Bitcoin's Year-End Rally Hits a Wall as Key Trendline Halts Push Above $90,000

Bitcoin's (BTC) recovery stalled after failing to break a key descending trendline from its $126,000 peak. With prices below $88,000, the focus shifts to support at $84,000. Here's what's next for the cryptocurrency.

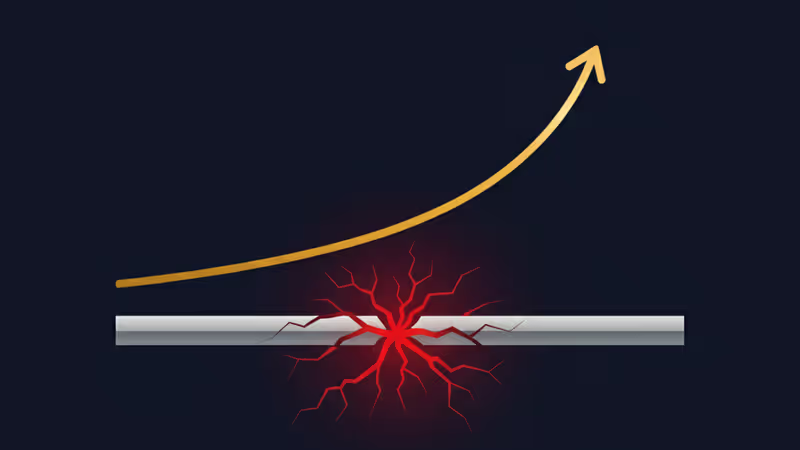

Bitcoin's late-year attempt to regain momentum stalled on Monday after prices were firmly rejected at a key technical resistance level, forcing the cryptocurrency back below $88,000. According to technical analysis from CoinDesk, the barrier is a descending trendline drawn from October's record high, acting as a glass ceiling for the market.

The resistance line originates from Bitcoin's all-time high above $126,000, connecting subsequent peaks from shallow recoveries, most notably the $116,400 high. Monday's failure to establish a foothold above $90,000 reinforces this barrier.

By failing to clear this hurdle, BTC has printed another "lower high." It’s a classic signal that sellers are re-emerging at resistance, confirming the "staircase-down" pattern that has defined the fourth quarter and stalling the momentum needed to challenge the six-figure mark.

As long as prices remain below this trendline, the immediate outlook is bearish. The latest rejection shifts traders' focus toward the $84,000–$84,500 support zone. If that level breaks, the next key area to watch is the November low near $80,000.

To revive a bullish case, analysts say BTC must achieve a decisive breakout above the trendline. Such a move could accelerate gains toward the $100,000 psychological level.

This single trendline has become the market's most critical short-term indicator. A breakout would do more than just lift the price; it could invalidate the entire Q4 downtrend and signal a major bearish-to-bullish reversal. Conversely, another firm rejection would confirm bearish control and likely trigger a deeper, swifter test of lower support levels.

本コンテンツはAIが原文記事を基に要約・分析したものです。正確性に努めていますが、誤りがある可能性があります。原文の確認をお勧めします。

関連記事

米GDP発表を前に、ビットコインが9万ドルを割り込み下落。一方、金は4500ドルに迫り、市場のリスク回避姿勢が強まっています。ドル安の中でもなぜBTCは売られるのか、専門家の見解と今後の展望を解説します。

ビットコイン(BTC)は23日、10月の最高値から引かれる重要な下降トレンドラインに上値を阻まれ8万8000ドルを割り込んだ。短期的な弱気見通しが強まる中、強気転換の鍵を握る価格水準を解説。

ビットコインの用途を巡る論争が激化。ベテラン開発者ルーク・ダッシュジュニアはOrdinalsを『スパム』と批判。BTCの思想と未来を深掘り分析します。

ビットコインが重要な支持線「100週移動平均線」で攻防。先行指標マイクロストラテジー株は既に下落。投資家が今取るべき戦略とは?専門家が徹底解説。