Waymo's Land Grab vs. Tesla's AI Dream: The Three Divergent Paths Shaping the $7 Trillion Robotaxi Market

The 2025 robotaxi race is a clash of titans. Waymo's aggressive expansion, Zoox's bespoke hardware, and Tesla's delayed AI dream reveal divergent strategies for owning the future of mobility.

The Lede: More Than Just Cars, It's a Clash of Titans

The year 2025 wasn't just when robotaxis went mainstream; it was when the strategic battle lines for the future of urban mobility were definitively drawn. While headlines focused on driverless cars navigating city streets, the real story unfolded in corporate boardrooms. We're witnessing a high-stakes clash between three fundamentally different philosophies, championed by the titans of tech: Alphabet's methodical land grab, Amazon's vertically-integrated hardware play, and Tesla's all-or-nothing bet on a software breakthrough. This isn't just about who can build the best self-driving car; it's a multi-trillion dollar war for the operating system of our cities, and the winner will redefine not just transportation, but real estate, logistics, and the very fabric of daily life.

Why It Matters: The Second-Order Effects

For investors and business leaders, the rise of robotaxis is a signal that extends far beyond the auto industry. The core competition is now shifting from pure technology to the messy business of deployment, regulation, and public trust. The key takeaways are:

- Regulatory Moats are Deepening: As Waymo expands, it navigates a complex web of city, state, and federal rules. Each approval it secures becomes a barrier to entry for competitors. Elon Musk's rare praise for Waymo "paving the path" is a candid admission that the regulatory battle is as crucial as the technological one.

- The End of the "Moonshot" Era: For years, autonomous vehicles were a far-off 'moonshot' project. Now, with Waymo generating significant ride volume (on track for over 20 million trips since launch) and Alphabet's CEO projecting it will be "meaningful in our financials" by 2027-28, the industry has shifted from R&D to commercial scaling. The question is no longer "if," but "how fast and with what business model?"

- Public Perception is the Wild Card: Despite technological progress, a 2025 AAA survey shows 66% of drivers remain fearful of AVs. Incidents like Waymo vehicles driving through a police standoff or minor collisions, while statistically rare, have an outsized impact on public trust. The company that masters public relations and demonstrates unimpeachable safety will have a significant advantage.

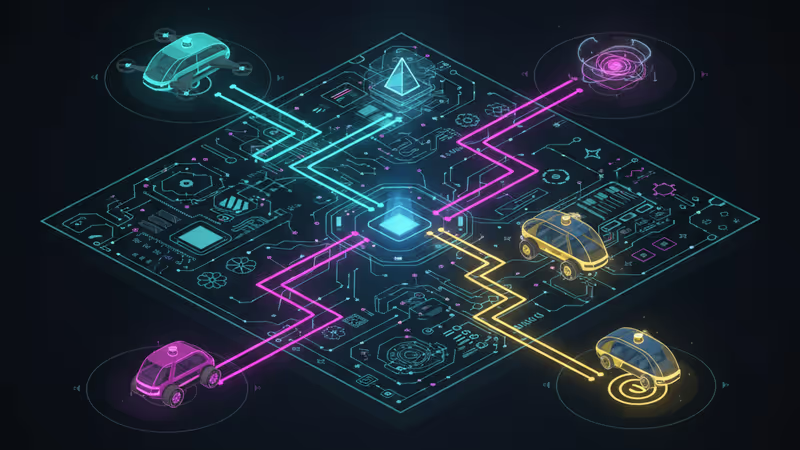

The Analysis: Three Companies, Three Grand Strategies

Waymo's 'Blitzscaling' Playbook: Capture Territory, Then Optimize

Alphabet's Waymo is executing a classic blitzscaling strategy, reminiscent of Uber's early global expansion. The goal is clear: achieve massive scale and network effects before competitors can get a foothold. By expanding or testing in 26 markets, Waymo is building an operational and regulatory moat, city by city. They are deliberately tackling complex environments like New York and harsh weather in Denver to prove the robustness of their system. This is a capital-intensive ground war, funded by Alphabet's deep pockets (the "Other Bets" segment lost $1.43 billion in Q3). The hiring of a new CFO strongly suggests Waymo is transitioning from a heavily subsidized research project into a mature business unit preparing for massive, independent growth. Their minor recalls and incidents are not signs of failure, but rather the inevitable friction of deploying a radical new technology in the unpredictable physical world.

Zoox's Vertical Integration Gambit: The Apple of Autonomy

Amazon's Zoox is taking a page from Apple's playbook. Instead of retrofitting existing cars like Waymo, they are building the entire ecosystem—hardware and software—from the ground up. Their purpose-built, toaster-shaped vehicle with no steering wheel is a bet that a fully integrated design will ultimately be safer, more efficient, and offer a superior passenger experience. This is a slower, more deliberate strategy. While they are behind Waymo in city count, their control over the entire stack could provide a long-term advantage in cost and performance. Backed by Amazon's logistics empire and patient capital, Zoox doesn't need to win the short-term land grab. Their biggest hurdle remains federal approval to charge for rides, a critical milestone expected in 2026 that will validate their bespoke model.

Tesla's Software-First Dream: A High-Stakes Bet on One Big Breakthrough

Tesla is playing a completely different game. Its "Robotaxi" service, which still requires human safety drivers, is less a commercial service and more a massive data-collection engine. The entire strategy hinges on a single, monumental bet: that they can solve general-purpose autonomous driving with software and then, via an over-the-air update, instantly activate a robotaxi network of millions of customer-owned vehicles. This approach bypasses the operational headaches of fleet management that Waymo is currently enduring. However, it's an all-or-nothing proposition. After years of promises, "solving autonomy" remains just over the horizon. If they succeed, they could leapfrog everyone overnight. If they fail to achieve true driverless capability, they will be left with a best-in-class driver-assist system while Waymo and Zoox own the actual autonomous transportation market.

PRISM Insight: The Investor's View

The market is being driven by three distinct investment theses:

- Alphabet (GOOGL): A bet on methodical execution and scaling. Waymo represents a massive, long-term growth option. Its current losses are a rounding error for Alphabet, but its success in navigating the physical and regulatory worlds de-risks the entire AV sector. This is the industrial-scale deployment play.

- Amazon (AMZN): A bet on synergy and vertical integration. Zoox is a small part of the Amazon machine, but its potential integration with Prime delivery, Whole Foods, and the entire Amazon logistics network is the real prize. Success here is about controlling the movement of people and goods from end to end.

- Tesla (TSLA): A high-volatility bet on a singular AI breakthrough. The stock's valuation is heavily predicated on the future promise of a fully autonomous network. The 2025 launch of a human-monitored service did little to change this. This remains a binary bet on whether Tesla can achieve a feat of general AI that has so far eluded everyone else.

PRISM's Take: The Ground War Is Beating the Air War

2025 has proven that the robotaxi war will not be won by the most elegant algorithm alone, but by the most effective deployment strategy. While Tesla continues to fight an ambitious air war—chasing a perfect, generalizable AI solution—Waymo is winning the messy, city-by-city ground war. It is building an insurmountable lead in operational experience, regulatory approvals, and public exposure. Amazon's Zoox is the strategic dark horse, betting that a superior, purpose-built product will ultimately prevail, but it remains years behind on the deployment map. For the foreseeable future, the path to autonomous mobility is being paved not by a sudden software miracle, but by Google's checkbook and its relentless fleet of sensor-laden vehicles. The era of the autonomous 'moonshot' is over; the era of autonomous logistics has begun.

Related Articles

A California judge found Tesla's 'Full Self-Driving' marketing deceptive. PRISM analyzes why this is more than a fine—it's a threat to Tesla's core valuation and a turning point for AI regulation.

Analysis of the e-scooter market's shift from a rental fad to a serious industry focused on private ownership, advanced technology, and long-term value.

Waymo is dominating the robotaxi market, but the real story is the strategic battle against Amazon's Zoox and Tesla. Our expert analysis explains why.

Waymo is leading the robotaxi race, but its victory is far from certain. A deep-dive analysis of the competing strategies of Waymo, Tesla, and Amazon's Zoox.