S&P 500 Hits Intraday Record High Above 6,050 Fueled by Rate Cut Bets

The S&P 500 hit a new intraday record high on Dec 24, 2025, as investors grow more confident about potential Federal Reserve interest rate cuts. We analyze the market optimism and potential risks.

Is the 'Santa Claus Rally' here to stay? The S&P 500 index surged to an intraday record high on December 24, 2025, as investor optimism swelled around potential interest rate cuts from the Federal Reserve. According to Reuters, the move signals a strong year-end sentiment driven by bets on a more accommodative monetary policy in the new year.

The Fuel for the Rally

During the session, the S&P 500 climbed as much as 1.2%, breaking the psychological 6,000 mark to touch a high of 6,050. This bullish momentum is largely credited to recent economic data showing inflation is cooling. With last month's Consumer Price Index (CPI) approaching the Fed's 2% target, the market believes the central bank has little reason to maintain its restrictive stance.

The tech-heavy Nasdaq Composite and the Dow Jones Industrial Average also posted gains, broadening the rally. Growth-oriented sectors like technology typically benefit from the prospect of lower borrowing costs.

A Note of Caution Amid the Cheer

However, some analysts urge caution. It's crucial to remember that the market's enthusiasm is based on bets, not on official announcements from the Federal Reserve. Fed officials have continued to strike a cautious tone, emphasizing that their fight against inflation isn't over yet.

For Investors: A potential disconnect between market expectations and the Fed's actual policy path could introduce significant volatility. Close attention should be paid to upcoming economic data and comments from Fed officials.

本内容由AI根据原文进行摘要和分析。我们力求准确,但可能存在错误,建议核实原文。

相关文章

由於韓元持續疲軟,彭博社數據顯示,全球主要投行已將南韓2026年通膨預測中位數上調至2.0%。此舉反映了輸入性通膨壓力,為南韓央行的政策帶來挑戰。

韓國LS Eco Energy投資1900萬美元開發越南稀土資源,旨在建立獨立於中國的供應鏈,以應對電動車與高科技產業的需求。分析此舉對全球供應鏈的影響。

美國在聯合國暗示將對委內瑞拉恢復極限制裁,恐導致國際油價飆升。本文深入分析此舉對全球能源市場、通膨及投資者的潛在影響。

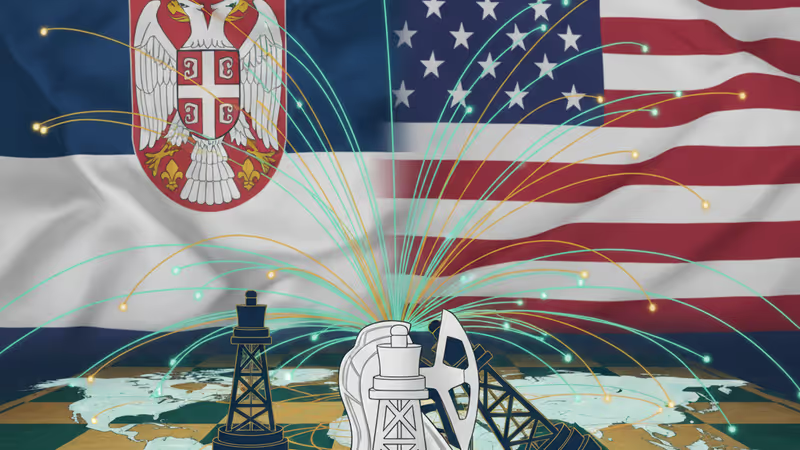

根據路透社報導,塞爾維亞石油公司NIS已獲美國批准,可就出售俄羅斯持股進行談判。此舉恐將重塑巴爾幹半島的能源地圖,並牽動複雜的地緣政治格局。