Ford Just Killed the All-Electric F-150 Lightning. Here's Why It's a Genius Move.

Ford is halting the all-electric F-150, but this isn't a failure. Our expert analysis reveals why the pivot to a range-extended EREV is a pragmatic masterstroke.

The Lede: Ford Hits the Brakes on Its EV Dream

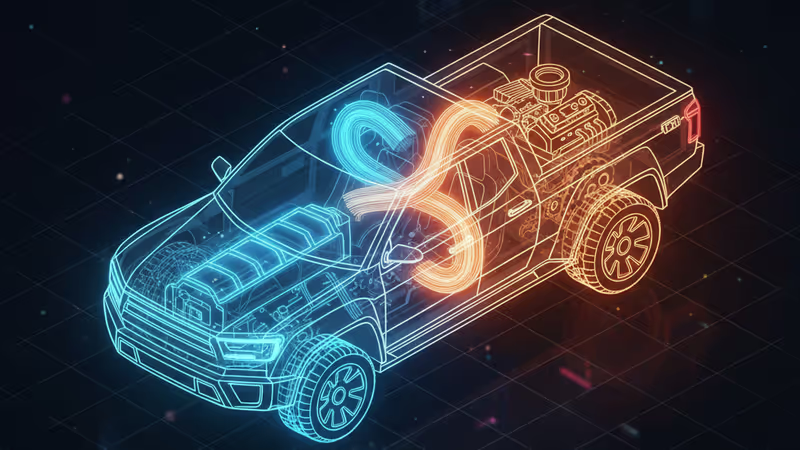

Ford is mothballing its all-electric F-150 Lightning production line, a stunning reversal of what was once the centerpiece of its EV strategy. Instead of chasing Tesla, Ford is pivoting to what its truck customers actually need: a range-extended electric vehicle (EREV). This isn't a retreat; it's a calculated, pragmatic masterstroke that acknowledges a hard truth: for America's most demanding vehicle segment, the all-electric dream is still a logistical nightmare. Ford is betting that a gas-powered generator under the hood is the key to unlocking the mainstream truck market.

Why This Matters: The Great EV Realignment

This decision sends shockwaves far beyond Detroit. It signals the end of the “EVs-at-all-costs” era and the beginning of a market-driven reality check. While tech media celebrated the Lightning's launch, Ford's core truck buyers—contractors, fleet managers, and rural families—were doing the math on towing range, charging times, and payload penalties. The numbers didn't add up.

This pivot has critical second-order effects:

- Validates Hybrid Tech: It hands a major victory to proponents of transitional technologies, like Toyota, who have long argued for a multi-pronged approach over an all-in bet on pure BEVs.

- Pressurizes Pure-Plays: It puts immense pressure on rivals like Rivian and Tesla's Cybertruck, whose entire value proposition is built on the pure-EV promise. Ford is creating a new category that directly attacks their biggest weakness: utility without compromise.

- Redefines "Electrification": For fleets and businesses, this EREV model could be the holy grail. It offers the low running costs and instant torque of an EV for daily, local use, paired with the go-anywhere, tow-anything reliability of a gas engine for serious work. This is practical electrification, not ideological.

The Analysis: Learning from the Past to Win the Future

History's Echo: The Ghost of the Chevy Volt

The EREV concept isn't new. General Motors tried it with the Chevrolet Volt, a sedan with a cult following that was ultimately deemed a commercial failure and discontinued. So why would it work for Ford now? The context is completely different. The Volt solved a problem (range anxiety) for a market segment that had other options. The F-150 EREV solves a mission-critical problem (crippling range loss under load) for a segment with no other viable electric alternative. For a truck user, towing a trailer and seeing the range plummet by 60% isn't an inconvenience; it's a catastrophic failure of the tool. The on-board generator transforms the F-150 from a compromised EV into a no-compromise workhorse.

The Competitive Battlefield Shifts

Ford is no longer playing on Tesla's and Rivian's turf. It's creating its own. While competitors focused on 0-60 times and futuristic designs, Ford listened to the focus groups that mattered: people who use their trucks for work. The upcoming EREV Lightning, with a claimed 700+ mile range and uncompromising towing, is a direct assault on the primary objection to EV trucks. How will GM, Ram, and Tesla respond? They are now faced with a difficult choice: stick to their pure-EV roadmaps and risk being painted as niche products, or invest billions in developing their own EREV systems, effectively admitting Ford was right.

PRISM Insight: The Market vs. The Mandate

This move highlights the growing chasm between government mandates pushing for 100% BEVs and the reality of consumer and commercial needs. Ford's data clearly showed that the total addressable market for a $70,000+ pure-electric truck with significant operational limitations was far smaller than initially hoped. The hype cycle outran the use case.

For investors, this is a de-risking of Ford's EV strategy. While less exciting than a full-scale EV war, it's a more defensible and potentially profitable position. The real investment opportunity may now shift from pure-play EV companies to the suppliers who master the components for these advanced hybrid and EREV systems. Ford is trading revolutionary fervor for evolutionary profit.

For businesses, the actionable guidance is clear. If you're a fleet manager who has been hesitant to electrify due to range and infrastructure concerns, the EREV F-150 is the product you've been waiting for. It promises the potential for significant fuel and maintenance savings on local routes without sacrificing the operational capability needed for demanding, long-distance jobs. This could dramatically accelerate commercial fleet turnover in the coming years.

PRISM's Take

Ford's pivot isn't a failure; it's the smartest move in the EV space this year. They have chosen to build the electric truck America actually wants to buy, not the one pundits claim it should want. By embedding a high-power generator, Ford transforms the electric powertrain from a limitation into a feature, offering silent, efficient daily driving while eliminating the single biggest barrier to adoption for its core audience. This strategic retreat from the pure-EV front line is, in fact, a brilliant flanking maneuver that could allow Ford to conquer the vast and profitable center of the American truck market.

相关文章

福特F-150 Lightning將轉向EREV增程技術,提供超過1100公里續航,解決電動卡車的拖曳焦慮。這項務實策略將如何重塑美國卡車市場的競爭格局?

南韓啟動150兆韓元國家增長基金,目標鎖定AI、半導體與電池。本文深度解析其在全球科技競賽中的戰略意圖、投資機會與潛在風險。

碟型衛星(DiskSat)成功發射,其獨特的扁平設計旨在徹底改變衛星部署效率。這項技術可能顛覆立方衛星標準,大幅降低星座建置成本。

AI伺服器需求正以前所未見的力道衝擊消費級PC市場。PRISM深度解析記憶體與SSD價格為何飆漲4倍,以及這對PC玩家的深遠影響。