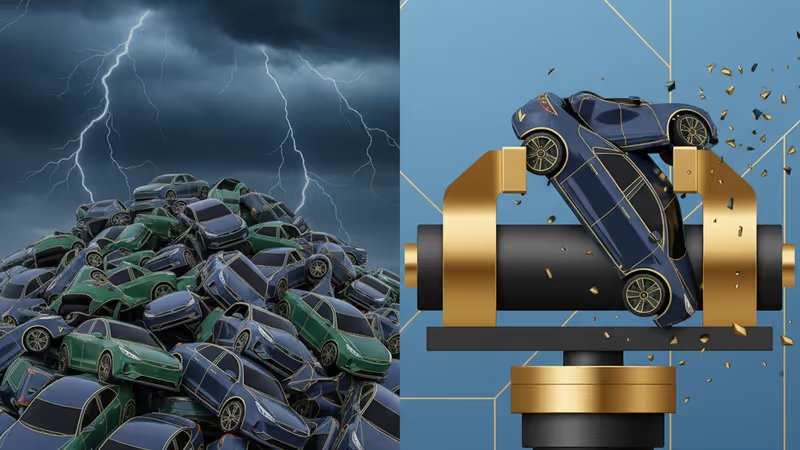

EV Gold Rush Is Over: Automakers Pivot Back to Gas Guzzlers After Billions Burned

The EV euphoria in the U.S. auto industry is over. Automakers like GM and Ford are pulling back on EV investments after billions in losses, pivoting back to profitable gas trucks and hybrids as consumer demand stalls.

The U.S. auto industry’s electric vehicle euphoria has slammed into a wall of realism. After wasting billions on an all-electric future that consumers didn't fully embrace, giants like and are hitting the brakes. They're now scaling back ambitious EV plans and refocusing on what sells: large, profitable gas-guzzling trucks and SUVs, with many executives admitting that government policies, not customers, were driving the charge.

A Costly Miscalculation

The financial fallout from this pivot is staggering. announced last week it expects to record about in special charges related to its restructuring and EV pullback. Meanwhile, has already disclosed a impact from its own scale-back, with more write-downs expected.

"We're following customers to where the market is, not where people thought it was going to be," CEO told CNBC. His counterpart at , CEO , noted it’s “too early to tell” what true EV demand is, suggesting the next six months will reveal the market’s natural level without heavy-handed incentives.

The Data Tells the Story

The numbers confirm the downturn. According to , U.S. EV sales peaked in September at of the new vehicle market, just before the administration killed federal incentives of up to . In the fourth quarter, that demand plummeted to a preliminary . Experts now believe the EV timeline is being “recalibrated.” forecasts EVs will make up of the U.S. market by 2030—a respectable figure, but one that doesn't justify the colossal upfront investments.

The 'Tesla Delusion' and the Rise of Hybrids

A core strategic error, analysts say, was misinterpreting ’s success. "Tesla wasn't creating a battery-electric vehicle market. They created a market for the Tesla brand," said Stephanie Brinley of . Consumers were making a "tech-buy," not simply choosing an EV. When legacy automakers tried to replicate this, they found customers weren't interested. Now, the industry is embracing what calls the "mosaic of powertrains." is refocusing on hybrids, plans to offer plug-in hybrids, and even is allocating production for hybrids at its new Georgia plant.

The era of rewarding 'all-in' EV strategies is over. For investors, the focus is shifting from pure-play EV growth stories to automakers with flexible production capabilities. Companies that can pivot between EVs, hybrids, and traditional ICE vehicles based on real-time market demand are now positioned as the more resilient, and potentially more profitable, long-term investments.

This content is AI-generated based on source articles. While we strive for accuracy, errors may occur. We recommend verifying with the original source.

Related Articles

An intense EV price war, fueled by massive overcapacity in China, is now hitting global automakers like Tesla and Ford, squeezing profits and forcing strategic retreats. Here's what it means for your portfolio.

U.S. regulators have escalated their investigation into Tesla's Autopilot system, now covering 830,000 vehicles. This move to an engineering analysis raises the risk of a major recall.

Elon Musk becomes the world's first person with a net worth of $700 billion following a court ruling that upheld his massive Tesla pay package. Analysis on what this means for investors and TSLA stock.

Fundstrat's Tom Lee and Sean Farrell offer differing Bitcoin outlooks. PRISM analyzes how mandates and time horizons shape expert crypto forecasts, highlighting market maturity.