China's EV Price War Goes Global, Squeezing Tesla and Legacy Automakers

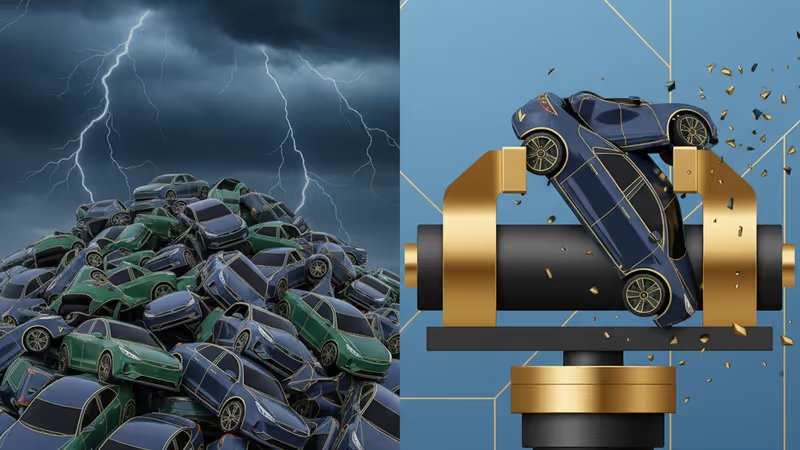

An intense EV price war, fueled by massive overcapacity in China, is now hitting global automakers like Tesla and Ford, squeezing profits and forcing strategic retreats. Here's what it means for your portfolio.

An Oversupply Problem Becomes a Global Threat

A brutal price war in China's electric vehicle market is no longer a domestic affair. It's now spilling onto the global stage, creating a severe margin crisis for industry leaders like Tesla, Ford, and Hyundai. With Chinese automakers like BYD launching models for under $10,000, a massive oversupply problem is forcing a painful reckoning across the entire automotive sector, reshaping the competitive landscape from Europe to Southeast Asia.

The Math Behind the Mayhem

The conflict's origin is simple: China can produce nearly twice as many EVs as it can sell domestically. Years of government subsidies fueled a boom that created over 100 different brands, all now fighting for survival as domestic growth slows. This has led to aggressive discounting, with the average vehicle in China selling for 15% below its sticker price in `2023`, according to Reuters. This excess inventory has to go somewhere, and the target is international markets.

Global Contagion: From Margin Pressure to Pulled Investments

The fallout for global automakers is stark. Tesla has been forced into repeated price cuts to defend its market share in China, eating into its once-enviable profit margins. Legacy automakers are feeling the chill, too. Ford and General Motors are scaling back or delaying their ambitious EV investment plans, a direct response to the deteriorating profitability of the sector. Meanwhile, Hyundai and Kia face intense pressure in key Asian growth markets from lower-priced, feature-packed Chinese rivals.

Western governments are starting to build a political moat. The European Union is investigating Chinese state subsidies, which could result in significant import tariffs. In the U.S., the Inflation Reduction Act (IRA) already serves as a major barrier, effectively locking out most Chinese-made EVs and batteries from its lucrative tax credits.

This war of attrition isn't creating clear winners, even in China. Tech-heavy but loss-making players like 'Nio' and 'Xpeng' are burning through cash at an alarming rate. The endgame isn't dominance; it's survival. The most likely outcome is a painful industry consolidation. For investors, this means balance sheets and cash flow statements have become far more important indicators of long-term viability than quarterly sales figures.

本内容由AI根据原文进行摘要和分析。我们力求准确,但可能存在错误,建议核实原文。

相关文章

馬斯克560億美元薪酬案大逆轉,PRISM深度解析。這不僅是個人勝利,更重塑了美國公司治理、高管薪酬及特拉華州的法律地位。

德拉瓦州最高法院推翻下級法院判決,恢復馬斯克560億美元薪酬方案。此案不僅影響特斯拉,更揭示了全球公司治理與法律管轄權的未來趨勢。

日本第三季GDP下修至年率-2.3%,敲響經濟衰退警鐘。面對困境,日本政府擬推出122兆日圓的史上最大預算。本文分析此舉對市場及投資者的潛在影響。

日本三井住友金融集團(SMFG)宣布與美國貝恩資本、穆茲尼奇合作,將共同管理一支約35億美元的基金,目標鎖定歐洲企業的併購融資市場,預計明年啟動。