The Coming AI Tax: Why Your Next MacBook Is About to Get More Expensive

A global memory shortage driven by AI is set to increase MacBook prices. PRISM analyzes the market forces and why your next laptop purchase will be different.

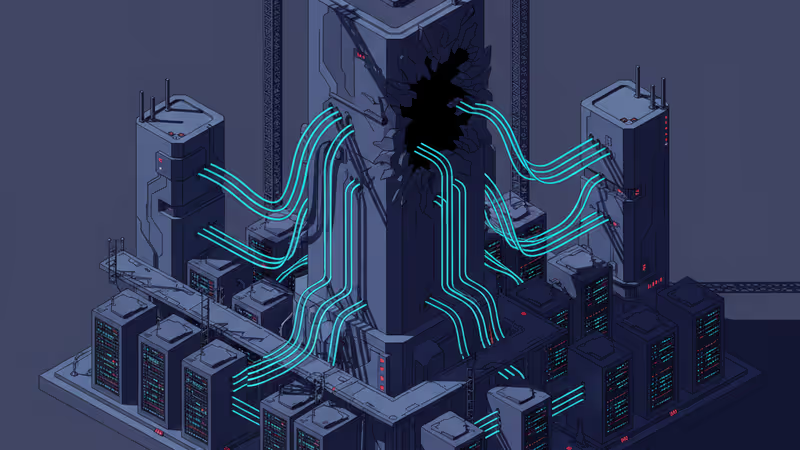

The Lede: The Invisible Force Reshaping Apple's Roadmap

If you're weighing a MacBook purchase, the debate between M4 or M5 silicon is a distraction. The single most critical factor influencing your decision today isn't a chip—it's the colossal, insatiable appetite of AI data centers for memory. A global supply shock is brewing, and it's poised to dismantle decades of predictable price-performance gains in consumer technology, starting with the laptop on your desk.

Why It Matters: The End of 'Cheaper, Faster, Better'

The unspoken contract between consumers and Big Tech has always been that hardware gets progressively more powerful for the same, or less, money. This fundamental assumption is now under threat. The AI gold rush is causing a massive diversion of high-performance DRAM and NAND memory from the consumer pipeline to enterprise data centers.

This isn't a cyclical shortage; it's a structural market shift with significant second-order effects:

- Corporate IT Budgets: CIOs planning hardware refresh cycles for 2026 will face unforeseen cost overruns. A 10-20% price hike on premium laptops, when multiplied across a workforce, becomes a material expense.

- Consumer Behavior: The upgrade cycle will lengthen. Consumers will be forced to hold onto devices longer, impacting sales volumes for the entire PC market.

- The Digital Divide: As entry-level prices for capable machines creep up, it could widen the accessibility gap for students and lower-income households, reversing years of progress.

The Analysis: Apple's Supply Chain Prowess Faces Its AI Stress Test

For two decades, Apple, under Tim Cook's operational stewardship, has been the undisputed master of supply chain logistics. They famously lock in favorable pricing on key components years in advance, effectively starving competitors and insulating their margins. We saw this with flash memory for the iPod and high-resolution displays for the iPhone.

However, the scale of the current memory demand is unprecedented. Hyperscalers like Amazon, Google, and Microsoft are buying up memory capacity with a ferocity that even Apple may not be able to sidestep. While competitors like HP and Lenovo have already begun telegraphing price increases for 2026, Apple remains silent. This presents a fascinating strategic dilemma for Cupertino:

1. Absorb the Cost: Apple could leverage its massive cash reserves to absorb the increased memory costs, maintaining current price points. This would squeeze their legendary hardware margins but could be a devastating blow to competitors, allowing Apple to aggressively seize market share.

2. Pass the Cost to Consumers: Alternatively, Apple could use the next product cycle (the M5 refresh) to introduce a new, higher price floor. This would protect their margins but risk alienating consumers and slowing growth in their Mac division, which has been a consistent performer.

The MacBook's unified memory architecture—where RAM is soldered to the chip—makes this situation even more acute. Customers can't upgrade later, forcing them to pay the premium for higher-spec models upfront. A price hike on memory will be felt immediately and permanently at the point of sale.

PRISM Insight: The Real Winners are the Component Makers

The core investment story here isn't about PC manufacturers; it's about the companies that produce the picks and shovels for the AI gold rush. Memory suppliers like Micron, Samsung, and SK Hynix are entering a golden era. Their ability to command premium pricing will dictate the financial health of the entire downstream electronics industry.

Watch Apple's pricing strategy for the early 2026 MacBook Air M5 refresh closely. It will be the ultimate tell. If they raise prices, it signals that the supply chain pressure is too immense even for the world's most powerful company. If they hold firm, prepare for a brutal price war in the PC market that only Apple is equipped to win.

PRISM's Take: This Is Not a Discount, It's a Warning

The current sub-$800 price on the M4 MacBook Air isn't a routine sale; it's the calm before the storm. We assess this is a strategic window for consumers to lock in hardware at pre-shortage prices. The era of assuming your next laptop will be a better value than your last is over. The 'AI Tax' is real, it's coming, and it will be collected not through software subscriptions, but baked directly into the silicon of your next device.

関連記事

GoogleのAIエンジニア採用の20%が「出戻り組」。大規模計算資源を武器に、人材獲得競争で新戦略を展開。これはAI覇権を巡る巨大テックの新たな力学を示す。

『ナイブズ・アウト』のライアン・ジョンソン監督がAI生成物を「魂なきスロップ」と痛烈批判。人間ならではの創造性と観客との繋がりこそが芸術の本質だと語る。その深層を分析します。

AIデータセンター向けメモリ需要急増で、2026年以降MacBookの価格高騰が予測されます。今が賢い購入タイミングである理由を専門家が徹底分析。

AIブームを支えるデータセンター建設が、電力不足と住民の反対で急ブレーキ。業界が直面する新たなボトルネックと、未来の投資機会を専門家が分析します。