BBVA's 120,000-Employee AI Gamble: Why This Is Banking's Point of No Return

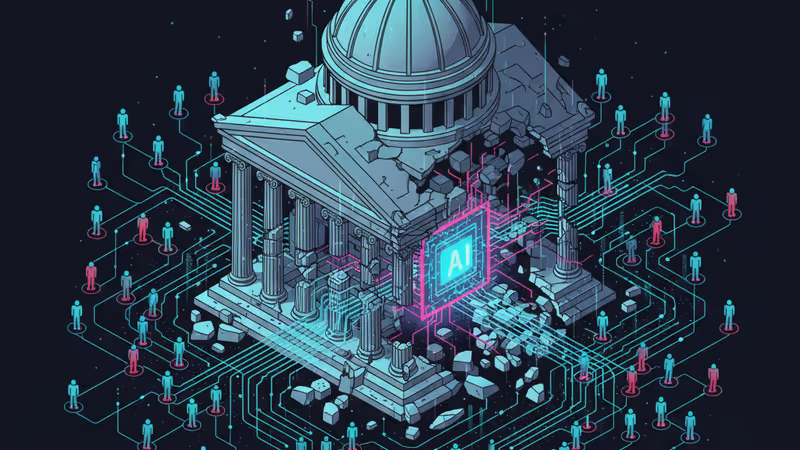

BBVA's massive rollout of ChatGPT Enterprise to 120,000 employees is more than a tech deal. It's a high-stakes bet on the future of AI-native banking.

The Lede: The Pilot Phase is Over

Spanish banking giant BBVA isn't just experimenting with AI; it's making a US$100 billion-plus bet on it. By rolling out OpenAI's ChatGPT Enterprise to its entire 120,000-person workforce, BBVA is executing one of the largest and most aggressive generative AI deployments in the hyper-regulated financial sector. This isn't another siloed tech pilot. It's a foundational, multi-year rewiring of the entire organization, signaling to the industry that the era of cautious AI experimentation is officially over. For every bank CEO, fintech founder, and enterprise investor, this move just raised the stakes for what it means to be a modern financial institution.

Why It Matters: The Shockwave Effect

Most observers see a big bank buying a big software license. We see a strategic inflection point with significant second-order effects:

- Forcing the Hand of Competitors: Cautious rivals like JPMorgan (with its internal Onyx platform) or Goldman Sachs (with its own suite of dev tools) now face a new competitive benchmark. BBVA's all-in approach challenges the slower, more insular model. The question for every bank board is no longer if they should deploy generative AI at scale, but how fast they can do it without breaking compliance.

- Redefining Operational Efficiency: The potential productivity gains aren't just in automating emails or summarizing reports. This is about augmenting every role—from investment analysts and wealth managers to compliance officers and marketing teams. A 5-10% productivity lift across 120,000 employees represents a seismic shift in operational leverage, creating a cost structure that smaller fintechs will struggle to match.

- The War for Talent 2.0: The most sought-after bankers will no longer be just those with the best client relationships, but those who are masters at leveraging AI co-pilots. This creates a new demand for an 'AI-augmented' workforce, fundamentally changing recruitment, training, and performance metrics.

The Analysis: From Defense to Offense

This Isn't Banking's First AI Rodeo

The financial industry has used AI for decades, primarily in a defensive capacity. Machine learning models have been the invisible backbone of fraud detection, credit scoring, and algorithmic trading. These systems were black boxes, operated by specialists and designed to mitigate risk. BBVA's move represents a strategic pivot from defensive, specialized AI to offensive, democratized AI. By putting a powerful, versatile tool directly into the hands of every employee, they are betting that the creative and productivity upside of human-AI collaboration will far outweigh the inherent risks of hallucinations and misuse.

Why 'ChatGPT Enterprise' is the Key

A bank of BBVA's scale couldn't simply let employees use the public version of ChatGPT. The 'Enterprise' tier is the critical enabler here, designed to overcome the core objections of any corporate counsel. It offers:

- Data Privacy: OpenAI does not train its models on ChatGPT Enterprise customer data. This creates a private, sandboxed environment, which is a non-negotiable for handling sensitive financial information.

- Security & Compliance: Enterprise-grade security protocols (like SAML SSO) and data encryption are table stakes for a bank. This version provides the guardrails necessary for a regulated industry.

- Scalability: Unlimited, high-speed access ensures the tool can become a core part of daily workflows without performance bottlenecks, unlike the metered public versions.

This isn't just about a chatbot; it's about an enterprise-grade intelligence layer that can be securely integrated into the bank's operational fabric.

PRISM Insight: The New Competitive Moat

Investment Implications: The 'Application Layer' Awakens

For the past 18 months, AI investment has been overwhelmingly focused on the infrastructure layer—Nvidia's chips, cloud providers, and foundation model builders like OpenAI. BBVA's deal is a massive signal that the value is now moving up the stack to the 'application layer'. The real winners over the next five years won't just be the ones building the AI, but the legacy giants who successfully integrate it. Investors should start looking for established companies with three key assets: massive proprietary datasets, vast distribution networks (customers), and now, the demonstrated will to execute an enterprise-wide AI transformation. A company like BBVA, if successful, could see a re-rating from the market, valued less like a traditional bank and more like a tech-enabled financial services platform.

Business Implications: The 'Intelligence-per-Employee' Metric

For decades, banks competed on assets under management, brand trust, and branch footprint. The digital era shifted competition to user experience and mobile-first design. We are now entering the third wave: competing on the 'intelligence-per-employee' (IPE) ratio. An institution where every employee is augmented by a powerful AI co-pilot has a fundamentally higher IPE than a competitor that doesn't. This new metric will directly correlate with efficiency, innovation speed, and customer satisfaction. BBVA is placing a massive bet that it can achieve a step-change in its IPE, creating a durable competitive advantage.

PRISM's Take

BBVA's OpenAI rollout is the financial industry's 'crossing the chasm' moment for generative AI. It transforms the technology from a futuristic novelty into a core utility, like email or the cloud. This move is a high-stakes, high-reward wager that the operational gains will be transformative enough to justify the immense implementation, training, and compliance challenges. While the risks are real, the risk of inaction is now greater. BBVA has fired the starting gun, and for every other major bank, the race to become an AI-native organization has just begun. They are no longer just competing with fintechs; they are competing with the most AI-augmented version of themselves.

相关文章

最新研究揭露Instacart利用AI動態定價,導致部分用戶多付23%。PRISM深度解析這背後的演算法歧視、信任危機與零工經濟的未來。

Uber One訂閱服務面臨FTC與24州聯合訴訟,指控其採用『暗黑模式』誤導消費者。PRISM深度分析此案如何預示訂閱經濟的信任危機,以及對企業與消費者的深遠影響。

美國參議員針對AI數據中心引發電價飆升展開調查。PRISM深度分析揭示這不僅是電費問題,更是AI產業面臨的重大ESG風險與其社會營運許可的關鍵挑戰。

Grindr CEO揭示其「AI優先」戰略,目標是將平台轉型為集健康、旅遊、社交於一體的同志超級應用。PRISM深度分析此舉對投資者、用戶及市場的深遠影響。