Bitcoin's Civil War: Is It Digital Gold or a Data Playground?

A deep dive into the ideological war for Bitcoin's soul. Veteran developer Luke Dashjr's crusade against Ordinals could redefine the network's entire future.

The Lede: A Battle for Bitcoin's Multi-Trillion Dollar Soul

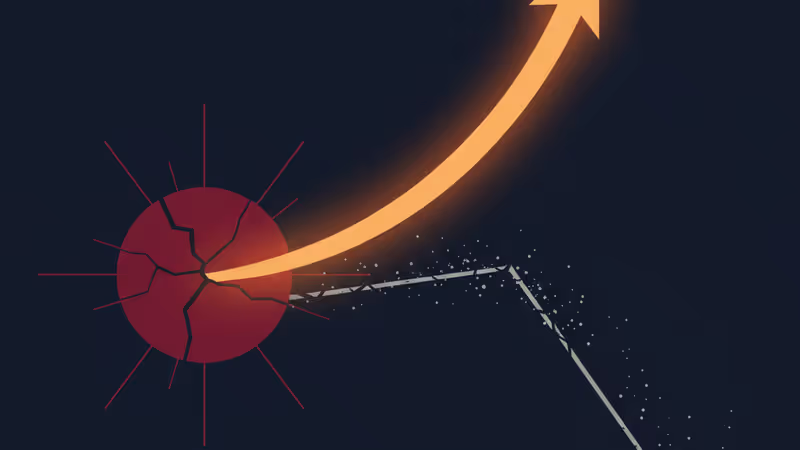

A technical debate raging within Bitcoin's core development community is far more than an esoteric squabble over code. It's a high-stakes ideological war for the soul of the world's premier cryptocurrency, with veteran developer Luke Dashjr leading a purist crusade against new data-heavy protocols like Ordinals and Runes. For executives and investors, the outcome of this conflict will directly impact Bitcoin's long-term economic model, its viability as an asset, and its role in the future of finance. This isn't about code; it's about defining the nature of a multi-trillion dollar network.

Why It Matters: The Future Economic Model is at Stake

The clash between Bitcoin purists and innovators creates ripple effects that extend far beyond developer forums. This is about the fundamental economic security and future utility of the network.

- The Miner's Dilemma: So-called "spam" transactions from Ordinals and Runes have generated hundreds of millions in fee revenue, providing a critical lifeline for miners, especially after the recent block reward halving. Dashjr's push to filter these transactions directly threatens the new economic equilibrium that secures the network. A less profitable mining industry means a less secure Bitcoin.

- The Innovation vs. Immutability Paradox: Dashjr's camp argues for preserving Bitcoin as a pristine, immutable settlement layer for digital gold. The opposition argues that this very immutability and permissionless nature means the network should process any transaction a user is willing to pay for. Forcing a specific vision on the network via code changes or transaction filtering could set a dangerous precedent for censorship.

- Defining Digital Scarcity: This debate forces a re-evaluation of what is truly scarce. Is it the 21 million Bitcoins, or is it the limited blockspace on the Bitcoin ledger? The market's willingness to pay high fees for inscriptions suggests blockspace itself is now a prime digital commodity.

The Analysis: History Rhymes in the War for Blockspace

This is not a new fight; it's the spiritual successor to the Block Size Wars of 2015-2017. While that conflict was about scaling for more transactions, this is about the type of transactions. Two fundamentally different visions for Bitcoin's future are in direct opposition:

Vision 1: Bitcoin as the Ultimate Settlement Layer (The Purists). Championed by figures like Dashjr, this view sees Bitcoin's base layer as sacrosanct—a global, decentralized equivalent of Fedwire, designed for high-value, final settlement. In this model, the chain must remain lean, efficient, and predictable. All other activity, from micropayments to complex data, belongs on secondary layers like the Lightning Network.

Vision 2: Bitcoin as a Secure General-Purpose Platform (The Builders). This camp sees Bitcoin's proof-of-work security as its ultimate feature. They argue that any attempt to define "valid" vs. "spam" transactions is a form of centralized planning that violates the network's core ethos. For them, a robust fee market driven by diverse use cases is a sign of a healthy, in-demand network, not a symptom of abuse.

Dashjr's status as a long-time, respected developer gives his purist stance significant weight. However, his proposal to have mining pools actively filter transactions is seen by many as a step too far, threatening the very permissionless quality that gives Bitcoin its power.

PRISM Insight: The Halving Has Forced the Issue

The recent Bitcoin halving is the silent catalyst accelerating this conflict. With block rewards for miners cut in half, transaction fees are no longer a secondary consideration—they are essential for survival. Ordinals and Runes arrived at the perfect economic moment, creating a booming fee market that subsidized the network's security budget.

From an investment perspective, this ideological battle is a powerful tailwind for Layer 2 ecosystems. The more contentious and congested the base layer becomes, the more urgent the need for scalable and efficient second-layer solutions. The success or failure of protocols like Lightning Network is now inextricably linked to the resolution of this base-layer identity crisis.

PRISM's Take: The Market Will Settle What a Developer Cannot

While Luke Dashjr's role as a conservative guardian is vital for protecting Bitcoin from reckless changes, his methods verge on contradicting the network's foundational principles. The idea of developers or miners acting as gatekeepers for "acceptable" transactions is a slippery slope toward the very censorship Bitcoin was built to resist.

Ultimately, the most powerful force in a decentralized system is the market. Users are voting with their wallets, paying enormous sums to inscribe data, demonstrating clear product-market fit. This economic reality cannot be ignored. Bitcoin is evolving beyond the simple narrative of "digital gold." It is becoming a secure, decentralized commodity—monetized blockspace. The future isn't a victory for one side, but a new synthesis: a base layer prized for its security and used for high-value data anchoring, driving an explosion of innovation and value capture on the layers built on top of it.

Related Articles

The Bank of Japan hiked rates, but the yen crumbled. PRISM analyzes why this signals a new macro regime and what it means for Bitcoin's role as a global asset.

The Bank of Japan's rate hike was expected to crash markets. Instead, Bitcoin surged. This analysis breaks down why the macro playbook failed and what it means.

The Bank of Japan's rate hike paradoxically weakened the yen, signaling global liquidity remains intact. Discover why this matters for risk assets like Bitcoin.

The Bank of Japan's historic rate hike removed a key global risk, signaling to investors that the path is clear for a new liquidity-driven rally in crypto and tech.