Russia's LNG Exports to China Surge 143% in November, Displacing Australia Amid Sanctions

In November, Russia's LNG shipments to China soared by 142.6%, making it a top supplier. The surge, fueled by the sanctioned Arctic LNG 2 project, saw Australia's market share decline, highlighting a major shift in global energy flows.

Russia's liquefied natural gas (LNG) shipments to China skyrocketed last month, cementing Moscow's role as a top energy supplier to the world’s second-largest economy and underscoring the deepening economic ties between the two nations in the face of Western sanctions.

A Stark Reversal in Trade Flows

According to the latest Chinese customs data, imports of LNG from Russia surged by a staggering 142.6% year-on-year in November, reaching 1.6 million tonnes. This propelled Russia to become one of China's top two suppliers, alongside Qatar. Russian LNG accounted for 23.5% of China's total shipments, more than doubling its 11% share from a year prior.

Meanwhile, Australia, previously the top supplier, saw its shipments slide. Australian LNG exports to China fell by 33.6% by volume in November. This decline left Australia with just 21.1% of China's LNG imports—a sharp retreat from its 36% market share a year ago.

The Sanctioned Source

According to Xu Tianchen, senior economist at the Economist Intelligence Unit, "the changes are very much a supply-side story." He attributed the surge to the resumption of production at the Arctic LNG 2 project on the Gydan Peninsula, which reportedly directs its entire output to China.

The Arctic LNG 2 project is a major Russian energy initiative that has been widely targeted by Western sanctions. Its ability to resume operations, which were halted last year, and channel its output to a single major buyer is a significant development.

It’s also an indication of China defying Western sanctions against Russian oil trade.

— Xu Tianchen, Economist Intelligence Unit

Western sanctions aimed at crippling Russia's energy sector may be having an unintended consequence: accelerating the formation of a resilient, non-Western economic bloc. This shift not only provides Russia with a stable revenue stream but also gives China access to energy, potentially at favorable terms, reshaping global energy maps and challenging the long-term effectiveness of sanctions as a foreign policy tool.

本コンテンツはAIが原文記事を基に要約・分析したものです。正確性に努めていますが、誤りがある可能性があります。原文の確認をお勧めします。

関連記事

2025年11月、ロシアから中国へのLNG輸出が前年比142.6%急増し160万トンに達した。これによりロシアはオーストラリアを抜き、中国にとって最大のLNG供給国の一角となった。背景には制裁下のプロジェクト再開と両国の戦略的連携がある。

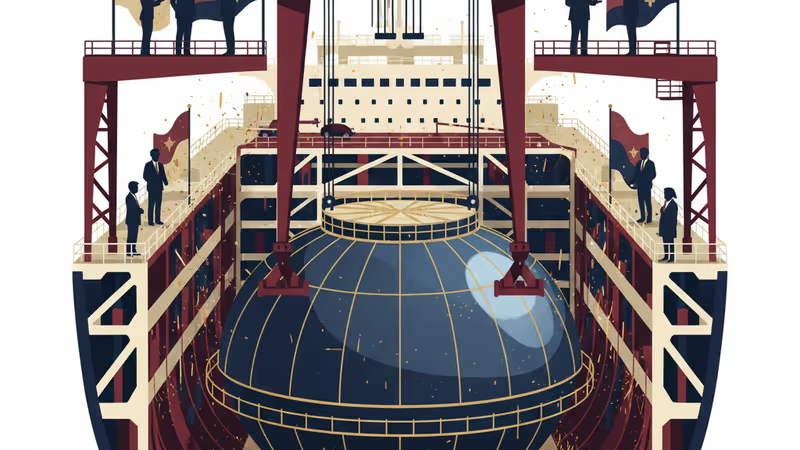

韓国政府が、LNG運搬船の核心技術である貨物タンクの国産化を目指し、官民合同のワーキンググループを発足。海外技術への依存から脱却し、数兆ウォンの技術料削減を狙う。

日本政府が2027年度導入の新制度で、外国人労働者の受け入れ上限を最初の2年で約42.6万人とする案を検討。人手不足と国民の懸念の間で揺れる日本の新政策を解説します。

中国最大級の同人誌即売会「Comicup」が、日中関係の悪化を背景に、開催直前に日本関連コンテンツを全面禁止。政治的緊張が文化交流に与える影響を分析します。