Europe's $105B Ukraine Lifeline: A Geopolitical Power Play or Economic Quicksand?

The EU's massive $105B loan to Ukraine is more than aid; it's a strategic gambit that reshapes global finance, defense, and Europe's role as a world power.

The Lede: Beyond the Battlefield

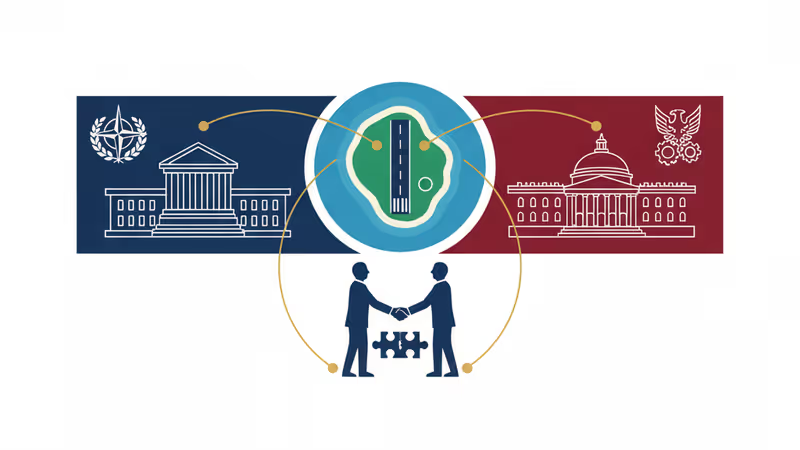

The European Union's commitment of a $105 billion loan facility to Ukraine is far more than a line item in a wartime budget. For global executives and investors, this isn't just about solidarity; it's a fundamental recalibration of European geopolitical strategy. This financial package acts as a strategic anchor, binding Ukraine's economic future to the West and signaling to Moscow, Beijing, and Washington that Europe is deploying its primary weapon—its economic might—for long-term influence on the world stage. This is not aid; it's an investment in a new European security architecture, with massive implications for defense, energy, and global supply chains.

Why It Matters: The Ripple Effects

This decision creates significant second-order effects that will reverberate across multiple sectors and regions:

- A New Precedent in Sovereign Finance: This politically-driven loan, structured over multiple years, challenges the traditional roles of institutions like the IMF. It establishes a model for large-scale, long-term financing during an active conflict, blending economic support with strategic security objectives.

- Stress-Testing European Unity: Securing this deal required navigating significant internal dissent, notably from Hungary. While its passage demonstrates resilience, it also highlights the political capital required. This spending will test the fiscal limits of member states, potentially fueling the very populist movements (like the recent farmer protests) that challenge EU cohesion.

- A Market Signal to the Defense Industry: The funds are explicitly for Ukraine's defense and reconstruction. This guarantees a multi-year revenue stream for European and allied defense contractors, spurring investment in next-generation military hardware, from drones and munitions to sophisticated cyber defense systems.

The Analysis: A Modern Marshall Plan with a Twist

Historical Context vs. Current Reality

Comparisons to the post-WWII Marshall Plan are inevitable, but critically flawed. The Marshall Plan was a post-conflict reconstruction effort in a world dominated by two superpowers. The EU's package is being deployed during a high-intensity war in a multipolar world. Its success is not predicated on rebuilding ruins, but on ensuring there is a sovereign, Western-aligned Ukraine left to rebuild. Unlike the Marshall Plan, which solidified US dominance, this initiative is an attempt by the EU to assert its own strategic autonomy, particularly as the reliability of future US support remains a political variable.

The Geopolitical Chessboard

From a competitive standpoint, this is a direct economic counter to Russia's war of attrition. Moscow is betting it can outlast the West's political will and financial capacity. This $105 billion package is Brussels' explicit answer, a declaration that it is prepared for a protracted economic, as well as military, confrontation. For China, it serves as a powerful case study on the potential economic consequences of geopolitical gambles, demonstrating the West's ability to weaponize its financial systems in a unified manner. This move forces a recalculation of risk for any nation considering aggressive territorial expansion.

PRISM Insight: Following the Capital

The deployment of this capital will accelerate key technological and investment trends. The focus on rebuilding Ukraine will not be a return to the past, but a leapfrog into the future. Expect massive investment in decentralized energy grids, leveraging renewables to build resilience against attacks. The reconstruction effort will be a testing ground for smart city technology, modern logistics infrastructure, and sustainable construction materials. For investors, the clear signals point toward European defense and aerospace stocks, cybersecurity firms, and infrastructure funds with a focus on Eastern Europe. Furthermore, the immense challenge of transparently disbursing these funds will supercharge the adoption of GovTech and FinTech solutions designed to track capital flows and mitigate corruption, creating a potential new standard for international aid.

PRISM's Take: Europe's High-Stakes Bet

The EU's $105 billion package is a historic pivot from being a primarily economic bloc to a true geopolitical actor. It's a high-stakes, high-reward bet that firmly subordinates short-term economic calculus to long-term strategic necessity. By locking Ukraine into its financial orbit, the EU is attempting to secure its eastern flank for a generation. However, the risks are profound. The strategy's success depends on Ukraine's ability to withstand military pressure and effectively absorb the capital. Failure could lead to a sovereign debt crisis on Europe's doorstep and embolden its adversaries. This is the moment the European Union chose to underwrite the future security map of the continent. The check has been written; the world will now watch to see if it can be cashed.

相关文章

深度分析烏克蘭庫皮揚斯克戰役,揭示戰場現實與俄羅斯宣傳的巨大鴻溝,以及無人機技術和資訊戰如何定義現代衝突的地緣政治影響。

西方制裁催生了龐大的「影子艦隊」,在新加坡等關鍵航道附近集結,引發環境、安全與全球貿易分裂的深遠風險。PRISM深度解析。

中國企業協助重建密克羅尼西亞二戰機場,引發美國對其在戰略太平洋地區影響力擴張的擔憂。PRISM分析其地緣政治深層含義。

歐盟對烏克蘭的巨額貸款不僅是軍事援助,更是一場重塑歐洲安全、挑戰俄羅斯並影響全球金融格局的深遠地緣政治博弈。