降息預期助燃!標普500指數盤中觸及歷史新高

在聯準會(Fed)降息預期的推動下,美國標普500指數盤中創下歷史新高。本文深入分析市場樂觀情緒背後的驅動力,並警示投資人應注意的潛在風險。

您的投資組合是否迎來了聖誕大禮?根據路透社報導,在市場對聯邦準備理事會(Fed)將於2026年降息的強烈預期推動下,美國標普500指數於2025年12月24日盤中勢如破竹,一舉刷新歷史最高紀錄,為市場點燃了年底的樂觀情緒。

降息預期成主要推手

此輪漲勢的核心驅動力,來自於投資人普遍預期聯準會將很快從緊縮貨幣政策轉向寬鬆。近期的經濟數據顯示通膨壓力正在緩解,這增強了市場對於降息即將到來的信心。較低的利率通常會降低企業的融資成本,並提高股票相對於債券等其他資產的吸引力,對股市構成利多。

投資人應注意的潛在風險

儘管市場洋溢著「聖誕行情」的喜悅,但這波漲勢完全建立在對未來的預期之上。投資人必須警惕,如果未來的通膨數據意外反彈,或聯準會的降息步伐不如市場預期的那樣迅速,當前的樂觀情緒可能迅速逆轉,導致市場出現劇烈回檔。

市場已提前反應降息利多,若聯準會的實際政策路徑與預期不符,市場可能出現劇烈回檔。投資人應避免過度追高,保持警惕。

This content is AI-generated based on source articles. While we strive for accuracy, errors may occur. We recommend verifying with the original source.

Related Articles

Major investment banks have lifted South Korea's 2026 inflation forecast to 2.0%, citing the persistently weak won. With the currency nearing 1,500 per dollar, import costs are rising, posing a dilemma for the Bank of Korea.

South Korea's LS Eco Energy is investing $19 million in Vietnam's rare-earth sector, a strategic move to diversify critical mineral supply chains away from China for EVs and robotics.

The U.S. has signaled a return to 'maximum pressure' sanctions on Venezuela at the UN Security Council. The move could tighten global oil supply and lead to higher crude prices.

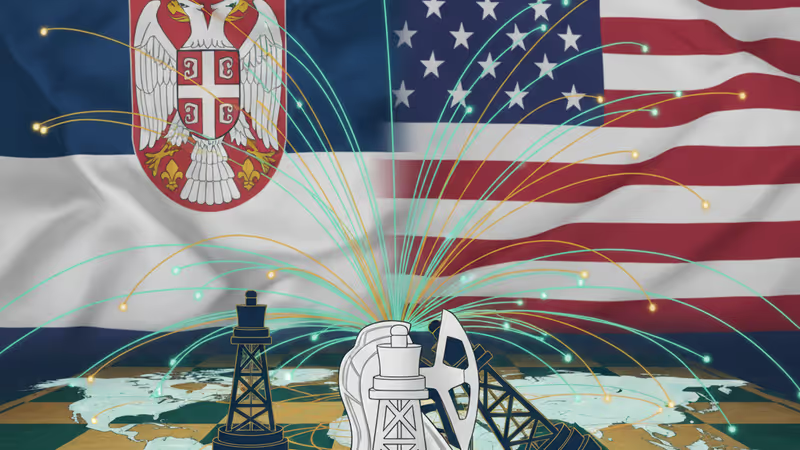

The U.S. has unusually approved negotiations for the sale of Gazprom Neft's stake in Serbian energy firm NIS, signaling a potential shift in the Balkan energy map.