Apple's Walled Garden Fractures: Japan Forces App Store Open, But Freedom Comes with a Fee

Apple opens iOS to third-party app stores in Japan, mirroring EU changes. PRISM analyzes the new fees and the global regulatory assault on the App Store.

The Lede: The Global Pincer Movement Tightens

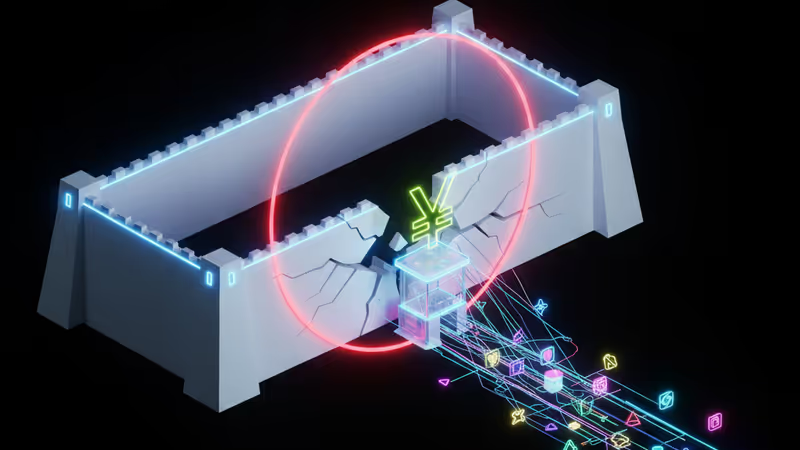

Apple's lucrative App Store monopoly is facing a coordinated global assault, and Japan just opened a critical second front. Following the EU's lead, Tokyo has forced Apple to permit third-party app stores and payment systems on iOS. For executives and investors, this isn't just a regional compliance issue; it's the crystallization of Apple’s global strategy for a post-monopoly world. They are building a playbook to contain regulatory threats, preserve services revenue, and ensure that even when the garden walls are breached, the house always wins.

Why It Matters: The Ripple Effects of a Regulated Gatekeeper

This development sends clear signals across the tech ecosystem, impacting developers, competitors, and future regulation worldwide.

- For Developers: The promise of choice comes with a catch. While developers in Japan can now access alternative distribution and payment channels, Apple is ensuring it still gets a cut. The new commission structures are a calculated friction, designed to make the simplicity and reach of the official App Store remain the most attractive option for the vast majority. This isn't liberation; it's a managed concession.

- For Apple: This is a test case for exporting its EU Digital Markets Act (DMA) compliance strategy. By replicating the core tenets—allowing alternatives while introducing new fees—Apple is creating a standardized, global template for defanging antitrust actions. This signals to Wall Street that its high-margin Services revenue is more resilient than feared, capable of adapting its monetization model under duress.

- For Regulators: Japan's move creates a powerful precedent. Other nations, including the United States and the United Kingdom, now have a clear model to follow. The era of platforms setting their own rules in a vacuum is definitively over. We are entering an age of internationally harmonized digital platform regulation.

The Analysis: Malicious Compliance Goes Global

A Playbook Perfected in Brussels

What we're seeing in Japan is a direct copy of the strategy Apple deployed in response to the EU's DMA. Critics, including Epic Games CEO Tim Sweeney, have labeled Apple's EU compliance a masterclass in complexity and deterrence, riddled with new fees like the "Core Technology Fee" that can make leaving the App Store financially unviable for many. Apple learned that the letter of the law can be met while violating its spirit.

By offering a similar deal in Japan—sideloading is allowed, but in-app purchases on third-party stores will still incur a 5 percent commission payable to Apple—the company is making a calculated bet. It bets that the combination of this new "Apple Tax" and the loss of the App Store's frictionless user experience and discovery engine will be enough to keep most developers and users firmly within its ecosystem. It’s a strategic retreat, not a surrender.

The Competitive Landscape Shifts

This also recalibrates the competitive dynamic with Google's Android. For years, Android’s openness to sideloading was a key differentiator. Now, as iOS is forced to open, the focus shifts from *access* to *economics*. Apple's intricate new fee models could, ironically, provide a blueprint for Google to further monetize its own platform under increasing regulatory scrutiny. The battleground is no longer about open vs. closed, but about which gatekeeper can architect the most profitable and regulator-proof tollbooth system.

PRISM Insight: The Morphing of the 'Apple Tax'

For investors, the key takeaway is the evolution, not the elimination, of the App Store's revenue stream. The monolithic 15-30% commission is being unbundled and replaced by a more complex, resilient, and defensible financial architecture.

The key metric to watch is no longer the headline commission rate, but the *blended effective take rate* across all transaction types, including the new third-party fees. Apple is demonstrating it can absorb direct regulatory hits and re-capture value elsewhere in the chain. This strategic financial engineering protects its multi-billion dollar Services division, the company's primary growth engine. The threat to Apple's earnings is not that the walls are coming down, but how much it costs to maintain the new, more complicated system of gates and tolls.

PRISM's Take: The Illusion of Choice

Apple is not fighting a war to keep its garden walls intact; that battle is lost. It is now fighting a guerrilla campaign to make the world outside those walls as complicated and economically unattractive as possible. The changes in Japan, like those in the EU, introduce a technical form of freedom that is practically constrained for most. This is a brilliant, if cynical, long-term strategy. It satisfies the regulators' checklists while ensuring the App Store remains the default commercial and developmental hub for iOS. The walled garden isn't being demolished; it's being converted into a gated community with a complex new set of bylaws and association fees.

相关文章

ChatGPT推出應用程式目錄,這不只是功能更新,而是劍指Google、Apple的平台戰略。PRISM深度解析其生態系野心與未來趨勢。

蘋果更新開發者協議,賦予其從App內購收入中直接扣款以追討佣金的權力。分析此舉對開發者財務風險及全球科技監管格局的深遠影響。

深度分析最新iOS更新引發的用戶反彈。這不僅是UI改動,更是蘋果為AI與空間運算佈局的戰略陣痛,一場控制權的拔河正在上演。

蘋果被迫在日本開放App Store,允許第三方商店和支付。這不僅是歐盟DMA的重演,更是全球監管浪潮的關鍵一步。開發者和投資者該如何應對?