Apple's New 'Tax Collector' Clause: A Chilling Warning to App Developers

Apple's new developer agreement allows it to seize IAP revenue to cover external payment fees, creating a chilling effect and major financial risks for developers.

The Lede

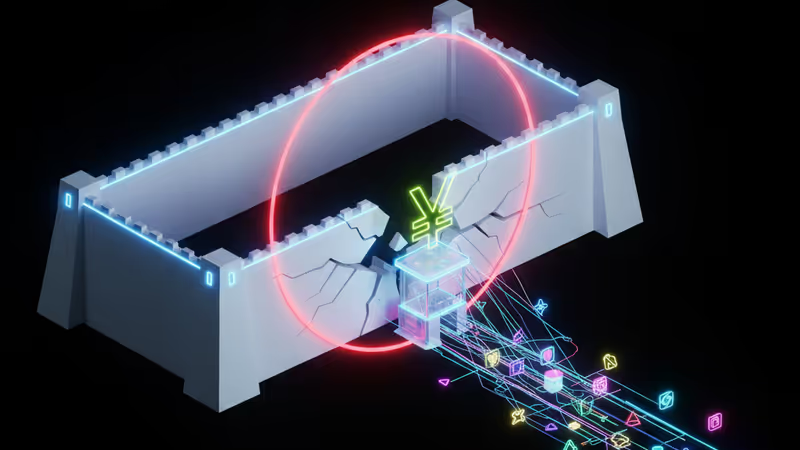

Apple has just weaponized its in-app purchase (IAP) system. In a quiet but seismic update to its developer license agreement, Apple has granted itself the power to act as a tax collector, judge, and enforcer, with the authority to directly seize a developer's IAP revenue to cover disputed fees from sales made outside the App Store. Make no mistake: this is a calculated power play designed to create a chilling effect on developers seeking to use the very payment freedoms regulators have fought to provide.

Why It Matters

For any executive running a global app business, this transforms a regulatory win into a new operational and financial nightmare. The ability to link to external payment systems was meant to foster competition and lower costs. Instead, Apple has introduced a new, potent form of risk.

- Financial Uncertainty is the New Normal: The agreement allows Apple to "offset or recoup" funds "at any time" if it simply "believes" a developer has underreported earnings from external sales. This vague language means a developer could face sudden, significant, and unappealable deductions from their primary revenue stream, crippling cash flow for smaller studios and complicating forecasting for large enterprises.

- The Chilling Effect is Real: Faced with the complexity of self-reporting and the direct threat of Apple seizing their IAP funds, many developers may now see using external payment links as too risky. The perceived safety of paying Apple's standard commission will seem preferable to navigating this new minefield, thereby achieving Apple's goal of keeping developers within its payment walls.

- Compliance Costs Skyrocket: This move forces developers to invest heavily in meticulous, bulletproof accounting systems to track, report, and defend every transaction. The operational overhead for a global app that navigates different fee structures in the EU, US, and Japan just increased exponentially.

The Analysis

This isn't a simple terms-of-service update; it's the latest salvo in Apple's long war against regulatory overreach. For years, Apple has fought to protect its walled garden and the lucrative 15-30% commission it commands. As regulators like the EU (with its Digital Markets Act) and courts in the US and Japan force open the gates, Apple is changing the rules of the garden itself.

This is a masterclass in what's known as "malicious compliance." Apple is technically adhering to the letter of the law by allowing external payment links. However, it is simultaneously erecting a new system of control that makes exercising that freedom punitive and fraught with peril. By linking a developer's entire IAP revenue—and even the revenue of parent or subsidiary companies—to compliance on external sales, Apple has created a powerful enforcement lever that regulators didn't anticipate.

The company is transitioning from a simple gatekeeper to a de facto sovereign fiscal authority. It has its own tax code (the complex web of commissions, the Core Technology Fee, etc.), its own auditing process (an opaque system where Apple "believes" you've underpaid), and now, its own enforcement agency with the power to garnish wages directly at the source.

PRISM Insight

The Rise of the 'Platform Nation-State'

We are witnessing the maturation of major tech platforms into quasi-governmental bodies. This move by Apple solidifies its role as a "Platform Nation-State," complete with its own economic policies and enforcement mechanisms. For investors and strategists, this has critical implications:

- Platform Risk is a Balance Sheet Item: The risk of being de-platformed or financially penalized by a platform like Apple is no longer a fringe operational concern; it's a core financial risk that must be modeled. A single, unilateral decision by Apple can now materially impact a public company's quarterly earnings.

- The 'Compliance Tech' Sector will Boom: The complexity of navigating these new platform rules will create a new market for services and software designed to manage multi-platform, multi-region compliance, reporting, and payment reconciliation.

PRISM's Take

The subtext of Apple's new agreement is crystal clear: "You can play outside our payment system, but we still control your primary bank account." This is a strategic and audacious move to re-centralize power at the very moment regulations were intended to decentralize it. It's a stark reminder that in the digital economy, the owner of the platform still makes the ultimate rules. Developers who celebrated regulatory victories must now prepare for a new, colder war—one fought not in the courts, but in the fine print of developer agreements and the unpredictable debits to their revenue reports.

相关文章

ChatGPT推出應用程式目錄,這不只是功能更新,而是劍指Google、Apple的平台戰略。PRISM深度解析其生態系野心與未來趨勢。

蘋果更新開發者協議,賦予其從App內購收入中直接扣款以追討佣金的權力。分析此舉對開發者財務風險及全球科技監管格局的深遠影響。

深度分析最新iOS更新引發的用戶反彈。這不僅是UI改動,更是蘋果為AI與空間運算佈局的戰略陣痛,一場控制權的拔河正在上演。

蘋果被迫在日本開放App Store,允許第三方商店和支付。這不僅是歐盟DMA的重演,更是全球監管浪潮的關鍵一步。開發者和投資者該如何應對?