OpenAI's $830B Valuation Isn't Just a Number—It's a Geopolitical Power Play

OpenAI's rumored $100B funding at an $830B valuation isn't just about capital. It signals a shift to AI as a geopolitical infrastructure race. Read our analysis.

The Lede: Beyond the Hype

OpenAI’s rumored pursuit of $100 billion at an eye-watering $830 billion valuation is not just another tech funding story. For the C-suite, this is a seismic signal that the AI race is no longer a software competition; it has escalated into a capital-intensive, global infrastructure buildout on par with national energy grids or telecom networks. This move redefines the financial and strategic stakes for every organization, transforming AI from a tool into a new class of strategic asset.

Why It Matters: The Second-Order Effects

This capital raise, if successful, fundamentally alters the AI landscape by creating a gravitational center of capital, talent, and compute that is nearly impossible to replicate. The implications ripple far beyond Silicon Valley.

- The Capital Moat: A war chest of this magnitude creates a nearly insurmountable barrier to entry for new foundational model players. The era of the lean AI startup challenging the incumbents at the core model level is effectively over. The game is now about scale, and OpenAI is building a fortress of capital.

- Sovereign Stakeholders: The reported courtship of sovereign wealth funds is the most critical detail. This is not just about diversifying investors; it's about enlisting nations as strategic partners. AI is being framed as a national security and economic sovereignty issue, and countries are being forced to choose their allegiance—invest in OpenAI or risk being left behind.

- The Compute Arms Race: With an estimated $20 billion in annual revenue against staggering compute costs, this funding isn't for runway; it's for dominance. It’s an explicit move to corner the market on future GPU supply, data center capacity, and the talent required to run it all, effectively starving competitors of the resources needed to keep pace.

The Analysis: From Research Lab to Global Utility

To understand the $830 billion figure, one must stop valuing OpenAI as a software company and start seeing it as a next-generation utility. Its valuation isn't based on a multiple of its current $20 billion revenue run-rate but on its potential to become a foundational, non-discretionary layer of the global economy.

Historically, Big Tech battles were fought over platforms—operating systems, social graphs, or search indices. OpenAI, along with rivals like Google and Anthropic, is fighting a much deeper war: the battle for the 'reasoning layer' of the internet. The rumored talks with Amazon for both capital and access to custom AI chips highlight a critical strategic pivot towards vertical integration. To control the future, OpenAI understands it must control the full stack, from the silicon up to the API call. This is a direct response to the primary bottleneck and existential threat to its growth: the chip supply chain, largely dominated by NVIDIA.

PRISM Insight: The Downstream Gold Rush

While OpenAI's valuation grabs headlines, the real investment signal is in the downstream flow of this capital. This $100 billion, and the trillions OpenAI plans to spend, will not stay within its walls. It will pour into the AI supply chain, creating enormous value for the 'picks and shovels' of the AI revolution.

The key takeaway for investors: The most tangible opportunities are not in trying to find the 'next OpenAI' but in identifying the critical enablers that will benefit from this capital tsunami. This includes:

- Advanced Hardware: Beyond NVIDIA, this means companies specializing in high-bandwidth memory (HBM), interconnects, and advanced cooling systems for data centers.

- Energy and Infrastructure: The power consumption of these AI factories is immense. Companies in energy generation, transmission, and data center real estate are becoming core components of the AI ecosystem.

- Specialized Software: Tools that manage and optimize massive GPU clusters and streamline AI development workflows will become mission-critical.

PRISM's Take: A Declaration of AI Statehood

This funding effort is a declaration that OpenAI intends to operate on the level of a nation-state. It is building a privately-controlled, strategic resource that other corporations and even countries will become dependent on. The $830 billion price tag is less a valuation and more of a capitalization table for a new kind of global power broker.

The immense risk is not just financial but existential. Can any single corporate entity be a responsible steward of technology this powerful? By courting sovereign wealth funds, OpenAI is implicitly acknowledging this, attempting to create a coalition of global stakeholders. However, it also sets the stage for a new era of geopolitical tension, where digital sovereignty is defined by access to foundational AI. This isn't just a funding round; it's the opening move in the consolidation of the AI-powered future.

相关文章

OpenAI推出ChatGPT個性化設定,讓用戶自訂AI的語氣與風格。這不只是UX優化,更是鞏固用戶忠誠度、對抗競爭的關鍵一步。

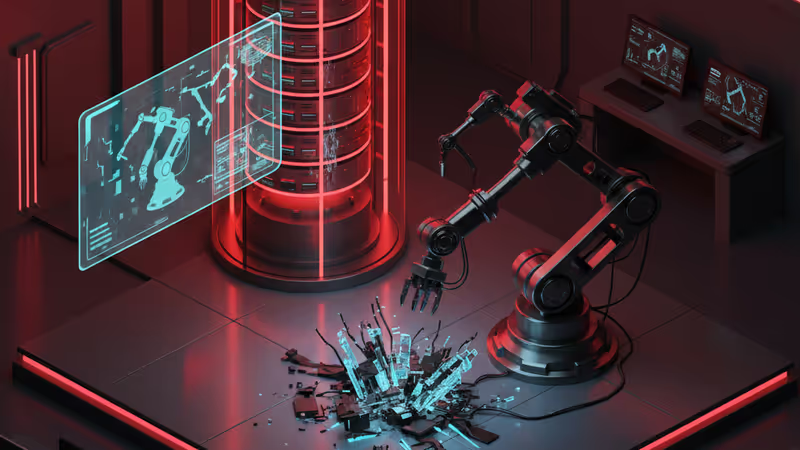

OpenAI的紅色警報揭示了AI競賽的殘酷現實。從數據中心的地緣政治風險到機器人技術的突破,PRISM深度解析AI霸權的未來戰場。

OpenAI更新青少年AI安全政策,此舉是應對監管壓力的防禦,也為產業設下新標竿。真正的挑戰在於技術執行,而非紙上政策。

ChatGPT推出應用程式目錄,這不只是功能更新,而是劍指Google、Apple的平台戰略。PRISM深度解析其生態系野心與未來趨勢。