the $80,000 psychological and technical support level. A weak print could see Bitcoin quickly reclaim higher ground, squeezing out recent shorts. Traders should have clear invalidation levels and consider strategies that profit from a spike in volatility, regardless of direction.

2. The Long-Term Accumulation Strategy

For long-term investors, the sell-off in crypto-related equities offers a more compelling opportunity than spot assets. Miners like Riot Platforms (-10.39%) and CleanSpark (-15.07%) have been hit disproportionately hard. This divergence presents a chance to gain leveraged exposure to the crypto ecosystem at a potential discount. Following the lead of firms like ARK Invest, investors with a multi-year thesis can use this macro-induced panic to build positions in high-beta stocks that will likely outperform spot Bitcoin during the next sustained leg up. The key is to distinguish temporary, macro-driven fear from a fundamental change in the long-term adoption thesis.

The Bottom Line

Today is a crucible for the crypto market. A strong jobs report will likely validate the bears, pushing Bitcoin towards a retest of its recent lows. A weak report could serve as the catalyst for a powerful reversal, punishing the crowded bearish sentiment. Sophisticated investors should look past the immediate price action and focus on the signals from different market participants. While ETF outflows indicate wavering sentiment from new entrants, the accumulation by conviction-driven funds like ARK provides a powerful counter-narrative. Your strategy should be defined by your thesis: either trade the short-term volatility or use the fear to build a long-term position.

関連記事

中国の若者失業率が微減。しかし新統計基準と構造問題が潜む。投資家やビジネスリーダーが今、中国経済の真のリスクを理解するために読むべき分析。

歴史的な円安の背景にある日米金利差と日銀のジレンマを分析。これが日本経済の構造転換と投資機会にどう繋がるのかを専門家が解説します。

石油元売り最大手ENEOSによる半導体材料JSRの買収を深掘り分析。脱炭素と経済安全保障が交差する、日本産業界の巨大な転換点の本質を解説します。

中国経済の新たな牽引役「新三様」(EV、電池、太陽光)を徹底分析。不動産危機からの脱却とグリーン覇権の野望が、世界の投資家とビジネスに与える影響とは。