Economy

Record ETF outflows push Bitcoin to a critical $83,000 support level. We analyze what this means for investors and if this is a structural shift or a dip-buying opportunity.

UK's FCA plans to regulate crypto like traditional finance by 2027. Discover the actionable investment strategy for this market shift and who wins.

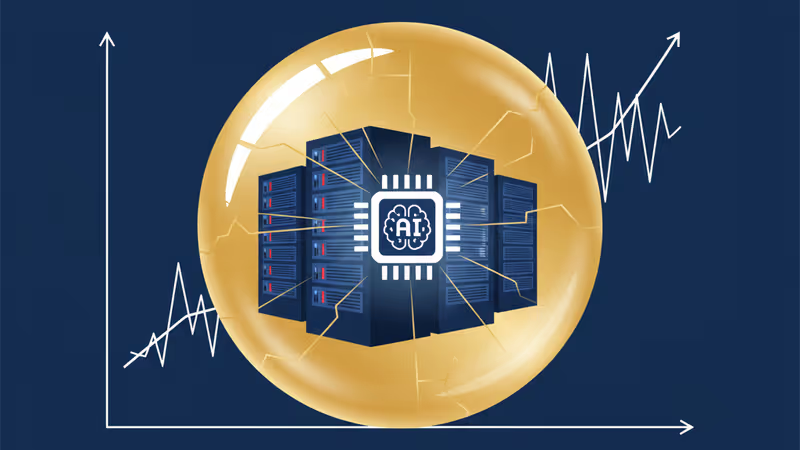

AI infrastructure stocks are tumbling over debt fears. PRISM analyzes if this is a temporary blip or the end of the AI gold rush, offering a new investment playbook.

The US has suspended a landmark UK tech deal, placing £31B in AI investments at risk. Our analysis reveals what this means for investors in Nvidia, Google, and the UK tech sector.

ConocoPhillips is buying Marathon Oil for $22.5B. Our expert analysis breaks down what this means for investors, the energy sector, and which companies could be next on the M&A block.

XRP shatters critical $1.93 support on a 246% volume surge. Our expert analysis decodes what this institutional sell-off means for investors and the next key levels to watch.

Dogecoin's 5.5% plunge on 267% higher volume signals a major market shift. Our analysis unpacks what institutional traders see and what you should watch next.

As Bitcoin dips below $86,000, retail fear is spiking. Our analysis reveals why institutional investors are buying this dip and what it means for your portfolio.

Cathie Wood's ARK Invest just spent $60M on falling crypto stocks like Coinbase and Circle. Our analysis decodes the infrastructure-focused strategy behind the bet.

AI infrastructure stocks like Oracle and Broadcom are falling on debt concerns. PRISM analyzes if this is a temporary dip or the start of a sector-wide bubble.

Filecoin (FIL) plummets 5% on massive institutional volume, breaking key support. Our analysis deciphers what this means for the DePIN sector and what investors should do next.

iRobot's bankruptcy is more than a corporate failure. It's a critical lesson for investors on regulatory risk, competitive moats, and the geopolitical shifts in tech.