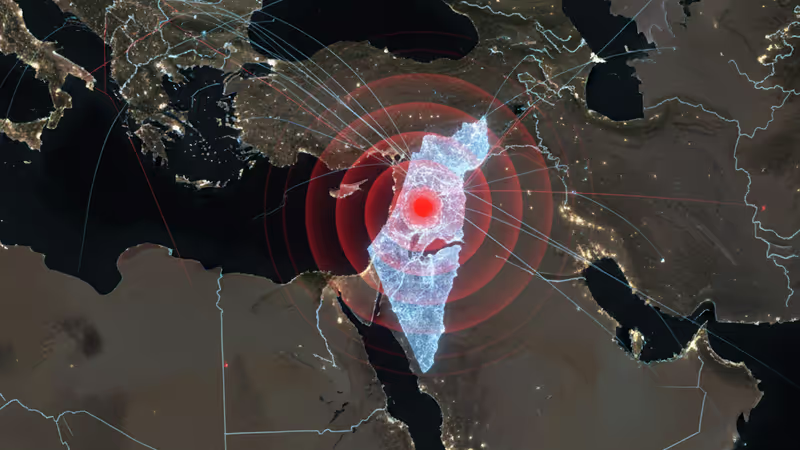

The 2024 Election's Global Shockwave: Biden's Alliances vs. Trump's Tariffs

The 2024 US election offers a stark choice between Biden's strategic alliances and Trump's disruptive tariffs, forcing a radical rethink of global supply chains.

The Lede

The 2024 U.S. presidential election is not merely a domestic political contest; it is a critical inflection point for the global economic order. For executives and investors, the choice between the incumbent Joe Biden and former President Donald Trump represents a decision between two fundamentally different blueprints for international trade, supply chains, and geopolitical stability. This is no longer a debate about incremental policy shifts; it’s a strategic fork in the road that will dictate the flow of capital, technology, and goods for the next decade. Preparing for this volatility is not optional.

Why It Matters

The outcome will trigger a seismic restructuring of global commerce, creating distinct sets of winners and losers across industries and nations. The core divergence lies in the methodology of economic nationalism.

Scenario 1: The Biden Doctrine - Strategic Competition via Alliances

A second Biden term would signal a continuation and deepening of the current strategy: using alliances to counter China and build resilient, ideologically aligned supply chains. This is “friend-shoring” in practice.

- Industry Impact: Favorable conditions for semiconductor, green technology, and EV sectors in the U.S. and allied nations (e.g., South Korea, Japan, EU members) through subsidies like the CHIPS Act and Inflation Reduction Act.

- Global Effect: A more predictable, but bifurcated world. The U.S. and its partners would form a tighter economic bloc, raising barriers to Chinese technology and investment. Nations like Vietnam and Mexico would continue to benefit as manufacturing hubs, but pressure would mount to align with U.S. standards on labor and environment. The EU, while a partner, would continue to clash with the U.S. over protectionist measures disguised as industrial policy.

Scenario 2: The Trump Disruption - Transactionalism and Broad Tariffs

A Trump presidency promises a more aggressive, unilateral approach defined by the threat of sweeping tariffs. Proposals include a potential 10% universal baseline tariff on all imports and tariffs exceeding 60% on Chinese goods.

- Industry Impact: Widespread disruption. While some domestic heavy manufacturing could see short-term protection, industries reliant on global supply chains—from consumer electronics to automotive—would face massive cost inflation and uncertainty. Retaliatory tariffs would target U.S. agricultural and tech exports.

- Global Effect: A potential unraveling of the current trading system. Allies would not be exempt, risking trade wars with the EU and other key partners. The focus would shift from strategic competition with China to a chaotic, transactional free-for-all, eroding trust in the U.S. as a stable economic anchor and likely pushing nations closer to China’s economic orbit out of necessity.

The Analysis

For decades, a bipartisan consensus in Washington favored global economic integration, viewing trade as a net positive that lifted all boats. That consensus is shattered. Both candidates now champion protectionism; they differ only on the tools and targets. Biden’s approach is a scalpel, surgically excising China from critical tech supply chains while reinforcing alliances. It's a complex, state-led effort to re-engineer globalization. Trump’s approach is a sledgehammer, viewing trade deficits as a direct loss and allies as economic competitors. His policy is rooted in the belief that economic confrontation can force concessions and reshore jobs through sheer force.

From a global perspective, allies in Europe and Asia view the Biden administration as the more predictable, if at times frustrating, partner. A Trump victory, however, is viewed with deep apprehension in Brussels and Tokyo, as it could force them to hedge their bets and build economic defenses against both the U.S. and China. Beijing, meanwhile, faces a strategic dilemma: Biden’s targeted, alliance-based pressure is arguably a more sophisticated and long-term threat to its technological ambitions, while Trump’s disruptive tactics could weaken the Western alliance system, creating new opportunities for China to expand its influence.

PRISM Insight

The defining tech trend driven by this political divergence is the 'Geopolitical Fragmentation of the Tech Stack.' Regardless of the winner, the era of a single, globalized tech ecosystem is over. Investment strategy must adapt.

- Under a Biden scenario: Capital will flow toward creating redundant, secure supply chains within the U.S.-led bloc. Expect continued massive investment in semiconductor fabrication in the U.S., battery technology in allied nations, and a standards war in AI and data governance between the West and China. The key risk is falling behind in a technology where China dominates the supply chain (e.g., critical minerals for batteries).

- Under a Trump scenario: The focus shifts from strategic resilience to tariff mitigation. Technology companies would be forced to radically re-evaluate their entire global footprint, potentially moving final assembly for the U.S. market to the U.S. at enormous cost. This creates immense volatility but could accelerate robotics and automation adoption within the U.S. to offset higher labor costs. The primary investment risk is market access and sudden, policy-driven margin collapse.

PRISM's Take

The central takeaway for global leaders is that the strategic assumptions that governed business for the past 30 years are now obsolete. The pursuit of pure efficiency in supply chains has been replaced by the urgent need for geopolitical resilience. The question is no longer *if* you should diversify away from single-country dependency, but *how* and *how quickly*.

Waiting until after the November election to act is a critical error. Businesses must be scenario-planning now for both outcomes. The most durable strategy will be one that builds flexibility, regionalizes supply networks, and hedges against currency and policy volatility. The 2024 election is not the cause of this new era of geoeconomic competition, but it is its most powerful accelerant.

Related Articles

The Bondi Beach terror attack is more than a tragedy; it's a critical test of Australia's social fabric and digital-age policies. A PRISM deep-dive analysis.

An analysis of how preventable infant deaths in Gaza are shifting diplomatic pressure, creating global brand risk, and signaling a new, dangerous phase in the conflict.

Rogue drones flying at airliner altitudes in China create a high-stakes test for Beijing. Will it crack down or innovate its way to a safe low-altitude economy?

Japan is making a calculated move into Central Asia to counter Chinese and Russian influence. This isn't just diplomacy; it's a new strategy for resource security.