Netflix's $82B Warner Bros. Gamble: The End of Hollywood or a Repeat of AOL's Biggest Mistake?

Our expert analysis on Netflix's $82.6B bid for Warner Bros. We break down the risks, the AOL-Time Warner parallels, and why this signals an end-game for the streaming wars.

The Lede: More Than a Merger, It's an End Game

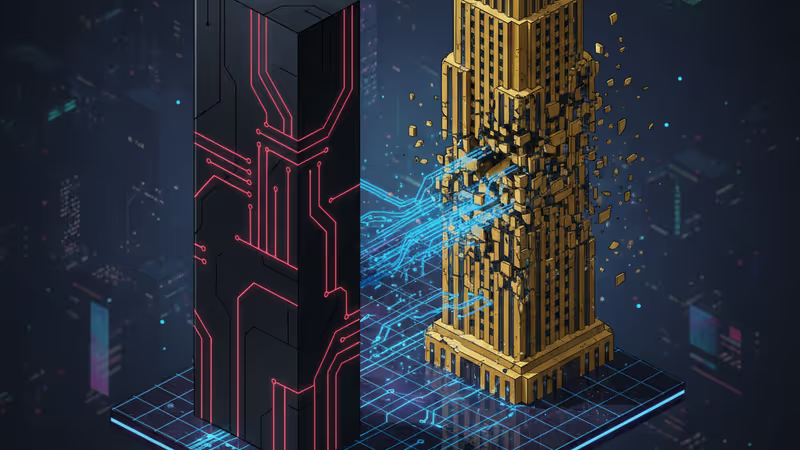

Netflix's rumored $82.6 billion bid for Warner Bros. is far more than a mega-deal; it's the potential final chapter in the streaming wars and the definitive moment where Silicon Valley consumes Hollywood. While regulatory hurdles and a competing bid from Paramount make the outcome uncertain, the strategic logic behind the move signals a permanent, irreversible shift in the entertainment landscape. For investors, executives, and creators, this isn't just about who owns Batman—it's about who owns the future of content, and whether that future is a utopia of endless choice or a consolidated wasteland.

Why It Matters: The Second-Order Effects

Most reports focus on the sheer size of the deal. The real story, however, lies in the ripple effects that will redefine the industry for the next decade:

- The End of the Standalone Studio: Warner Bros.' inability to remain independent, squeezed between a tech giant's bid and a legacy rival's hostile takeover, is a death knell for mid-tier players. The new reality is stark: achieve massive scale and vertical integration, or be acquired.

- The Rise of the 'IP Stack': This acquisition is about buying a century of intellectual property. Netflix isn't just buying a film library; it's buying the DC universe, Harry Potter, and HBO's prestige brand. The strategy is to create an unassailable 'IP Stack' that can be monetized across streaming, gaming, merchandise, and theme parks—a playbook perfected by Disney.

- Regulatory Armageddon: A deal of this magnitude will face unprecedented scrutiny from antitrust regulators in the U.S. and Europe. The core question for regulators will be whether combining the largest streamer with a major studio reduces consumer choice and gives one entity too much pricing power over both subscriptions and creative talent.

The Analysis: A High-Stakes Bet on a Turbulent Past

The Ghost of Mergers Past: Is This AOL-Time Warner 2.0?

It's impossible to analyze this deal without invoking the ghost of 2000's disastrous AOL-Time Warner merger. That deal, a symbol of new media arrogance, failed spectacularly due to a cataclysmic culture clash and an inability to realize promised synergies. Netflix executives would argue this time is different: their business is content, not dial-up internet. However, the risk of a culture clash between Netflix's data-driven, engineering-led ethos and Warner Bros.' century-old, relationship-driven Hollywood system is immense. Successful integration is far from guaranteed.

A War Chest of IP vs. A Mountain of Debt

For Netflix, the prize is obvious: instant ownership of a legendary content library and iconic franchises. This solves their biggest problem: an expensive, never-ending treadmill of producing original content to retain subscribers. With Warner's IP, they can build durable, multi-generational revenue streams. The cost, however, is staggering. Taking on Warner Bros., which already has significant debt from its recent Discovery merger, would saddle Netflix with a colossal debt burden. Wall Street analysts are rightfully skeptical, questioning if the price tag is justifiable when the streaming giant could, in theory, spend that money on decades of original production without the headache of integration.

The Hollywood Counter-Offensive

Paramount's hostile bid is a crucial piece of this puzzle. It's a defensive move from a legacy player trying to bulk up to survive. This signals that old Hollywood won't be consumed without a fight. The result is a forced sale scenario for Warner Bros., ensuring that no matter who wins, the industry will consolidate further. This dynamic puts every other player—from NBCUniversal to Sony—on high alert, likely triggering a new wave of M&A discussions across the industry.

PRISM Insight: For Investors and Industry Leaders

Investment Impact Analysis

The Bull Case for Netflix: If the deal succeeds and integration is managed well, Netflix becomes an untouchable entertainment behemoth. It would possess the world's leading streaming platform, a massive IP war chest, and diversified businesses like theme parks and theatrical distribution. This could justify a major stock re-rating as its business model shifts from high-growth tech to a stable, cash-flow-generating media conglomerate like Disney.

The Bear Case: The risks are monumental. Massive debt, regulatory roadblocks, a potential culture clash that destroys value, and the possibility of overpaying for assets whose primary value was in a pre-streaming world. A failed or botched integration could cripple Netflix for years, making it a cautionary tale akin to AOL-Time Warner.

Industry and Business Implications

This potential deal is an extinction-level event for the status quo. For other media companies, the message is clear: the era of incrementalism is over. You must now compete on the scale of Disney, Netflix-Warner, or tech giants like Amazon and Apple. This forces an immediate strategic re-evaluation: Do you sell now? Do you seek a merger with a rival? Or do you find a niche so defensible that the giants will ignore you? For talent—writers, directors, actors—the consolidation reduces the number of potential buyers for their work, potentially suppressing wages and creative freedom in the long term, which is why unions are already voicing major concerns.

PRISM's Take

This move, whether it succeeds or fails, marks the end of the first streaming war. That war was fought over technology, subscriber growth, and a firehose of original content. The next one will be fought over multi-generational IP and diversified monetization. Netflix has realized that its original model—spending billions annually just to keep users from churning—is a strategic dead end. It needs the durable, culturally embedded power of legacy IP. This is an act of necessity, not just ambition. It's a tacit admission that the pure-play streaming model is not enough. The future of entertainment belongs not to the best streamer, but to the most integrated IP-driven universe. Netflix is betting $82 billion that it can buy its way into that future before its rivals build it first.

Related Articles

Netflix's $82.6B bid for Warner Bros. isn't just a deal; it's a high-stakes pivot. Our analysis breaks down the risks, rewards, and what it means for investors.

The multi-state lawsuit against Uber's subscription isn't just about ride-sharing. It's a regulatory assault on the 'dark patterns' that prop up the entire tech economy.

Caught between its privacy mission and its financial reliance on Google, Mozilla is pivoting to AI. Our analysis explores if this can save it from irrelevance.

Microsoft is killing the vulnerable RC4 cipher. Our analysis reveals why this overdue move exposes a deeper industry crisis of technical debt and corporate negligence.