The Ghost Fleet at the Gates: Sanctioned Oil Creates a New Geopolitical Flashpoint in Singapore

A 'shadow fleet' of rogue oil tankers is massing near Singapore, creating a major risk for global trade, finance, and the environment. PRISM analyzes the impact.

The Lede: A High-Stakes Game in the World's Busiest Waterway

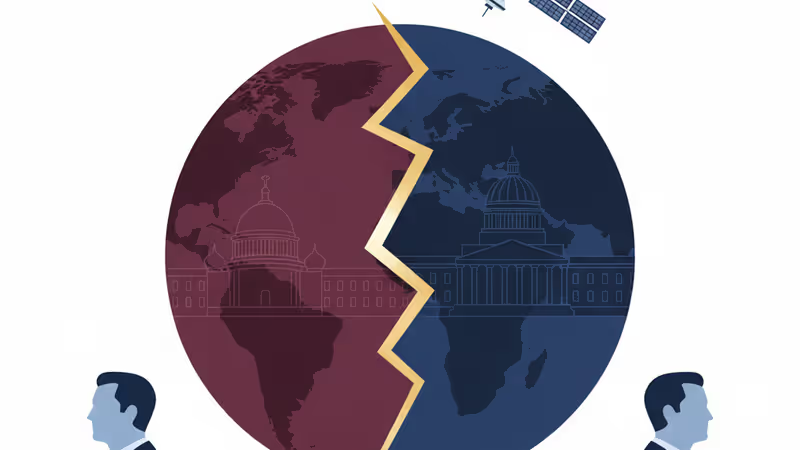

A vast, unregulated armada of oil tankers is massing at the doorstep of the world's most critical maritime chokepoint. The congregation of this “shadow fleet” near Singapore is more than just a cat-and-mouse game of sanctions evasion. It represents the physical manifestation of a bifurcated global economy, creating a systemic risk that threatens environmental security, financial stability, and the very rules that govern global trade. For any leader in finance, energy, or logistics, understanding this new grey zone is no longer optional—it's critical to navigating the future of geopolitical risk.

Why It Matters: The System Under Strain

The immediate presence of over 150 untraceable or questionably flagged vessels in the Singapore Strait's vicinity creates cascading, second-order effects that extend far beyond the oil market.

- Financial Contagion Risk: Legitimate financial institutions, insurers, and commodity traders face a heightened risk of unknowingly interacting with sanctioned entities. The cost of compliance is soaring as firms invest in advanced tracking to de-risk their supply chains, while the penalty for a single misstep could mean crippling fines and reputational damage.

- Environmental Catastrophe in Waiting: Shadow fleet vessels are often older, poorly maintained, and operate with dubious insurance. A significant oil spill in the narrow, congested Malacca and Singapore Straits would be an ecological disaster and could shut down a commercial artery that carries one-third of global goods, triggering a supply chain crisis.

- Erosion of Maritime Law: These fleets thrive in the legal ambiguity of international waters, just outside the reach of rigorous jurisdictions like Singapore. This systematic exploitation of legal loopholes challenges the efficacy of international maritime law and creates a precedent for other illicit activities, from smuggling to terrorism, to operate with impunity.

The Analysis: A New Cold War at Sea

This phenomenon is a direct consequence of the West's escalating use of economic sanctions against nations like Russia, Iran, and Venezuela. While sanctions are a primary tool of modern statecraft, their extensive application has inadvertently catalyzed the creation of a resilient, parallel logistics and financial ecosystem. This isn't simply a collection of rogue captains; it's a sophisticated network with state-level support designed to operate entirely outside the US-led financial and regulatory sphere.

Singapore, a nation built on the principles of free trade and the rule of law, is now in an unenviable position. Its Maritime and Port Authority (MPA) meticulously polices its own territorial waters, but its authority ends at the 12-nautical-mile limit. The shadow fleet operates just beyond this line, turning the high seas into a vast, unregulated parking lot and ship-to-ship transfer zone. This dynamic places immense pressure on ASEAN nations and highlights a critical vulnerability in global governance: key economic chokepoints are bordered by legal grey zones that can be exploited by strategic adversaries.

PRISM Insight: The Compliance Tech Arms Race

The rise of the shadow fleet is fueling a technological arms race. Sanctioned actors use GPS spoofing, flag-hopping, and complex ownership structures to mask their activities. In response, a new sector of “maritime intelligence” is booming. Companies are leveraging AI-powered analysis of satellite imagery (optical and radar), radio frequency (RF) signal tracking, and predictive analytics to pierce the veil of deception. This technology is becoming essential for any entity exposed to the maritime supply chain. The key investment implication is that a company’s valuation in shipping, insurance, or commodity trading will increasingly depend on its investment in and mastery of this compliance technology stack. The ability to prove a clean chain of custody is becoming a distinct competitive advantage.

PRISM's Take: The Sanctions Paradox and the New Normal

The shadow fleet clustering off Singapore is not a temporary anomaly; it is a durable feature of a fractured world order. It demonstrates the law of unintended consequences: the more the West weaponizes sanctions, the more it incentivizes adversaries to build a sanctions-proof parallel system. This parallel system is now so large and sophisticated that it can absorb and redirect vast quantities of resources, blunting the impact of future economic pressure.

For global hubs like Singapore, the challenge is shifting from policing territory to managing systemic risk at their borders. For global corporations, it means accepting that geopolitical risk is no longer an abstract concept but a physical reality that can drift into view off the coast. The era of a single, unified global maritime order is over. Navigating the murky waters of this new reality requires a fundamental rethink of risk, compliance, and the technology needed to maintain a clear view in the fog of geopolitical competition.

관련 기사

틱톡 매각 협상 타결 분석: 바이트댄스가 핵심 알고리즘을 유지하는 '하이브리드' 모델이 미중 기술 전쟁과 글로벌 데이터 주권에 미치는 영향은?

러시아가 ISS 이후 독자 우주정거장 ROS 건설을 발표했습니다. 이는 단순한 기술 계획을 넘어, 지정학적 홀로서기와 새로운 우주 경쟁의 서막을 알리는 신호입니다.

2027년 UN 평화유지군 철수를 앞둔 레바논-이스라엘 국경. 평화 회담 이면의 안보 공백과 강대국들의 지정학적 셈법을 심층 분석합니다.

미국과 베네수엘라의 군사적 대치가 푸에르토리코를 지정학적 최전선으로 밀어내고 있습니다. 카리브해의 긴장이 글로벌 에너지 시장과 지역 안정에 미치는 영향을 분석합니다.