Beyond the FDA: The New Regulatory Playbook for Disruptive Startups

Startups in regulated industries face more than just the FDA. A new analysis of the 'Legislative Quilt' vs. the 'Regulatory Moat' for founders and VCs.

The Two-Front War on Regulation

For decades, founders in regulated spaces viewed the challenge as a singular, monolithic beast: conquer the FDA, the SEC, or the FCC, and you’ve built an unassailable moat. This view is now dangerously obsolete. The new reality is a two-front war. While giants like Enspectra Health spend a decade navigating the federal labyrinth, a new breed of disruptor like Earth Funeral is fighting a guerilla war, state by state, in the court of public opinion and legislative session. Understanding which battle you’re fighting is now the most critical strategic decision a founder can make.

Why It Matters: Strategy Follows Structure

The type of regulatory hurdle a startup faces dictates its entire operational and financial strategy. The distinction isn't academic; it's the difference between life and death for the company.

- The FDA Moat: Enspectra Health’s decade-long quest for FDA clearance for its non-invasive biopsy device is a classic example. This is a capital-intensive, R&D-heavy marathon. The prize is a massive, protected market. The second-order effect is a company built for deep science and clinical rigor, attracting patient capital from specialized life-science VCs. The moat is deep but requires immense upfront investment to dig.

- The Legislative Quilt: Earth Funeral, which turns human remains into soil, faces a different challenge. With no single federal body governing funeral practices, its market access is a patchwork of state laws. This requires a strategy of political agility, public affairs, and grassroots lobbying. The company's core competency isn't just its technology, but its ability to change laws and societal norms, one state at a time. This model favors operators with policy savvy and VCs who understand how to price political risk.

The Analysis: The Evolution of the Moat

The traditional venture capital thesis lionized the “regulatory moat.” It was a barrier to entry that, once crossed, defended a startup from fast-following competitors. This model holds true in deep tech and biotech, where scientific validation is paramount. We see this in the years-long journeys of companies in gene editing, medical devices, and novel therapeutics.

However, as software and novel business models continue to eat the world, they are increasingly colliding with industries governed not by federal agencies, but by a complex web of state and local rules. Think Uber and the taxi commissions, Airbnb and city zoning laws, or fintechs and the 50 different state money transmitter licenses. Earth Funeral is the latest archetype in this trend. Its success hinges less on a single green light from Washington D.C. and more on a sustained campaign to win over hearts, minds, and legislative votes from Sacramento to Albany.

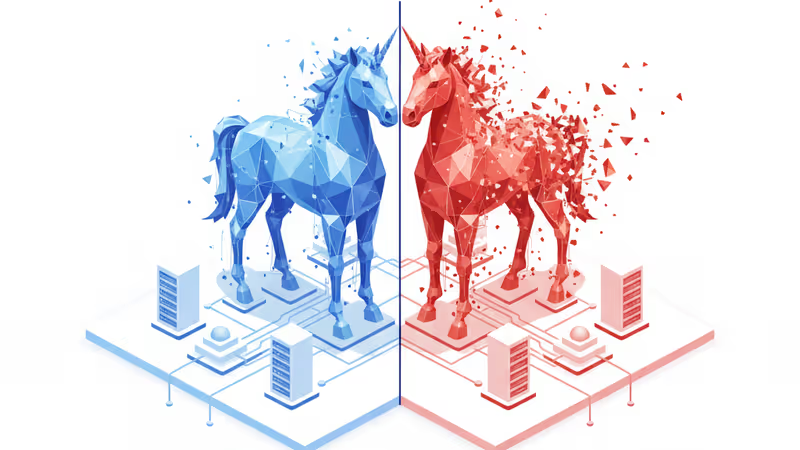

This creates a bifurcation in startup strategy. The “FDA Moat” requires a fortress-building approach: concentrate resources, build an unbreachable scientific case, and wait for the single gatekeeper to grant access. The “Legislative Quilt” demands a dynamic campaign approach: deploy resources flexibly, build local coalitions, and secure market access incrementally.

PRISM Insight: The New Due Diligence for VCs

For investors, this new landscape demands a fundamental shift in due diligence. Asking a healthtech founder about their “FDA pathway” is table stakes. The more sophisticated question is now, “What is your policy and public affairs strategy?”

VCs must now underwrite a new type of risk: legislative execution risk. A brilliant technology or business model is worthless if it remains illegal in 45 states. We anticipate the rise of funds with in-house policy experts and former lobbyists, capable of not only evaluating a startup's GTM strategy but actively helping them execute it. The ability to navigate and shape legislation is becoming as valuable a skill set in a founding team as engineering or product management.

PRISM's Take: Regulation is the Product

The most consequential founders of the next decade will not treat regulation as a bureaucratic hurdle to be cleared, but as a core feature of their product. They will understand that in industries from climate tech to end-of-life care, the code they write is inseparable from the legal code they must navigate or rewrite. The old playbook of “move fast and break things” is being replaced by a more calculated “move deliberately and build consensus.” The startups that master this two-front war—marrying deep technological innovation with sophisticated political strategy—will not just enter markets; they will create them.

相关文章

Resolve AI以250倍營收的驚人估值完成A輪募資。PRISM深度解析其多階段投資結構、AIOps賽道,以及企業自主維運的未來。

美國正試點用AI審核H-1B簽證,這將如何改變全球科技人才的流動?PRISM深度解析其對企業與個人的衝擊及未來趨勢。

Google為遵守法院命令而開放Android支付,但新的「服務費」卻讓開發者的勝利蒙上陰影。PRISM深度解析此舉對全球App經濟的真正影響。

Google起訴數據抓取公司SerpApi,不僅是商業訴訟,更是保護其在AI時代核心數據資產的關鍵戰役。這將重塑AI產業的數據供應鏈。