Japan's 30-Year Gamble Ends: BOJ Hike Reshapes Global Capital Flows

The Bank of Japan's rate hike isn't just a local story. It signals the end of cheap yen, threatening the global carry trade and reshaping investment strategy.

The Lede: The End of an Era

The Bank of Japan's decision to raise its key interest rate to 0.75%, a 30-year high, is far more than a minor monetary adjustment. It's the definitive end of a multi-decade experiment in ultra-cheap money that has profoundly shaped global markets. For investors and executives, this isn't a distant tremor; it's a seismic shift signaling the unwinding of the world's most significant funding source—the Japanese yen—and forcing a fundamental reassessment of global risk.

Why It Matters: The Ripple Effects

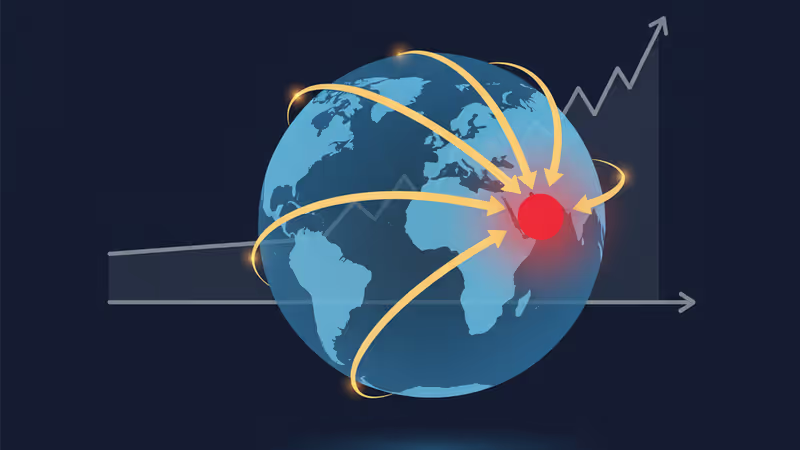

This move has immediate and second-order consequences that extend well beyond Tokyo. The core issue is the potential dismantling of the 'yen carry trade,' a strategy where investors borrowed yen at near-zero cost to fund higher-yielding investments worldwide. As Japanese rates rise, this engine of global liquidity sputters.

- Global Asset Volatility: The carry trade's unwind means a potential mass repatriation of capital back to Japan. This exodus could drain liquidity from global equity, bond, and even crypto markets that have been fueled by this cheap funding for years.

- Recalibrating Borrowing Costs: For decades, Japanese Government Bonds (JGBs) acted as a low-yield anchor for global finance. As JGB yields rise in response to BOJ policy, it puts upward pressure on sovereign debt yields everywhere, making borrowing more expensive for governments and corporations alike.

- A Stronger Yen's Double-Edged Sword: While the yen weakened initially on the 'sell the news' reaction, the medium-term trajectory points upward. This will pressure Japan's export titans (e.g., in auto and electronics) but bolster the domestic economy by increasing purchasing power and potentially attracting new investment into yen-denominated assets.

The Analysis: A High-Stakes Policy Collision

This rate hike is a bold—and risky—departure from the past. After the 'lost decades' of stagnation and the radical 'Abenomics' experiment of massive quantitative easing, the BOJ is finally declaring a partial victory over deflation. However, it's doing so under fraught circumstances.

The critical tension is between monetary and fiscal policy. The BOJ is tapping the brakes while Prime Minister Takaichi's government is slamming the fiscal accelerator with a new ¥18.3 trillion stimulus package. This policy divergence is unsustainable. The BOJ is prioritizing the fight against persistent 3% inflation—driven by real-world costs like the 37% surge in rice prices—and the financial instability caused by a perpetually weak yen. They are hiking into an economy that contracted 0.6% last quarter, a clear signal that taming inflation and normalizing policy now outweigh short-term growth concerns.

Governor Ueda's comment that U.S. corporates have absorbed tariff costs is telling. It suggests the BOJ believes external risks are manageable, giving it the confidence to focus on domestic price stability. This is a central bank asserting its independence and pivoting from growth-at-all-costs to a more orthodox inflation-fighting stance.

PRISM Insight: The New Investment Playbook

The end of Japan's zero-rate policy rewrites the rules for global asset allocation. The primary implication is a structural shift away from assets that relied on cheap leverage. Investors must now actively seek out fundamental value rather than riding a wave of cheap money.

- Go Long Japanese Financials: Japanese banks, insurers, and other financial institutions are direct beneficiaries of a steeper yield curve, as it improves their net interest margins.

- Re-evaluate Global Equities: Sectors and markets that were darlings of the carry trade may face headwinds. Scrutiny on valuations and leverage will be paramount.

- The Rise of Domestic Japan: A stronger yen and reviving domestic demand could make Japan-focused consumer and real estate sectors attractive propositions for the first time in a generation.

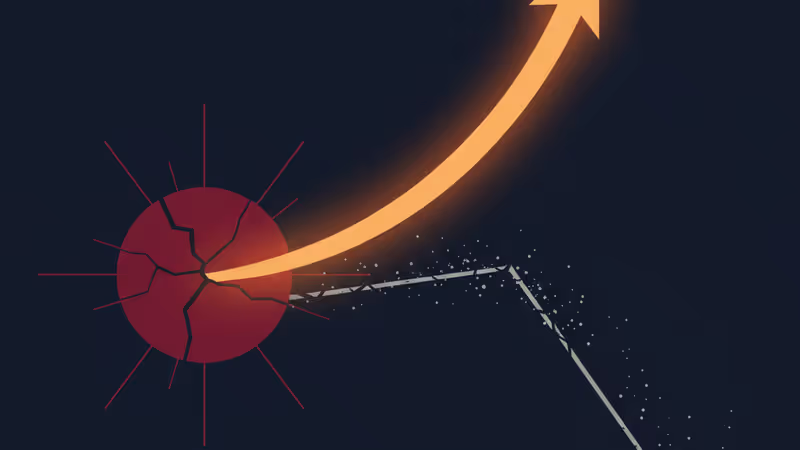

PRISM's Take: The World Has Been Put on Notice

This 25-basis-point hike is not the main event; the signal is. The Bank of Japan has officially retired its role as the world's lender of last resort for cheap capital. The move is a calculated gamble, prioritizing long-term stability over short-term economic pain. For the rest of the world, the message is clear: the training wheels are off. The coming months will test the resilience of a global financial system that grew accustomed to, and perhaps dependent on, Japan's monetary largesse. The resulting volatility will create significant opportunities, but it will ruthlessly punish those who fail to recognize that the game has fundamentally changed.

Related Articles

The Bank of Japan hiked rates, but the yen crumbled. PRISM analyzes why this signals a new macro regime and what it means for Bitcoin's role as a global asset.

The Bank of Japan's first major rate hike in 30 years marks a pivotal shift for the global economy. PRISM analyzes the impact on capital flows and supply chains.

The Bank of Japan's rate hike signals a tectonic shift in global finance. Our analysis unpacks the hidden risks and opportunities beyond the headlines.

The Bank of Japan's rate hike was expected to crash markets. Instead, Bitcoin surged. This analysis breaks down why the macro playbook failed and what it means.