iRobot's Bankruptcy: What the Fire Sale to its Chinese Supplier Signals for Tech Investors

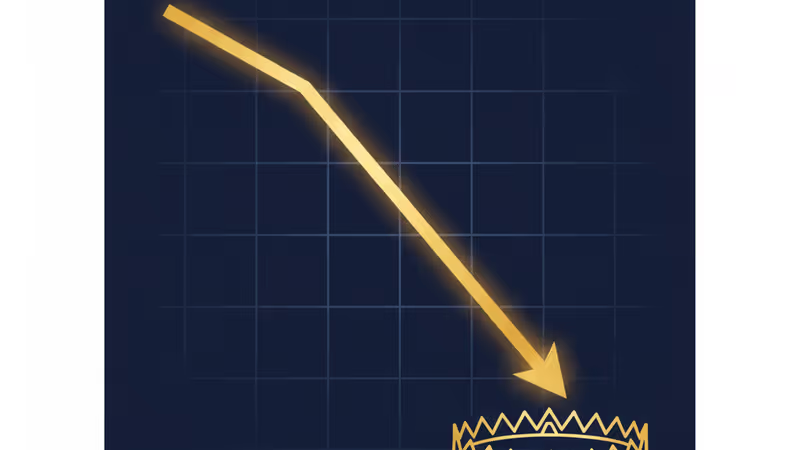

iRobot's bankruptcy and sale to its Chinese supplier reveals critical lessons for investors on hardware commoditization, regulatory risk, and a new M&A playbook.

The Lede: A Pioneer's End, A Supplier's Beginning

iRobot, the company that pioneered the robotic vacuum cleaner with its Roomba brand, has filed for Chapter 11 bankruptcy. In a stark reversal of fortune, the American innovator is set to be acquired by its primary Chinese supplier, Shenzhen-based Picea Robotics. This collapse comes nearly two years after a life-saving $1.5 billion acquisition by Amazon was blocked by EU regulators, leaving iRobot exposed to a relentless wave of low-cost competition that ultimately erased its market leadership and financial stability.

Key Numbers

- Chapter 11: The bankruptcy filing signals the end of iRobot as an independent, publicly traded entity and initiates a court-supervised restructuring.

- $1.5 Billion: The value of the failed 2022 Amazon acquisition deal, a price tag that stands in stark contrast to the company's current distressed valuation.

- 0 to 1: The shift in power dynamic, from iRobot being the customer (1) and Picea the supplier (0), to Picea becoming the owner of the entire operation.

The Analysis

The Unintended Consequences of Regulation

The story of iRobot's demise cannot be told without scrutinizing the role of regulatory intervention. When the EU blocked Amazon's takeover on antitrust grounds, the stated goal was to preserve competition in the consumer robotics market. The outcome, however, has been the opposite. The decision left iRobot fatally weakened and unable to compete with the very rivals the regulation was meant to empower. Instead of being owned by a US tech giant, its valuable brand and intellectual property will now be controlled by a Chinese entity. This raises critical questions for investors about geopolitical risk and the unforeseen consequences of regulatory actions in a globally competitive landscape. The market is learning a harsh lesson: blocking a domestic acquisition can sometimes pave the way for a foreign one under far less favorable terms.

Hardware is Hard, Commoditization is Brutal

iRobot is a classic case study in the brutal lifecycle of consumer hardware. The company enjoyed a decade of dominance, building a brand synonymous with the product category itself. However, its moat—brand recognition and patented technology—proved insufficient against the tide of commoditization. Competitors, many leveraging the same Chinese supply chains, reverse-engineered the core product and offered 80% of the functionality for 50% of the price. iRobot failed to build a significant recurring revenue stream or a software and services ecosystem to lock in customers, leaving it vulnerable to a pure price war it was destined to lose. This serves as a cautionary tale for investors in any hardware-centric company: without a defensible software or service layer, even the most innovative hardware is on a path to becoming a low-margin commodity.

PRISM Insight: Investment Strategy & Geopolitical Shifts

The iRobot saga offers two powerful takeaways for sophisticated investors.

First, the investment thesis for consumer hardware has fundamentally shifted. The playbook of 'build a better mousetrap' is obsolete. Value creation is no longer in the physical device itself but in the data it collects, the software that powers it, and the ecosystem it plugs into. Investors should be rigorously stress-testing their hardware holdings. Does the company have a recurring revenue model? Is there a strong software component that creates a sticky user experience? If the answer is no, the company is likely on the same trajectory as iRobot.

Second, we are witnessing the 'Supply Chain Acquisition' playbook. This is a significant evolution in US-China economic relations. Chinese manufacturers are no longer content being the low-cost factory for the world. They are moving up the value chain by acquiring the very Western brands they once supplied. For Picea Robotics, this is a masterful strategic move: they acquire a globally recognized brand, a distribution network in the US and Europe, and a patent portfolio for pennies on the dollar, all while having intimate knowledge of the product's manufacturing and cost structure. Investors must now view supply chain partners not just as vendors, but as potential competitors and strategic acquirers, fundamentally changing the risk profile of companies heavily reliant on outsourced manufacturing.

The Bottom Line

For investors, the fall of iRobot is a critical signal to re-evaluate exposure to pure-play hardware companies. The new benchmark for success is a hybrid model that blends hardware with a robust, high-margin software and services ecosystem. Furthermore, the acquisition by Picea Robotics is a watershed moment, highlighting a new strategic capability within China's tech ecosystem. Businesses must now account for a new risk: the day your supplier becomes your owner.

相关文章

OPEC+意外每日減產200萬桶,推升油價。PRISM獨家分析此舉對通膨、央行政策及投資組合的深遠影響,並提供具體策略建議。

最新美國CPI數據高於預期,聯準會降息時程可能延後。PRISM深度分析對投資組合的影響,並提供下半年的具體佈局策略。

XRP價格在成交量暴增246%的情況下失守1.93美元。我們的深度分析揭示了這對投資者意味著什麼,以及大型參與者下一步的可能動向。

狗狗幣(DOGE)在交易量激增下暴跌5.5%,跌破關鍵支撐。本文深度分析這究竟是散戶的恐慌性拋售,還是機構投資者正在伺機入場的信號。