BNB Tops $860 But Lags Market as New Binance Probe Spooks Investors

BNB price breaks $860 but underperforms the market amid a Financial Times report on Binance's regulatory failures. Analysis on the clash between bullish technicals and rising legal risks.

Binance's BNB coin pushed past the $860 resistance level Monday, climbing 1.7% in 24 hours on a surge in trading volume. But the token is lagging the broader crypto market, which saw the CoinDesk 20 (CD20) index gain 2.2% in the same period, as fresh regulatory concerns weigh on investor sentiment.

The underperformance comes as the Financial Times reported that Binance has failed to stop hundreds of millions of dollars from flowing through suspicious accounts. According to the FT's investigation, these failures occurred even after the exchange agreed to a landmark $4.3 billion settlement with U.S. authorities in 2023 to resolve a criminal case.

Technically, the picture looks bullish. Trading volume jumped 192% above the daily average, a sign of institutional demand, and hourly charts showed a V-shaped recovery. However, the fundamental picture is less clear. BNB remains 32% below its all-time high of $1,360. In contrast, other exchange tokens like KCS and LEO are down far less from their peaks, showing more resilient performance, according to CryptoQuant data.

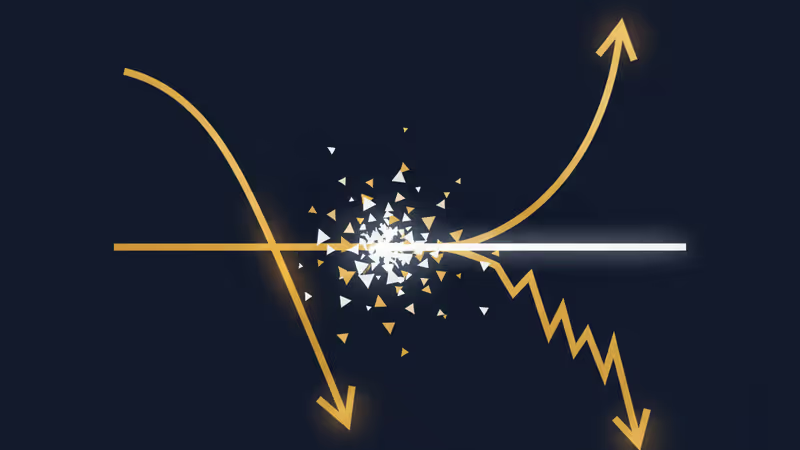

Investors are facing a classic divergence: bullish technicals versus bearish fundamentals. The surge in volume and chart patterns suggest strong buying pressure is present. However, the renewed regulatory scrutiny following the FT report represents a significant, unquantifiable risk that could cap further gains and deter more conservative capital from entering the market.

本内容由AI根据原文进行摘要和分析。我们力求准确,但可能存在错误,建议核实原文。

相关文章

儘管BNB價格突破860美元,但因《金融時報》披露幣安監管漏洞,其表現仍落後於市場。本文深入分析BNB價格走勢、技術指標與面臨的監管挑戰。

2025年底前必讀的加密貨幣節稅指南。本文詳解如何利用市場下跌,透過「虧損收割」三步驟沖銷資本利得,並提醒投資者應對2026年報稅新規的關鍵注意事項。

BNB跌破$850關鍵支撐位,引發市場擔憂。本文深入分析其背後的技術信號、對投資組合的影響,並為短線交易者和長線投資者提供實用策略。

英國洲際酒店集團(IHG)計畫於2029年在大阪開設一間超過800間客房的大型酒店,地點鄰近環球影城與未來的賭場,目標鎖定高端旅客與商務客。