Crypto's $3 Trillion Test: A Divergence Signal Investors Can't Ignore

Crypto's $3T floor is tested as institutional ETF selling clashes with long-term corporate buying. PRISM analyzes the divergence and provides actionable strategy.

The Lede

The global crypto market is testing a critical $3 trillion support level for the third time in a month, with Bitcoin falling to $86,580. But this is no ordinary pullback. A clear divergence is emerging: short-term institutional players are de-risking via ETFs, while corporate treasuries are using the dip to accumulate, creating a complex and pivotal moment for investors.

Key Numbers

- Total Market Cap: Below $3 Trillion

- Bitcoin Price: $86,580 (-1.5%)

- Crypto Fear & Greed Index: 11 (Extreme Fear)

- US Unemployment Rate: 4.6% (Highest since 2021)

- Strategy's Recent BTC Purchase: $1 Billion (10,624 BTC)

The Analysis

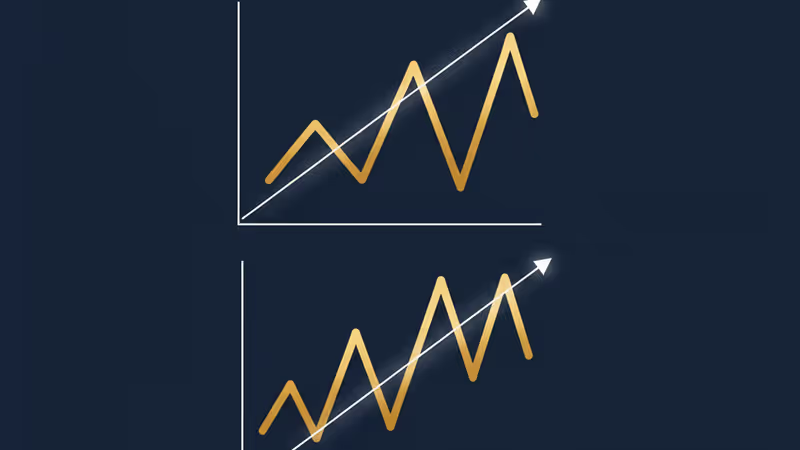

The Great Institutional Divergence

The current selling pressure is not a broad-based retail panic; it's a sophisticated rebalancing act within the institutional class. We are witnessing two distinct institutional behaviors playing out simultaneously.

First, the "fast money" – hedge funds and asset managers with ETF exposure – appears to be taking profits and reducing risk into the year-end. This is tactical, short-term positioning, amplified by thin holiday-season liquidity. The selling in ETF-heavy assets like Bitcoin and Ether is a direct reflection of this sentiment shift.

Second, the "conviction capital" – long-term corporate accumulators like Strategy – views this price weakness as a strategic buying opportunity. Strategy's recent $1 billion BTC purchase, as noted by Glassnode's on-chain data, is a powerful counter-signal. These players are focused on long-term treasury management, not quarterly performance, and are absorbing the supply from shorter-term traders.

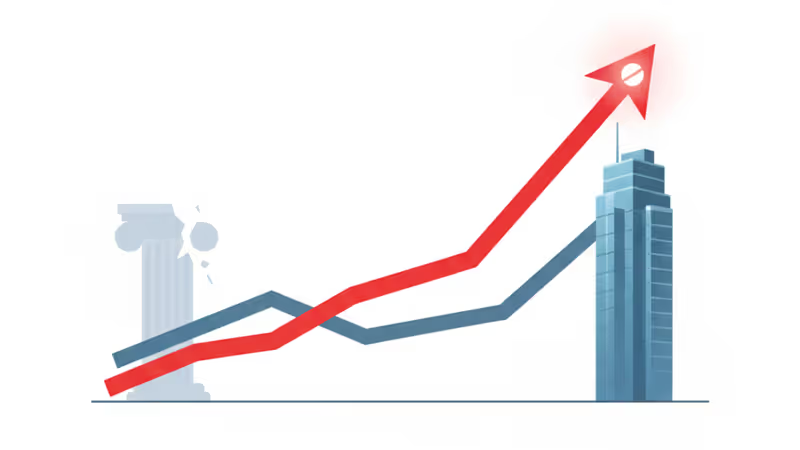

Macro Headwinds Clash with On-Chain Strength

Bitcoin's current price action demonstrates its increasing integration into the global macro landscape. The dip coincides with a strengthening U.S. dollar (DXY recovering to 98.30) and unsettling U.S. jobs data, where a jump in unemployment to a four-year high of 4.6% hints at economic fragility. For traditional finance, these are classic risk-off signals.

This contrasts sharply with Asian equity markets, which are rallying on expectations of fiscal stimulus from Beijing. The key takeaway is that crypto is now sensitive enough to be swayed by Western macro data, even when other global risk assets are looking elsewhere for direction. This is a sign of market maturation, but also a new source of volatility for crypto investors to monitor.

PRISM Insight: Portfolio Strategy for the ETF Shakeout

This is not a market-wide capitulation, but rather a significant rotation from weaker, sentiment-driven hands to stronger, long-term holders. The key for investors is to identify which side of this trade they are on and act accordingly.

- For Tactical Traders: The battlefield is clearly defined at the $81,000 support level for Bitcoin—a confluence of November lows and prior consolidation. A break below this level could accelerate downside moves due to thin market depth. Keep a close watch on the DXY; continued dollar strength is a primary headwind.

- For Long-Term Investors: The current ETF-led selling presents a potential discount. The actions of corporate accumulators provide a strong signal of long-term conviction. This environment is favorable for dollar-cost averaging (DCA) strategies, allowing for accumulation at lower prices as short-term players exit. The focus should be on the persistent on-chain accumulation by large entities, not the transient sentiment reflected in the Fear & Greed Index.

The Bottom Line

The current market weakness is a critical test, revealing the fault lines in the institutional landscape. Investors must look past the headline numbers and recognize the underlying rotation. The key is to differentiate between the short-term noise of ETF rebalancing and the long-term signal of corporate balance sheet adoption. The defense of Bitcoin's $81,000 level will be the immediate tell, but the more significant trend is the ongoing transfer of digital assets to holders with a multi-year investment horizon.

関連記事

中国製薬業界がジェネリックから革新ハブへ。新指標が示す圧倒的なコスト効率と開発力。投資家と業界リーダー必見の分析です。

中国が米国債保有高を17年ぶりの低水準に。地政学的緊張と米国の債務問題が背景。脱ドル化の動きが世界金融システムに与える影響を専門家が分析。

日銀が政策金利を30年ぶり高水準の0.75%へ衝撃利上げ。デフレ脱却の象徴か、新たなリスクか。世界市場への影響と投資戦略を専門家が分析します。

ECBがFRBに先駆け利下げを開始。主要中銀の『政策デカップリング』が世界経済と金融市場に与える影響を、専門家が深く分析します。