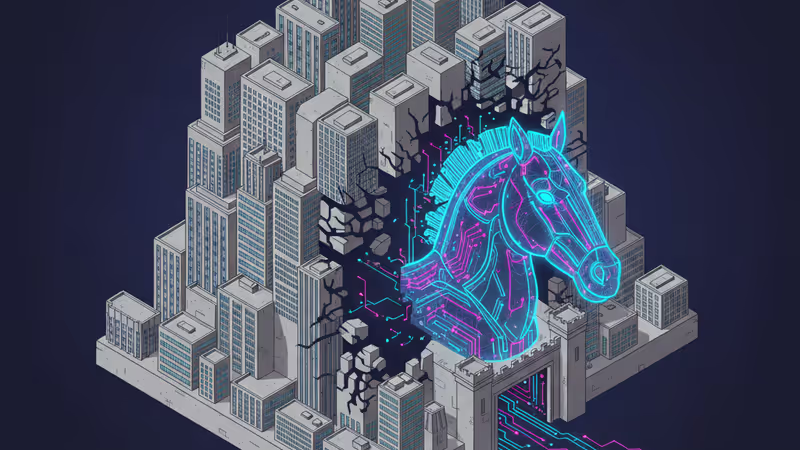

OpenAI's Trojan Horse: Why Chai Discovery's $1.3B Valuation Is a Warning Shot to Big Pharma

Chai Discovery's $1.3B valuation, backed by OpenAI, isn't just a funding round. It's a signal that AI is set to industrialize drug creation, challenging Big Pharma's core model.

The Lede: This Isn't About Funding, It's About a Fundamental Reshuffle in Drug Discovery

Chai Discovery, an AI-native biotech firm with deep ties to OpenAI, just closed a $130 million Series B, catapulting its valuation to $1.3 billion a mere year after its founding. For busy executives and investors, the headline number isn't the real story. The crucial signal is this: the playbook that created large language models is now being deployed to industrialize the creation of novel medicines, representing a direct existential threat to the traditional, multi-billion-dollar R&D models of established pharmaceutical giants.

Why It Matters: The Second-Order Effects

While most reports focus on the funding, the strategic implications are far more profound. This event signals three critical shifts that will redefine the next decade of biotechnology:

- The Platformization of Biotech: OpenAI's backing is more than capital; it's a validation of a new paradigm. Just as AWS created a platform for building software companies, AI leaders are fostering ecosystems to build specialized vertical platforms. Chai isn't just another drug startup; it's a bet on becoming the 'Autodesk for molecules,' a foundational layer upon which future therapies are designed.

- From AI Co-Pilot to AI Creator: For years, AI in pharma has been a co-pilot—screening existing compounds or optimizing trial data. Chai's focus on de novo (from scratch) antibody design represents a leap to AI as the originator. It's the difference between finding a needle in a haystack and designing and manufacturing a better needle on demand.

- The Great Compression of R&D: The traditional 10-15 year, $2 billion drug development pipeline is a liability in the AI era. The rapid ascent of companies like Chai suggests investors are betting on a dramatic compression of the discovery phase from years to months, fundamentally altering the economics of the entire industry.

The Analysis: Beyond the Press Release

A New Breed of Founder

Chai's CEO, Josh Meier, isn't a traditional biologist or chemist; he's a machine learning veteran from Facebook and, crucially, OpenAI. This represents a changing of the guard. The leadership of next-generation biotech firms will increasingly look like the leadership of top AI labs. Their competitive advantage isn't a patent on a single molecule, but the architectural superiority and continuous improvement of their underlying AI models—a concept foreign to most pharmaceutical boardrooms.

The 'De Novo' Holy Grail

The term 'de novo antibody design' is key. Historically, creating custom antibodies has been a monumental challenge involving laborious trial and error. Most AI has focused on modifying what already exists. Chai's claim that its Chai 2 model can design entirely new molecules to hit previously 'undruggable' targets is the core of its billion-dollar valuation. If this process proves repeatable and reliable, it moves the bottleneck from initial discovery to clinical validation, shifting the entire value chain. This is the industry's 'CAD moment'—akin to how computer-aided design moved engineering from the drawing board to the simulation, enabling complexity that was previously unimaginable.

Competitive Dynamics: The AI-Native vs. The Incumbent

How do rivals like Recursion, Insitro, or even Google's Isomorphic Labs compare? Many apply AI to specific stages of the pipeline. Chai's stated ambition to build a foundational 'design suite' is different. It's a platform play, not a product play. Big Pharma's response has been to partner with or acquire AI startups, but this often leads to cultural clashes and integration failures. They are attempting to bolt AI onto a legacy system, while Chai is building a new system from the ground up with AI at its core. This is a classic innovator's dilemma scenario.

PRISM Insight: The Investor and Technology Outlook

For Investors: Bet on the Platform, Not Just the Pill

The $1.3 billion valuation isn't for a drug candidate; it's for the 'factory' that produces them. This is a critical distinction for investors in the space. The risk is no longer concentrated in a single molecule's clinical trial outcome. Instead, the investment thesis is built on the scalability and efficiency of the AI platform itself. A successful platform like Chai could generate a portfolio of drug candidates, distributing risk and creating compounding value. We are witnessing the venture capital playbook for enterprise SaaS being applied to biotech, with a focus on platform dominance over individual product success.

For Technologists: The 'In Silico' to 'In Vivo' Gap

The ultimate challenge remains: bridging the gap between digital design (in silico) and biological reality (in vivo). An AI can design a theoretically perfect molecule, but its real-world efficacy, toxicity, and delivery remain complex hurdles. The success of Chai and its peers will hinge on the tightness of the feedback loop between their AI models and their wet lab validation processes. The company that masters this data-driven, iterative cycle of design, test, and learn will not just lead the market; it will define it.

PRISM's Take

Chai Discovery’s funding round is a watershed moment, marking the formal arrival of the AI-native bioplatform. This is not an incremental improvement; it is a fundamental architectural shift. While pharmaceutical giants continue to spend billions on legacy R&D infrastructure, a new generation of companies born from the DNA of AI leaders is building a faster, cheaper, and more intelligent assembly line for modern medicine. The question for incumbents is no longer *if* they should adopt AI, but whether they can transform their core operating model before companies like Chai make it obsolete.

Related Articles

OpenAI's quiet reversal of a key ChatGPT feature reveals a critical truth: speed is beating raw intelligence in the AI race. Our analysis on why this is a major win for Google.

OpenAI's AI for biology is more than a paper. It's a strategic play to upend the multi-trillion dollar pharma industry. Here's our expert analysis.

OpenAI's FrontierScience benchmark signals a strategic pivot from chatbots to automating scientific discovery. A deep dive into why this changes the game for R&D and tech investors.

BBVA's deal to deploy ChatGPT to 120,000 staff is more than a tech upgrade. Our analysis shows it's a strategic gambit to become the world's first AI-native bank.