Europe's Two-Year Bet on Ukraine: Why a Loan, Not Seizure, is the Real Story

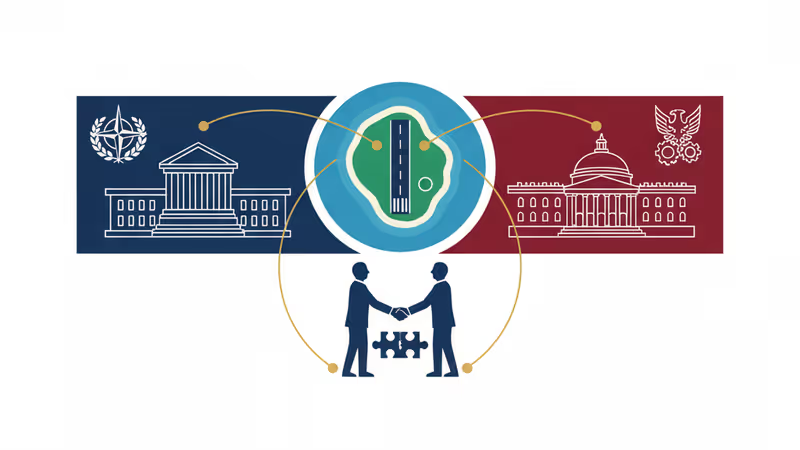

The EU's new loan for Ukraine is more than aid; it's a strategic pivot on global finance, defense, and dependency on the US. Here's why it matters.

The Lede: Beyond the Bottom Line

European Union leaders have just rewritten the rules of economic statecraft. By agreeing to a massive, long-term loan for Ukraine—funded from their own coffers, not frozen Russian assets—they've made a strategic declaration. For the busy executive, this isn't just another aid package; it's a pivotal move to de-risk European security from American political volatility and a calculated decision to uphold the global financial order, even in wartime.

Why It Matters: The Second-Order Effects

This decision creates significant ripples beyond Kyiv. It's a multi-year green light for industry and a stabilizing force for markets, signaling a fundamental shift from reactive aid to proactive strategy.

- For the Defense Sector: A two-year funding horizon provides the predictability European defense contractors like Rheinmetall and BAE Systems need to ramp up production. This moves the continent from draining existing stockpiles to actively building a larger, more sustainable military-industrial base.

- For Financial Markets: The EU is acting as a powerful financial backstop for an allied nation at war. This bolsters confidence in Ukraine's solvency, but also demonstrates the EU's willingness to leverage its collective balance sheet for geopolitical ends, with potential long-term impacts on the Euro and EU bond yields.

- For Global Finance: The choice to forego the seizure of Russian sovereign assets is the crucial detail. It sends a powerful message to non-Western economic powers like China and Gulf states: the core principles of sovereign immunity in the Western-led financial system will be upheld. This is a defensive move to preserve the Euro and Dollar's status as global reserve currencies.

The Analysis: A Calculated Geopolitical Gambit

This loan represents a maturation of the EU's role as a global power. Historically, Europe has often been criticized for financial might that doesn't translate into geopolitical heft. This move directly challenges that narrative. It's not the magnanimity of a post-war Marshall Plan, but a hard-nosed, pre-emptive investment in continental stability.

The Strategic Calculus:

The competitive dynamics are clear. First, it's a direct message to the Kremlin that its strategy of outlasting Western resolve is flawed; the EU is signaling the financial stamina for a long conflict. Second, it's a transatlantic message. With a contentious US election on the horizon, European leaders are building a financial firewall to ensure Ukraine's survival is not solely dependent on the political whims of Washington. This is a significant step toward the long-debated concept of European "strategic autonomy."

Internally, securing this agreement—despite predictable opposition from members like Hungary—demonstrates a remarkable level of unity on a core security issue. The EU is leveraging its greatest strength, its economic scale, to project power in a way its fragmented military capabilities cannot.

PRISM Insight: The War Economy as an Innovation Lab

The true forward-looking angle lies in where this capital will be deployed. This isn't just for bullets and salaries; it's a massive injection of fuel for Ukraine's burgeoning defense-tech ecosystem. Ukraine has become a live-fire laboratory for 21st-century warfare, rapidly innovating in drone technology, signals intelligence, and battlefield software.

This EU funding acts as venture capital on a national scale. It will accelerate the development and deployment of next-generation autonomous systems and cyber warfare capabilities. For investors and tech firms, the implication is clear: the frontier of military tech is shifting eastward, and European capital is now underwriting its expansion. Expect increased partnerships and M&A activity between established European defense primes and agile Ukrainian tech startups.

PRISM's Take: The Pragmatist's Power Play

The EU's decision is a masterclass in pragmatic statecraft. It bypasses the legally and diplomatically treacherous path of seizing Russian assets, which would have set a dangerous precedent and alienated key global economic players. Instead, the EU is using its own financial strength, a more sustainable and legally sound foundation for long-term support.

This is Europe taking ownership of its security. It is a costly, politically difficult decision, but it's also a rational one. The EU is making a calculated bet that the price of this loan is far lower than the future cost of instability, or worse, a Russian victory on its eastern border. This isn't just a lifeline to Ukraine; it's a strategic down payment on the future of European security architecture.

관련 기사

중국 자본의 미크로네시아 활주로 재건이 미중 갈등의 새 뇌관으로 부상했습니다. 태평양 지정학적 균형과 미국의 안보 딜레마를 심층 분석합니다.

EU의 1050억 달러 우크라이나 지원은 단순 원조를 넘어선 지정학적 베팅입니다. 장기 경제 전쟁의 서막과 글로벌 시장에 미칠 영향을 심층 분석합니다.

미국, 카타르, 이집트, 튀르키예가 마이애미에서 비밀 회동을 갖습니다. 교착 상태인 가자지구 휴전 협상의 돌파구와 중동의 미래 질서를 분석합니다.

제프리 엡스타인 관련 법원 문서 공개가 미국 대선을 넘어 전 세계 권력 지형에 미칠 파장을 심층 분석합니다. 단순 스캔들을 넘어선 지정학적 함의를 확인하세요.